Friends,

This week, I’d like to start by examining the whiplash many of us feel (perhaps you don’t feel the whiplash, but I do, so bear with me).

We are buffeted by competing narratives about the world and that leaves us feeling uncertain and a bit unmoored. I’d like provide some commentary on that and then geek out a bit by describing an emerging technology stack that I think is essential to understanding the future that is emerging (or next stage of modernity) as well as the Sino-American rivalry… and then end the commentary with some observations on what is stifling American technology leadership.

But let’s start with the competing narratives.

One narrative is pessimistic, I think of it as the “Entropy, Decline, and Impotency” (EDI) narrative. Across democracies we see political gridlock, an inability to bring wars to a successful conclusion (Iraq, Afghanistan, Ukraine, Sudan, and Gaza), a failure of our governments and international organizations to solve big problems (climate change and pandemics), a feeling that our governments and societies just don’t work anymore, and the perception that we are falling behind rising authoritarian powers in Beijing and Moscow. This narrative sees us as entering a new dark age, one where worsening climate, dystopian technology, and authoritarian regimes shape our future. Under this narrative we feel we are not in control, and the future belongs to someone (or something) else.

The second narrative is more optimistic, what I call the “Birthing a New Order” narrative. This outlook observes that the post-First Cold War order, a rules-based, liberal international order has collapsed. That old order had been built on the foundations of the industrial revolution and an analog world, but the information revolution and digital world (which emerged just as the Soviets disappeared) has changed how power manifests and gets wielded. While the collapse of that old order is distressing, that order had some pretty bad side-effects and was not fit for purpose, particularly for folks in the developed world who weren’t the elites or the managerial class. This narrative sees us in a new era, one in which we are building something from the pieces laying around, creating our own future. There are risks to mitigate and threats to face, but under this narrative we feel empowered. We don’t know what this new order will look like yet, but the future is ours to shape.

So, where does this unease and uncertainty come from?

Well, I think we have to do a bit of self-reflection and examine our recent past.

At least for folks in the West, we had grown comfortable with a relatively stable international order that emerged after the collapse of the Soviet Union. But after 35 years and quite a few technological advancements and geopolitical decisions, that old order has come to an end. The quadruple shocks of the information revolution, China’s entry into the WTO, the Global Financial Crisis, and the COVID-19 pandemic eroded the foundations of that post-First Cold War, rules-based, liberal international order. (9/11, and the wars in Afghanistan and Iraq, played a role as well… but with greater hindsight, perhaps not as much as we originally thought… it distracted Americans, forcing them to concentrate on an immediate, but secondary set of problems, rather than the critical ones.)

That old order no longer functions as an order. We hear all the time we folks complain that powers shouldn’t invade their neighbors for territory, or powers shouldn’t use trade and economic power for political leverage, or powers shouldn’t make unreasonable demands of allies, or powers shouldn’t disregard international law. Those “shouldn’ts” are all appeals to the norms of the old order, and while they may be great norms (in fact, I hope we embed those norms when we build a new order), there is no longer an order to enforce them.

Rules and norms are NOT self-enforcing.

[Note to my European colleagues: If you want the world to respect your norms, rules, and regulations, you must possess power AND be able to wield it… Europe has latent power, but wielding power requires a degree of political cohesion that Europe lacks. The norms, rules, and regulations that you thought controlled the world rested on someone else’s power and when that power decided to re-engineer the international order, you found yourself in the back seat instead of behind the steering wheel.]

Whether you view the immediate past as a disaster or as an opportunity (or both), then you likely have conflicting views about the future (or you have manic-depressive mood swings). We feel like we are driving change or being run over by it. As an historian, I find comfort in knowing that folks have had to wrestle with these competing narratives about modernity for centuries.

Depending on your perspective and the narrative that most appeals to you on a certain day of the week, you will likely have different answers to questions like these:

Was the old order something to be maintained and strengthened or something to be torn down and replaced?

Was the WTO an organization that just needed some tweaks or something much more consequential?

Was deindustrialization through outsourcing (abandoning an “old economy” for the “new economy” as President Obama observed) a good idea or had the U.S. made a critical error when it pursued financial engineering and manufacturing over actual engineering and manufacturing?

What is the purpose of the United Nations and what should it focus its efforts on?

Are open borders, free trade, and unimpeded flows of information a utopian future or are they threat vectors that societies must monitor and control?

Which is the more significant threat: climate change, pandemics, technology, or war?

Now for some geeking out… I’m still working through these ideas but have been following the arguments and ideas of others in this space.

Forging a New Order with a New Tech Stack

The old order was built on its own technology stack and that technology stack determined who made decisions about the exercise of power, where those decisions about power were made, and how power translated into actions. A Technology Stack is the layering of technologies that work together to produce functional things and shape our world.

The old order was built upon the foundations of the industrial revolution which created an analog world dependent upon combustion for energy. By “analog world,” I mean a world of mechanical things built or produced through industrial processes, often powered by combustion (burning fuels to create heat or controlled explosions to move things). I contrast the analog world with the classical world (before the industrial revolution) and the digital world (after the information revolution).

This Analog-Combustion Technology Stack consists of the following parts (perhaps there’s more or less, I’m still mulling it over):

Processing carbon deposits for combustion and the creation of new materials

Engines that use internal combustion for locomotion

Assembly line production and the standardization of components

Managerial organizations to control large-scale activities

This technology stack took shape in the 19th and 20th Centuries and like other technology stacks, it consists of human-machine teaming and drove changes in social and cultural patterns.

An example of this is the creation of the automobile, a general-purpose technology that incorporates these four elements. Aircraft provide another example. The nation-states that developed this entire technology stack and could wield it for national security and economic prosperity, set the rules for the international order that emerged in middle of the 20th Century and became even more refined at the end of the 20th Century.

Those nation-states that only created parts of this analog-combustion technology stack became appendages of other powers. They became rule-takers, not rule-makers.

That analog technology stack is being disrupted by a new technology stack.

Let’s take a look at another example.

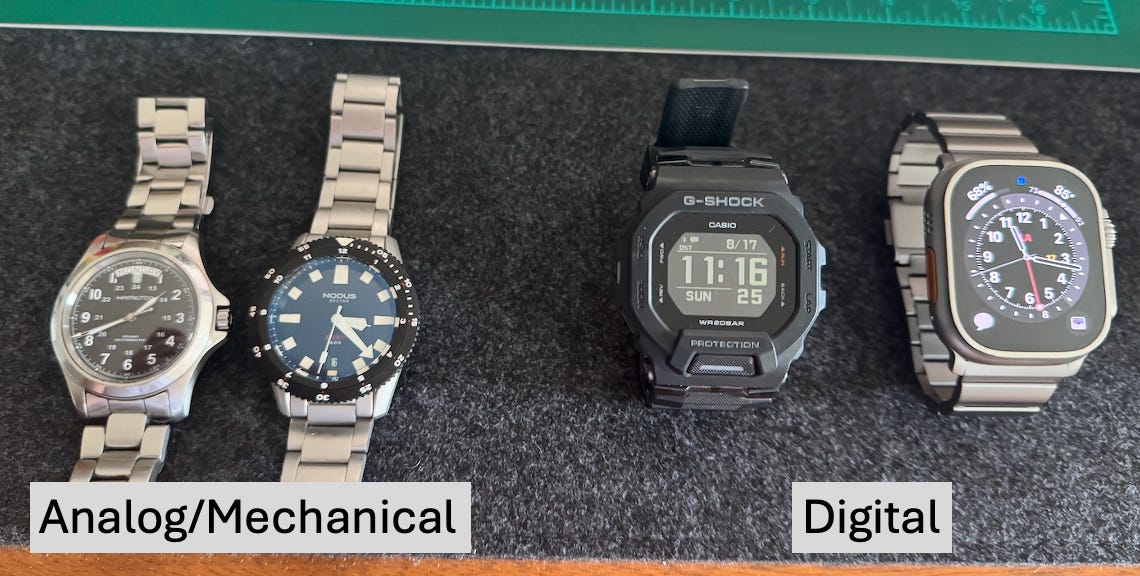

I don’t know about you, but I love me an analog watch, also known as a mechanical watch.

For me, it’s an aesthetic thing.

[NOTE: If you share this regard for mechanical watches, then you’ve probably seen the best YouTube channel out there, YoureTerrific… if you know, you know. If you don’t know, then start with this 9-minute video, “Rolex vs Apple Watch Ultra 2. Sorry.” You will thank me for introducing you to an excellent source of entertainment.]

For all that admiration I have for analog watches, my brain knows that a digital watch is vastly superior.

In fact, anyone who owns a mechanical watch must use a digital one to set the time, which means almost always their phone (i.e. the computer in their pocket), suggesting that analog watches are completely superfluous… let’s be honest, it’s just jewelry.

My analog watches are beautiful and amazing pieces of engineering… but they are fragile, expensive, and have limited functionality.

My digital watches can do everything an analog watch can do, but better.

The analog/mechanical won’t disappear, but increasingly they will become luxury goods, things chosen for aesthetic purposes (think of an old Toyota Land Cruiser). We will want these things because they have meaning, not because they are the best thing for the job. Maybe our children, grandchildren, or great grandchildren will drop that affinity, but I somewhat doubt it.

We are transiting from gears, springs, and combustion to circuits, conductors, and electrons and it is happening to everything in ways that are hard to appreciate.

This new stack is the Software-Electric Tech Stack. It will have enormous impacts not just in the things we use or our day-to-day lives, but in the distribution of power in our world, just as the Analog-Combustion Tech Stack did in creating the world of the 20th Century.

The Software-Electric World is Eating the Analog World

Almost exactly 14 years ago, Marc Andreessen posted his now famous “Why Software is Eating the World.” I think it is important to build on his ideas and observe that in many ways software was just one part of what was happening.

For an interesting conversation on this, listen to Marshall Kosloff’s latest episode of his podcast, The Realignment (Episode 567 – Sam D'Amico & Noah Smith: Why Electricity Is Eating the World - How the Electric Tech Stack Will Dominate the 21st Century). Sam and Noah call this the Electric Tech Stack, but I think software belongs upfront as we consider what this really is.

During the 1990s and 2000s, four technological advances made significant headway and have come together to create this new Tech Stack that we touch multiple times a day in our lives.

Batteries – Advances in lithium-ion batteries give us a storage capacity and quick release of power that exceeds what we can get through combustion (storing fuels which we burn to produce controlled explosions to move something for us).

Electric motors – Advances in permanent magnets which allows us to build much more energy efficient electric motors for very small things or very large things.

Power electronics – Advances in materials and microelectronics which gives us the ability to manage electricity at much higher levels of power and to do it completely with software instead of analog switches.

Software – Enabling computers to control things for humans, provide intuitive interfaces, and manage data and complexity at scale. Software reshapes organizations and societies. Software is everywhere, Marc Andreessen was right in 2011, software ate the world. We all use software constantly; you are interfacing with it now as you read these words. As we consider how software will develop, remember that Artificial Intelligence is simply software. When AI manipulates things in the real world it will be through the three segments above (batteries, electric motors, and power electronics).

Controlling the Software-Electric Tech Stack will be the strategic high ground of the 21st Century (and perhaps the 22nd Century as well). The nation-states that possess and shape all four elements, deploy it for national security and economic prosperity will be the ones with the power to set the rules and norms of our new international order.

Today, the United States has a clear competitive advantage in software but is behind the PRC in both batteries and electric motors, with competition in power electronics more evenly matched. Decisions by American companies and American leaders will determine whether we can construct that full Software-Electric Technology Stack and deploy it to solve the country’s most pressing problems or whether we will become dependent on someone else’s stack (along with the values, norms, and rules, they embed within it).

I’ll cover more in the future on the Sino-American rivalry over this technology stack, but suffice it to say that simply having one element of the stack will relegate us to being a rule-taker, rather than a rule-maker. We should abandon the distinction between “high-value add” activities and “low-value add” activities as building a technology stack requires doing it all, designing AND making all the parts.

So now I’m going to go on a short rant… because I’m not sure that some of our tech leaders are prepared for what’s coming.

***

What really stifles U.S. economic and technology leadership?

From Twitter/X

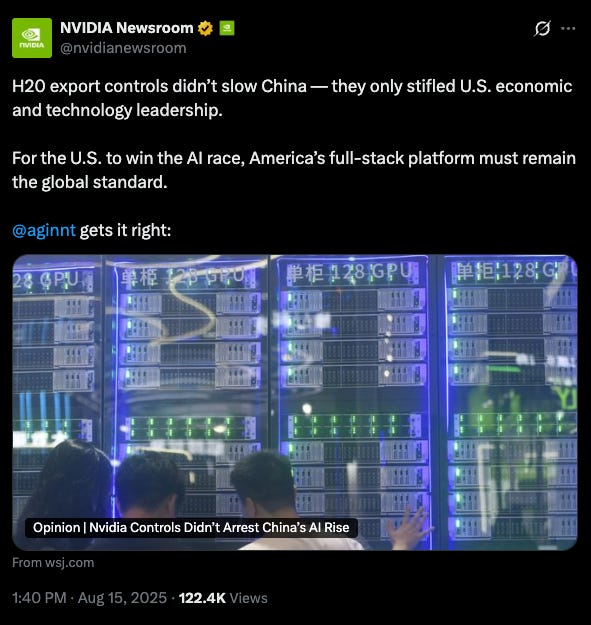

On Friday, Nvidia was at it again claiming that export controls don’t have an effect on China and that “they only stifled U.S. economic and technology leadership.”

The company links to a letter to the Wall Street Journal editors by Aaron Ginn titled “Nvidia Controls Didn’t Arrest China’s AI Rise.” If the name Aaron Ginn doesn’t sounds familiar, he is the CEO of an AI data center company that has close commercial ties to Nvidia. In early August he wrote an OpEd in the Wall Street Journal titled: “China’s Z.ai and America’s Self-Defeating AI Strategy.” His letter this week was an objection to a piece by Matt Pottinger and Liza Tobin in The Free Press (#1 below).

The underlying theme of Ginn’s pieces, and Nvidia’s promotion of them, is that export controls on advanced semiconductors don’t work and that by preventing Nvidia from selling their chips to the PRC, the U.S. Government is harming American technology leadership. Nvidia and its supporters also argue that Huawei is breathing down their necks with massive R&D budgets and catching up fast, hence why they need to sell in China too or else Huawei will get lock-in with their products domestically and then expand internationally.

So, since Nvidia brought this point up, let’s examine what might be stifling technology leadership because I agree we shouldn’t be doing things that undermines the technology innovation that happens in our companies.

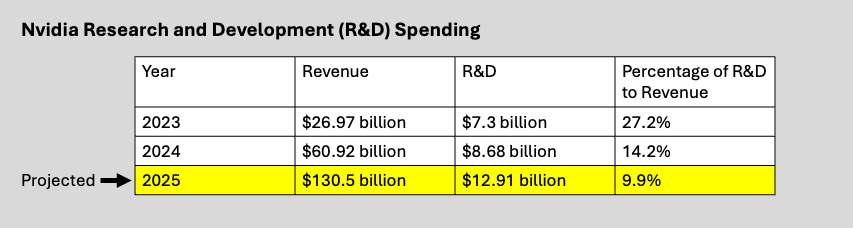

Despite more than doubling its revenues between 2023 and 2024 (these were the years that the U.S. Government limited Nvidia’s sales to the PRC), Nvidia nearly halved its spending on R&D as a proportion of revenues (from 27.2% in 2023 and 14.2% in 2024). According to projections, that proportion is set to drop even further to 9.9% in 2025 even as Nvidia more than doubles its revenues again.

If Nvidia was really concerned about technology leadership and worried about the billions that Huawei is pouring into R&D, it seems like the company has plenty of revenues to at least double its own R&D spending.

If Nvidia simply held its 2023 R&D spending as a proportion of revenue constant, it would be close to $36 billion this year alone (BTW, that is about the price of a sub-2nm fab).

So, with all these revenues increasing and essentially flat-lined R&D, what is Nvidia spending its money on?

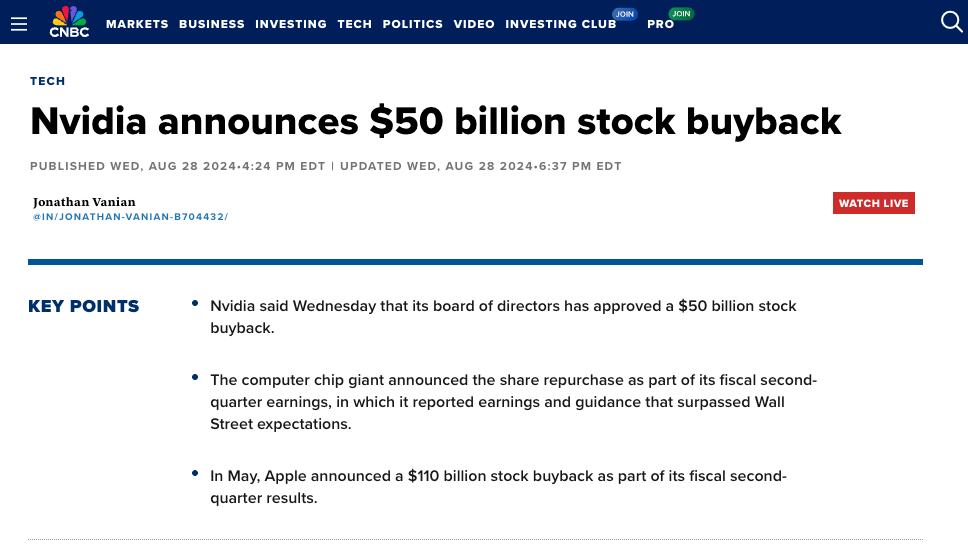

Yep, you guessed it: Stock buybacks

In August 2023, Nvidia spent $25 billion buying back its own stock… more than three times as much as it spent on R&D that year.

In August 2024, Nvidia spent as much on buying back their own stock as they had spent on R&D over the previous decade.

And in April 2025, Nvidia reported stock buybacks of $14.4 billion for just the first quarter of 2025… that is more than what Nvidia is projected to spend on R&D for the entire year.

By no means do I think I’ve found all of Nvidia’s stock buybacks, but from what I’ve found so far, the company has spent over $89 billion on stock buybacks since 2023. I think that is more than the company has spent on R&D since it was founded in 1993 (I could be wrong, so don’t quote me).

Under the logic of maximizing “shareholder value,” there can be good reasons why a company uses its revenues for stock buybacks. Consider this explanation from a report by the Center for Tax and Budget Policy at the Baker Institute, “Understanding Stock Buybacks — Should We Tax Them?” (May 2023):

“Companies should retain earnings and use those funds to invest in new projects if the return on that investment is greater than the next best alternative available to the company or to shareholders. If investing the funds within the company does not provide a return greater than alternatives that are available in the market, then the company should return the funds to shareholders to be invested elsewhere or used for alternative purposes.”

Do we think this is what is happening at Nvidia, that “investing the funds within the company does not provide a return greater” than repurchasing its own stock?

Is Nvidia in a stagnant industry sector which won’t benefit from further investment?

Are we to believe that the company that makes the world’s most advanced AI chips and the software to control those chips (the backbone of a Software-Electric Technology Stack), can’t use $89 billion to push technology and innovation forward in the field of artificial intelligence?

That the best use of this money is NOT to reinvest in even more technology innovation, but instead to simply pass the money back to speculators and short-term investors?

This seems fantastical… this is the same sector with leaders that routinely talk about needing trillions for energy infrastructure, data centers, and chip production, so that we can usher in a complete transformation of our economy. What should we conclude if Nvidia’s leadership thinks that they can’t use $89 billion?

Repurchasing your own stock is inherently a short-term strategy, and it is one for corporate leaders who aren’t confident about the long-term prospects of their own company or the industry sector they are in. It is a strategy aimed at investors who really don’t care about the long-term value of the company. Folks who will simply sell their shares when the stock price drops and find another company who is willing to use its revenues to boost its stock price.

Stock buybacks are what companies do when they want to cannibalize themselves for the benefit of speculators and short-term investors. No CEO that thinks they can make real technology innovations or create new products that will change the world, would “waste” revenues in that way.

If Nvidia’s leaders really wanted to stay ahead of Huawei or make American AI the best in the world, they would take that $89 billion and pour it all into R&D rather than telling investors: “Hey, I can’t really do anything useful with this money, you take it.”

This seems like a way to stifle technology leadership far more than restrictions on who Nvidia can sell to, particularly when those restrictions don’t limit their revenues because the customer demand exceeds the supply Nvidia (and its manufacturing partner, TSMC) can produce.

Shareholders might legitimately ask: even if all $89 billion couldn’t be productively used in R&D, couldn’t a significant portion of that $89 billion have been used to expand the production base Nvidia uses to make its chips that are in such high demand? Presumably that would result in even higher revenues as additional chip-making capacity came online.

It seems to me that the return on that investment inside Nvidia, which would have pushed forward innovation in artificial intelligence, would provide far better returns than what many investors did with that money: buy T-bills.

When Tech Companies shift from actual engineering to financial engineering.

We’ve seen this movie before; it came out almost a decade ago.

Shifting from actual engineering to financial engineering is what got another American chip company, Intel Corporation, into such trouble.

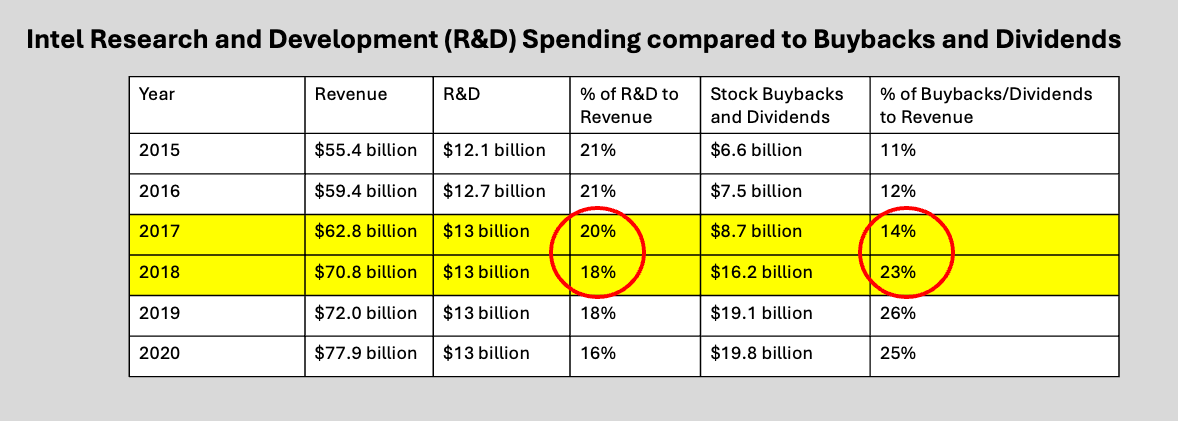

To remind folks, back in 2016 just as the competition over advanced semiconductors was heating up and Intel should have been making massive increases to their R&D budget, Bob Swan became Intel’s CFO, under the company’s CEO, Brian Krzanich. Krzanich was forced to resign in June 2018, when an affair with a subordinate went public and Swan became Intel’s first non-engineer CEO in January 2019 and stayed in that position until February 2021, when the board was forced to bring back Pat Gelsinger.

Swan was a life-long finance guy who had done well at companies up to that point. Under Swan’s leadership, and a Board of Directors that seemed to be asleep, Intel made the fateful decision to vastly expand dividends and stock buybacks while holding R&D spending stagnant even as its revenues were going up.

By spending those revenues on stock buybacks, Swan, for a short time, made investors happy with higher stock prices.

See the inversion between 2017 and 2018 when Intel started spending more money on stock buybacks and dividends than on R&D? That’s when Intel sacrificed its own technological leadership to please Wall Street analysts and day traders.

By failing to make long-term R&D investments in the company’s technology, as well as capital upgrades to its manufacturing base, Swan condemned Intel to the death spiral we see them in today. By giving speculators and short-term investors what they wanted most (immediate cashflow to goose the stock price), Intel stifled American technology leadership.

It should also be noted that at that time (2017-18), Intel was heavily lobbying the U.S. government to lower export controls on chips, and chip making tools, to China so that the company could make even more sales there and shift more production to China (Intel’s argument was also that China would be addicted to their technology and therefore it was good for America).

These decisions by Intel’s management resulted in the United States not having a leading-edge semiconductor manufacturer. A few years later, the United States had to pass the CHIPS and Science Act to try to rescue the situation. But let’s not forget that it was Intel’s corporate leadership and its Board of Directors that wasted nearly $60 billion of its own revenues between 2017 and 2020 on making speculators happy, rather than improving the company’s position.

I’m not predicting that Nvidia is going to enter into an Intel-like death spiral (it took nearly a decade for Intel’s boneheaded decisions to play out), but the decision to goose the stock price in the short term, rather than make even greater investments in technology innovation for the long term, almost never turns out well.

So, the next time Nvidia announces another $50 billion in stock buybacks, you will know who is really stifling American technology leadership… it ain’t Nvidia’s critics.

***

If you find this newsletter helpful and want to support its production, please consider becoming a paid subscriber. I want to reach a wide audience, and your support helps me do that!

Thanks for reading!

Matt

MUST READ

Trump Just Handed China the Tools to Beat America in AI

Matt Pottinger and Liza Tobin, The Free Press, August 12, 2025

Ending an export ban will help China catch up in the race for control of the global economy and military dominance in the 21st century.

President Donald Trump’s team just gave China’s rulers the technology they need to beat us in the artificial intelligence race. If he doesn’t reverse this decision, it may be remembered as the moment when America surrendered the technological advantage needed to bring manufacturing home and keep our nation secure.

His advisers, including Nvidia CEO Jensen Huang, persuaded him to lift his ban on exporting Nvidia’s powerful H20 chips to China, which desperately needs these chips to make its AI smarter. The president should have stuck with his gut.

In exchange, the U.S. government has apparently become a financial beneficiary in AI chip sales to China: Press reports indicate that Nvidia and AMD (another chipmaker) have agreed to turn over 15% of their China chip revenues as a condition for obtaining export licenses, an arrangement that effectively monetizes what was supposed to be a national security restriction.

Don’t believe the claims that these chips aren’t very advanced. Before Trump banned them from export to China in April, H20s were instrumental in China’s DeepSeek AI model that shocked the world in January. DeepSeek’s CEO publicly admitted that United States “bans on shipments of advanced chips” are his company’s biggest challenge. In May, a senior executive at Chinese tech giant Tencent said he expected the ban on the H20 to “widen the gap” the U.S. enjoys over China in AI.

China’s lack of unfettered access to U.S.-designed AI chips is America’s clearest advantage in the AI race. By reversing the ban, the White House is helping Beijing’s Communist regime close the gap.

While it makes sense to sell advanced Nvidia chips to U.S. allies and trusted partners, the regime in Beijing is waging a new cold war against the United States. In December, Mike Waltz, then Trump’s pick for national security adviser, said Beijing was “literally putting cyber time bombs on our infrastructure, our water systems, our grids, even our ports.”

In April, the Chinese military released a video titled “The Robot Dog’s Time to Kill Has Come.” It showed an AI-enabled, four-legged terminator unit, made by Chinese robotics firm Unitree, with an assault rifle mounted on its back, running alongside human soldiers and firing at a target. It was a small peek into Beijing’s AI-enabled military ambitions.

Nvidia has shrugged off concerns that its chips could assist the Chinese military. That view is uninformed at best. Procurement records reviewed by Business Insider show recent attempts by China’s People’s Liberation Army (PLA) to procure Nvidia’s chips for a range of weapons systems, including robotic dogs.

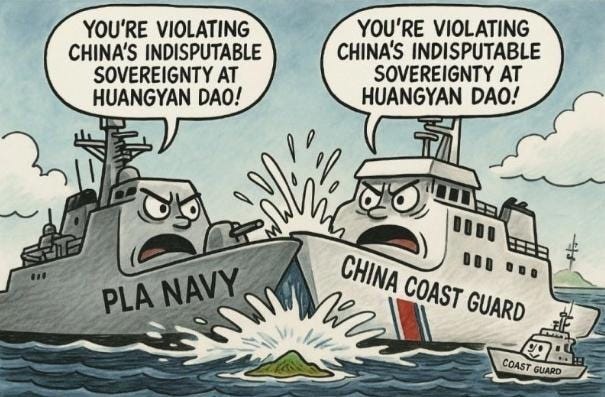

VIDEO – Moment Chinese ships CRASH while tailing Filipino boat in South China Sea

The Sun, August 11, 2025

COMMENT – I love how the Filipinos filmed themselves offering assistance after the accident.

There were two guys standing on the bow of the Chinese Coast Guard ship seconds before the collision.

In all seriousness, my heart goes out to those families, I don’t think those two young men are coming home.

VIDEO – Chinese Coast Guard Cutter and Chinese Navy Destroyer Collide While Pursuing a Filipino Cutter

Sal Mercogliano, What’s Going on with Shipping, August 12, 2025

In this episode, Sal Mercogliano — a maritime historian at Campbell University (@campbelledu) and former merchant mariner — discusses the collision between the People's Liberation Army Navy destroyer Guilin and the Chinese Coast Guard Cutter 3104 while harassing and pursuing the Philippine Coast Guard Cutter Suluan on August 11, 2025, off Scarborough Shoal.

COMMENT - As I watch these videos, all I can think of is that scene from Rogue One.

2 U.S. warships deployed to disputed waters after Chinese ships collided

CBS News, August 14, 2025

The United States deployed two warships Wednesday to a shoal in disputed waters in South China Sea, where two Chinese ships collided earlier in the week while chasing a smaller Philippine ship. The high-seas accident raised concerns about maritime safety and questions about the extent to which the U.S. should involve itself in longstanding tensions between those countries.

Both China and the Philippines claim Scarborough Shoal and other outcroppings in the South China Sea. Vietnam, Malaysia, Brunei and Taiwan also lay overlapping claims in the contested waters.

The USS Higgins, a guided missile destroyer, and USS Cincinnati, a littoral combat ship, were shadowed by a Chinese navy ship while sailing about 30 nautical miles from the Scarborough Shoal. There were no reports of any untoward incident, Philippine coast guard Commodore Jay Tarriela said, citing information from U.S. officials and a Philippine surveillance flight.

The U.S. Navy has staged what it calls freedom-of-navigation voyages and overflights in the South China Sea for years to challenge China's restrictions and its demand for entry notifications in virtually the entire stretch of the disputed waters that it claims. That has angered China and its forces have had close runs-in with U.S. warships and aircraft on such patrols in international waters and airspace.

The deployment happened after Washington's ambassador to Manila, MaryKay Carlson, on Tuesday condemned "the latest reckless action by China directed against a Philippine vessel" in Scarborough. The rich fishing atoll off the northwestern Philippines has been the scene of increasingly tense confrontations between the Chinese and Philippine coast guard, fishing and other ships in recent years.

World’s top hedge fund Bridgewater dumps all China stocks in retreat from market

Yulu Ao, South China Morning Post, August 14, 2025

World’s largest hedge fund drops US$1.41 billion of shares in firms including Alibaba, JD.com, Baidu, Nio and Yum China in second quarter.

The world’s largest hedge fund, Bridgewater Associates, sold all of its holdings in US-listed Chinese companies in the second quarter, marking a decisive retreat from the market as geopolitical tensions and shifting investor sentiment clouded the outlook for the world’s second-largest economy.

The fund exited positions in 16 Chinese stocks, which were worth US$1.41 billion in total, according to its 13F filing with the US Securities and Exchange Commission on Wednesday. This included e-commerce giants Alibaba Group Holding, JD.com and PDD Holdings, search-engine operator Baidu, electric-vehicle maker Nio, travel services provider Trip.com Group and restaurant chain Yum China. Alibaba owns the South China Morning Post.

The sell-off also included TAL Education Group, H World Group, KE Holdings and Autohome, wiping out Bridgewater’s direct exposure to US-traded Chinese equities for the first time in years.

The exit came after Bridgewater made headlines in recent quarters by slashing its exposure to US equities and piling into Chinese names. The firm had sharply increased its bet on e-commerce leader Alibaba in the first quarter – boosting its stake by more than 3,360 per cent to US$748.4 million from US$21.6 million at the end of 2024.

The reversal coincided with growing market volatility and signs of investor caution. In the second quarter, renewed tariff shocks between the US and China triggered sharp corrections in both markets.

Founded by veteran investor Ray Dalio, who has long described China as a strategic part of a diversified global portfolio, Bridgewater appears to have reassessed its exposure amid the global trade tensions.

Bridgewater pivoted towards US mega-cap technology stocks. It raised its stake in Nvidia by 154 per cent to 4.61 per cent of its portfolio, while also significantly increasing positions in Microsoft by 112 per cent, Alphabet by 84 per cent and Meta Platforms by 90 per cent.

The firm disclosed 585 positions worth about US$24.8 billion in public equities as of June 30, up from roughly US$21.6 billion three months earlier, as part of its US$136.5 billion in global assets under management.

It also closed out its indirect exposure to Chinese equities by exiting exchange-traded funds such as the iShares MSCI China ETF and the iShares China Large-Cap ETF, the filing showed, suggesting a broader strategic reallocation away from China.

COMMENT – This marks a significant departure for Bridgewater, whose founder, Ray Dalio, was saying just a few short years ago that everyone should split their investments between the United States and the PRC.

Thai gallery removes China-focused artworks after 'pressure' from Beijing

Napat Wesshasartar, Reuters, August 10, 2025

One of Thailand’s top art galleries removed, at China's request, materials about Beijing's treatment of ethnic minorities and Hong Kong from an exhibit on authoritarian governments, according to a curator and communications seen by Reuters.

In what the artists called the latest attempt by Beijing to silence critics overseas, the Bangkok Arts and Cultural Centre changed multiple works by artists in exile in the exhibit on authoritarian governments collaborating across borders.

China’s new ‘Air Silk Road’ brings thousands of tons of goods from Xinjiang to Europe

Politico, August 11, 2025

More than 40 freight routes now connect Europe to the region, where Beijing is accused of subjecting the Uyghur ethnic group to forced labor.

Rare-Earth Magnet Maker Raises $65 Million in Push to Counter China

Hannah Miao, Wall Street Journal, August 11, 2025

Startup Vulcan Elements said it raised $65 million in a new funding round to increase production of the rare-earth magnets crucial to everything from drones to electric vehicles.

The funding signals the growing push to build up an industry in the U.S. and reduce dependence on China.

The details

North Carolina-based Vulcan was valued at around $250 million in the funding round led by Brad Gerstner’s Altimeter Capital, a tech-focused investment firm that has backed companies such as OpenAI and Uber Technologies.

Gerstner also led efforts to create “Trump accounts,” the $1,000 government-funded investment accounts for children that recently became law.

One Investment Management, run by former SoftBank financier Rajeev Misra, is also an investor.

Vulcan Chief Executive John Maslin, a former Navy officer, co-founded the company in 2023 as a student at Harvard Business School. He was concerned that China controls around 90% of the world’s supply of rare-earth magnets.

“When you talked about rare-earth magnets a couple years ago, they would look at you like you’re insane,” Maslin said. “People actually understand the strategic importance of onshoring this now.”

Vulcan, which said it previously raised about $10 million in seed funding, opened a pilot manufacturing facility this March in Durham, N.C., and has made initial magnets for military and commercial clients. Vulcan said it doesn’t use any material, equipment or software from China, only from the U.S. and its allies.

Maslin said the new funding would go to building a large-scale facility that could produce hundreds of metric tons of magnets annually within a couple of years, and thousands by the end of this decade.

The context

Rare-earth magnets have become a flashpoint in U.S.-China trade tensions.

In April, Beijing began requiring licenses for exports of certain rare-earth metals and related products, slowing exports to a trickle. Automotive, electronics and defense companies in the U.S. and around the world struggled to get supplies.

Rare-earth magnet exports from China have recovered a bit after negotiations between the U.S. and China, but flows are well below last year’s levels and remain restricted for Western defense companies.

To counter China’s dominance, the Pentagon is making a multibillion-dollar commitment to America’s biggest rare-earth miner, MP Materials. The Defense Department will take a 15% stake in the company, purchase its products and guarantee a price floor.

COMMENT – Seeing news about companies like Vulcan Elements makes me more confident that we are getting our act together and that we have a good chance to build the complete Software-Electric Technology Stack in the United States.

GM Signs Domestic Rare-Earth Deal to Reduce Reliance on China

David Welch, Bloomberg, August 6, 2025

General Motors Co. has signed a deal with Texas-based Noveon Magnetics Inc. to secure rare-earth magnets for its full-size pickup trucks and SUVs, marking the third domestic supply contract the automaker has signed related to the critical trade dominated by China.

The latest agreement and two others — with Las Vegas-based MP Materials Corp. and E-Vac Magnetics, a South Carolina-based unit of Germany’s Vacuumschmelze GmbH — will allow GM to get the majority of rare-earth magnets it sources directly from domestic suppliers, the Detroit carmaker said Wednesday. But many of the parts it buys still rely on Chinese-made magnets.

Beijing has imposed export controls over rare-earth magnet production in retaliation for US tariff threats. Ford Motor Co. had to temporarily idle plants in June due to a shortage of magnet supplies.

While the Chinese government has eased those restrictions after reaching a deal with the Trump administration, Washington continues to push for more domestic production to reduce reliance on China, including having the Pentagon take an equity stake in MP Materials.

GM started working with MP Materials in 2021 during the Biden Administration to develop a US supply chain for the magnets, which are crucial for internal combustions engines, electric-vehicle motors and other key parts. MP and E-Vac are both expected to begin production from next year, according to the auto manufacturer. Noveon already is producing magnets and began deliveries as of last month.

COMMENT – Also a positive sign that we can build the full tech stack here!

Rare-Earth Deals Show the US Can Break China’s Grip

Thomas Black, Bloomberg, August 12, 2025

America can reclaim its supplies — but only with government support.

Jim Litinsky, chief executive officer and co-founder of MP Materials Corp., should be forgiven for waxing melodramatic during the rare-earth mining company’s second-quarter conference call on Thursday.

Litinsky had just realized his dream during the past quarter of becoming a large, fully integrated supplier of rare-earth magnets after reaching two transformational deals in July with the Department of Defense and Apple Inc. Those two deals will add to MP Materials’ contract with General Motors Co. to supply magnets for electric vehicles from a new plant in Fort Worth, Texas, that’s about to begin production.

Litinksy and co-founder Michael Rosenthal had foreseen the crisis over China’s stranglehold on rare-earth materials when they pursued the 2017 purchase of a bankrupt rare-earth mine at Mountain Pass, California.

The agreements with the Pentagon, Apple and GM provide MP Materials with the capital and the marquee customers to rapidly increase production capacity for mining materials and producing finished magnets, which are used in automobiles, phones, aircraft and an astonishingly wide variety of products. They are also a template for expanding the rare-earth supply chain in the US.

“These agreements validate the mission we have pursued since Day 1 and mark a new chapter, not only for our company, but for the country,” Litinsky said on the call.

He added: “The rare-earth supply chain, long built on a single point of failure, had cracked. I said that Humpty Dumpty was not getting put back together again and that this moment would be transformational and remembered.”

That single point of failure he was referring to is, of course, China, which controls about 90% of the rare-earth magnets.

The deal with Apple is monumental for MP Materials because its paves the way for the company to build a large magnet recycling facility. Apple provides the feedstock, such as old phones and other discarded electronics, giving MP Materials a big leg up for entering the recycling business.

The Defense Department deal is monumental for the country. Under the agreement, the department put a floor on material prices and MP Industrial’s profits and will take all the volume produced if need be. This extraordinarily advantageous deal is the only way that a US company could defend itself from the onslaught of Chinese competitors fully supported by their government.

The Pentagon should do more of these deals to support the mining and processing of rare-earth materials and other specialty metals on which US industry depends and that are now controlled mostly by China. It’s unfortunate that the US government must enter these markets with subsidies because such support distorts markets, and the government is usually bad at picking winners.

But China’s practice of choosing champions and subsidizing them to gain market share has forced the US’ hand. The bad cocktail of authoritarian government coupled with a top-down variant of capitalism has allowed China to dominate markets such as shipbuilding and steel production and then move up the technology chain to drones and electric vehicles. Space rockets and robots are next.

The good news is that the effort to increase US production of these materials is bipartisan and the driver is the Pentagon. The first National Defense Industrial Strategy was released in January 2024. A fire has now been lit under the current administration after President Donald Trump was forced to retreat from his 145% tariffs on Chinese goods after China cut off the supply of rare earths and industrial magnets, which threatened to shut down US factories.

The Defense Department didn’t just give away money. Part of the funding is in the form of preferred stock that is convertible to shares and a warrant that allows it to buy more shares. This allows the Pentagon to reap the benefit of the wealth it’s helping create at MP Materials.

Such deals should aim at other supply chain choke points and don’t have to be limited to rare earths. For example, tungsten isn’t classified as a rare earth, but it’s a specialty metal with unusual strength used in all kinds of industrial applications including armor-piercing munitions and jet-engine fan blades. The US no longer produces the metal while China, Russia and North Korea have captured 90% of the global supply.

The Pentagon in July provided a $6.2 million award to Golden Metal Resources, the US unit of the UK-based holding company Guardian Metal Resources Plc, to perform a pre-feasibility study for a tungsten mine near Hawthorne, Nevada. Five years ago, the company scooped up the World War II-area mining site that produced the metal for ammunition on the bet that domestic production would become a national security issue.

Guardian bought another abandoned tungsten mine in Nevada that had been operated by Union Carbide, which is now a part of Dow Inc. Production there stopped after the Chinese drove down the price of the metal and put miners out of business.

Guardian aims to begin production at both projects by the end of 2028 and expects to produce as much 4,000 tons annually, which is the same amount that the US now imports from China. CEO Oliver Friesen pointed out that MP Materials’ success began with a $9.6 million Defense Department technology investment in 2020.

“We want to be the champion of US tungsten, and we think we have the assets and the team to do that,” Friesen, who has previous experience working in Nevada with Barrick Mining Corp., said in an interview.

The Defense Department may have to step in with price supports for this metal and other rare-earth elements to encourage domestic production and break the Chinese stranglehold. While these mining operations should follow best practices to mitigate the harm to nature, undue roadblocks in the name of environmental protection shouldn’t prevent these crucial mining and processing operations from moving forward.

With Pentagon support and large customer contracts, MP Industrial now plans to expand its industrial magnet factory to 10,000 tons a year from 1,000 tons and will expand its mining operation at Mountain Pass, California, to keep pace.

“We have the platform, the partners, and the perspective to seize another enormous runway of opportunity,” Litinsky said.

The proliferation of modern gadgets, such as robots and driverless vehicles, will only drive more demand for these materials. It’s imperative that the US controls its own supply of these materials — even if it requires government support.

COMMENT – My advice to the Trump Administration is that cutting a deal with Beijing now will destroy these nascent efforts to make the United States self-sufficient.

China cries foul over Labubu counterfeits. That’s rich.

Washington Post, August 13, 2025

China, long known as the counterfeit capital of the world, has discovered a new respect for intellectual property.

It’s hard to say what’s more amusing about the meteoric rise of China’s Labubu toys: the bizarre appearance of the dolls themselves or the fact that they’ve spawned knockoffs that are sometimes just as popular as the originals.

Labubus — a wildly popular elf-like “monster” created by Hong Kong-born artist Kasing Lung and sold by Chinese toy giant Pop Mart — have become so desirable that a group of masked thieves in Los Angeles stole $7,000 worth of them last week. More than $400 million worth of the toys were sold last year.

To protect this lucrative innovation, China has launched a crackdown on what are called “Lafufu” dolls. Nearly 49,000 counterfeit toys have been seized by Chinese customs officials in recent weeks. Pop Mart has sued 7-Eleven and seven of its California stores, accusing them of selling knockoffs.

In a landmark ruling in June, a Chinese court sided with Pop Mart against a defendant caught selling unauthorized 3D-printed replicas of the toy. The $1,380 in damages may seem modest, but the symbolism was rich: official recognition that Pop Mart has intellectual property rights – a courtesy not extended to American companies in China.

This is the crux of the problem. Chinese companies such as Pop Mart have access to strong legal protections for copyright and IP violations in the United States, but American companies don’t enjoy the same protections in China. Pop Mart, for example, has registered trademarks for Labubu products in the United States, and the American Bar Association notes it has multiple legal tools at its disposal to fight counterfeits.

By contrast, China ranks 24th out of 55 countries in the U.S. Chamber of Commerce’s 2024 International IP Index — far behind the U.S., which ranks No. 1. The Office of the U.S. Trade Representative has China on its priority watch list because of persistent issues including trade-secret theft, forced technology transfer and large-scale counterfeiting.

Foreign companies hardly bother to file IP cases: These cases constitute less than 1 percent of China’s IP docket. Even when U.S. companies manage to win IP cases in Chinese courts, they often receive minimal compensation. Enforcement of rulings remains spotty at best.

This comes at a huge cost. According to a 2019 CNBC survey, 1 in 5 companies based in North America said Chinese companies had stolen their intellectual property in the year before. Small businesses are especially vulnerable to IP theft and have led the charge against Chinese IP violations in Congress.

China remains the epicenter of counterfeit goods coming into American markets: China and Hong Kong were the source of more than 93 percent of the total value of counterfeit and pirated goods seized by U.S. Customs and Border Protection in fiscal year 2024. The FBI estimates that Chinese IP theft costs the U.S. economy up to $600 billion a year.

COMMENT – I have one word: schadenfreude

Authoritarianism

Xi Foreign Policy Team in Doubt on Diplomat’s Reported Detention

Nikkei Asia, August 12, 2025

China’s foreign-policy apparatus is again facing questions about succession after the reported questioning of a top figure who had been widely viewed as the nation’s next foreign minister.

Just two years after the surprise ouster of Foreign Minister Qin Gang, senior diplomat Liu Jianchao has been detained for unclear reasons, according to a Wall Street Journal report. Liu has been heading the Communist Party’s International Department, which conducts outreach to political parties and civic groups around the world and runs in parallel to the Foreign Ministry.

If Liu were to be removed, it would create another leadership vacuum in foreign policy just as President Xi Jinping tries to position China as a more trustworthy partner than the US under Donald Trump. For now, Wang Yi, who turns 72 in October and has surpassed the once-official retirement age, remains foreign minister and the party’s head of international affairs.

Wang — who returned to the foreign minister role after Qin’s ouster — is now doing jobs that used to be shared by two senior officials during Xi’s second term, meaning he has to do both planning and front-line diplomacy.

“It is unclear who will and can replace Wang Yi,” said Dylan Loh, assistant professor at the Nanyang Technological University in Singapore. “It might cause some morale issues” if Liu’s removal is confirmed and further dented Beijing’s top foreign policy expertise, he said.

Neither China’s Foreign Ministry nor the International Department responded to a question about Liu’s status.

If Liu does get officially removed, it’s possible the reason never gets publicly revealed, but when senior Chinese officials are questioned it’s often for corruption-related issues. Liu’s impending downfall wasn’t apparent in his recent schedule. His latest sit-downs, according to his department’s website, included South African President Cyril Ramaphosa and the foreign ministers of India and Singapore.

Liu was “unusually candid and friendly” for a Chinese official, said Dexter Roberts, a nonresident senior fellow at the Atlantic Council’s Global China Hub, who interacted with Liu while serving as a foreign correspondent in Beijing. Liu “was clearly in favor of a better relationship with the Western media and the West more generally.”

Liu, 61, has been an important face of China, first during the 2000s as Foreign Ministry spokesperson, and more recently in his Communist Party role. He was known to advocate for reform and positive relations with Western media. In a Council on Foreign Relations event last year, he highlighted how “reform and opening up” had transformed China, enabling him as a child of the 1960s to witness “the sheer contrast of life before and after.”

If China is now again on the hunt for a successor to Wang as foreign minister, the following may be among potential candidates — based on an examination of career diplomats at China’s key foreign policy agencies looking at factors including age, ranking and experience.

As executive vice foreign minister since 2023, Ma Zhaoxu has been overseeing daily operations at the ministry — first under Qin and later under Wang. After failing to get tapped to succeed Qin, analysts largely expected Ma to serve out his current post until retirement. But the new shakeup could mean he gets another look. While his title is vice minister, his official ranking is “ministerial.”

Liu Haixing is another candidate with full “ministerial” ranking, he is the executive deputy director of the office of the Central National Security Commission, which is headed by Xi’s close aide Cai Qi. The secretive body is believed to help implement Xi’s vision for “big power diplomacy.” Liu’s position suggests that he has trust from the top leader.

Sun Weidong, a former ambassador to India, was promoted to vice foreign minister in 2022. Analysts say he appears to be overseeing relations with Asian nations, a region that is increasingly important as Xi prioritizes “neighborhood diplomacy.”

A former Foreign Ministry spokeswoman, Hua Chunying is one of the most familiar faces to the outside world. Her promotion has been relatively fast tracked, becoming an assistant minister in late 2021 and a vice foreign minister less than three years later — making her the youngest among peers. Her experience overseeing protocol issues granted her ample face time with Xi. Hua’s lack of experience as a foreign ambassador might be a disadvantage.

Lu Kang is deputy director of the party’s International Department, which Liu headed, and another younger-generation contender. He also worked as a Foreign Ministry spokesperson before heading the department that deals with the North America and Oceania. His 2022-24 tenure as ambassador to Indonesia overlapped with Xi’s visit to the Southeast Asian nation and a period when ties between the two nations strengthened.

Anti-US summit in Tianjin to follow Trump-Putin Alaska meeting

Katsuji Nakazawa, Nikkei Asia, August 14, 2025

China’s tech dealmaker Bao Fan freed from detention after two years

Cheng Leng and Ryan McMorrow, Financial Times, August 8, 2025

Disappearance of China Renaissance founder sent chills through the country’s finance sector in 2023.

Bao Fan, one of China’s star tech dealmakers and founder of boutique investment bank China Renaissance, has been freed by Chinese authorities after nearly two and half years of detention.

Bao, a former Morgan Stanley and Credit Suisse banker famed for wheeling and dealing on behalf of China’s big tech groups, was released recently, according to people familiar with the matter. The state’s charges against him were never made public.

Bao’s disappearance in 2023 sent chills through the country’s tech and finance sectors, and came amid a wide-ranging anti-corruption campaign led by President Xi Jinping.

The disappearance of its chief rainmaker also hit China Renaissance, which had been at the centre of China’s tech boom with Bao often leaning on his deep personal relationships with tech moguls to stitch together deals.

The Hong Kong-listed shares of China Renaissance jumped by 17 per cent on Friday afternoon, shortly after Chinese media outlet Caixin reported on Bao’s release.

China Renaissance first told its investors Bao had gone missing in February 2023, and subsequently stated he was “co-operating in an investigation”. But as the months dragged on, Chinese authorities did not make any public allegations against Bao or provide China Renaissance with further information.

Turmoil at the bank had initially started in September 2022 when the group’s president, Cong Lin, was called in by China’s securities regulator for a “supervisory discussion”. Within days Cong had exited key positions at China Renaissance’s securities unit and was later detained by Chinese authorities. His whereabouts remain unknown and he has not been publicly charged.

People close to Bao said they believed his detention was linked to Cong’s, who Bao hired from state-owned ICBC International in 2020.

COMMENT – Disappeared for two and half years and held at a shadow detention facility… that’s some shady shit.

WAY BACK MACHINE – Disappearance of dealmaker Bao Fan casts chill across China’s tech sector

Thomas Hale, Ryan McMorrow, and Kai Waluszewski, Financial Times, February 20, 2023

In May 2021, a group of Chinese banks agreed to lend $300mn to investment bank China Renaissance with a condition: if Bao Fan, the company’s well-known founder, ceased to be its largest shareholder or was no longer chair of the board they could demand early repayment.

Nearly two years later, lawyers may soon be poring over that clause. The disappearance of Bao last week, announced in a company filing, has set on edge the country’s vast tech industry that the dealmaker helped to build.

The fate of Bao and his company, which has for years been at the heart of financing Chinese tech, is a pivotal test of Beijing’s stance on the industry. A two-year government crackdown has already sidelined Alibaba chief Jack Ma, decimated the vast for-profit education industry and hit investments globally.

“The question is — is it going to spread out?” said Desmond Shum, author of Red Roulette, a memoir on working in Chinese finance. “For the industry it’s a very, very scary moment.”

When China Renaissance listed in Hong Kong in 2018, it was the culmination of years of success in the rise of mainland China’s tech industry.

Bao, in his early 50s, began his career as an M&A banker at Morgan Stanley and Credit Suisse and later worked as head of strategy at AsiaInfo Technologies, a company that provides software solutions to Asian enterprises and listed on the Nasdaq exchange in 2000.

In 2005, he launched China Renaissance to capitalise on the fast-growing tech industry. His success stemmed in part from personal relationships with many of China’s future tech billionaires, formed in his early years at Morgan Stanley and Credit Suisse.

Soon, the bank was offering merger and acquisition, initial public offering and capital management services to the nascent tech stars. It had clients such as Tencent, Alibaba and Didi and boasted of advising on approximately 980 transactions worth $146bn by June 2020.

China Renaissance decided to focus on the tech and healthcare sectors instead of competing head-to-head across industries with foreign groups such as Goldman Sachs or China’s homegrown and state-backed banks such as Citic Securities.

Yet its fortunes have changed as a result of China’s regulatory crackdown on the tech sector. Revenue in the first half of last year fell by more than 40 per cent from a year earlier, pushing the group from a Rmb1.2bn ($175mn) profit for the first half of 2021 to a loss of Rmb154mn.

For China Renaissance, Bao’s absence could be devastating. The bank’s shares closed almost 30 per cent lower on Friday following news of his absence.

China Renaissance did not respond to a request for comment.

Bao is the face of the bank and the main rainmaker roping in clients and putting together complicated deals that have shaped the fortunes of many of China’s multibillion-dollar business leaders and entrepreneurs.

“No one at China Renaissance works harder than he does,” said a person close to the bank.

Important mergers in the country’s tech industry, such as between food delivery group Meituan and restaurant rating provider Dianping, as well as ride-hailing companies Didi and Kuaidi, would not have been possible without him, the person said.

China Renaissance has in recent years become more closely connected to the country’s state-owned sector, though it still makes the majority of its money through tech deals.

In 2017, China Renaissance formed a strategic partnership with ICBC International, a division of the state-owned bank ICBC. ICBC International provided the investment bank with a $200mn credit line backed by pledged China Renaissance shares, stipulating the borrowed funds be repaid soon after its Hong Kong listing.

Cong Lin, a figure instrumental in that deal, later joined China Renaissance in 2020 and was until recently its president and head of its securities unit.

His recruitment to lead the group’s securities business marked China Renaissance’s first big hire of a well-connected banker with deep ties in China’s state-owned banking system.

In September last year, a branch of China’s securities regulator demanded Cong come in for a “supervisory discussion”. Three days later, Cong quietly exited key positions in the group’s securities unit. He was detained by Chinese authorities around that time and no longer appears among the management listed on China Renaissance’s website.

Some people close to Bao believe his problems could be linked to Cong’s, with his disappearance coming on the heels of his lieutenant’s own run-in with authorities. Others speculate Chinese authorities could be chasing information related to his years of backroom dealmaking in the tech industry.

China targets 2 Lithuanian banks as EU relations sour over Ukraine

Thomas Hale and Alice Hancock, Financial Times, August 14, 2025

Brussels earlier imposed curbs on two Chinese lenders over trade with Russia

China has imposed sanctions on two Lithuanian banks, in retaliation for recent EU curbs on two Chinese lenders as relations sour over Russia’s invasion of Ukraine.

The measures, announced by China’s Ministry of Commerce on Wednesday, come after Brussels imposed sanctions on two regional Chinese lenders last month after allegations they had financed banned trade with Russia.

UAB Urbo Bankas and AB Mano Bankas would be added to a countermeasure list, the official ministry statement said, while individuals and organisations in China would be blocked from engaging in transactions, co-operation or “other activities” with them.

The statement referred to the banks as “EU financial institutions” and did not mention Lithuania directly.

A European Commission spokesperson said Beijing had informed Brussels of its intention to impose sanctions on the banks on August 12.

“Once formally received, the EU will study these measures in detail, before deciding on any additional next steps,” they said.

“The EU is open to identifying a mutually acceptable solution that could ultimately lead to the delisting of the banks.”

Beijing had previously warned the EU it would retaliate against its sanctions, which marked the first instance of the 27-member bloc targeting third-country lenders over Russia’s 2022 invasion of Ukraine.

Brussels has increased its pressure on China over the hostilities, urging it to use its influence on Moscow to bring about an end to the conflict after repeatedly expressing concerns over military-related trade. Germany has also raised these concerns.

Brussels said this week it was preparing a 19th package of measures that could target Russia’s trading partners as well as tightening economic screws on Moscow itself.

Lithuania has historically been one of the most hawkish countries towards China in the EU. Relations between Beijing and Vilnius hit a low point in 2021 when Lithuania allowed the Taiwanese government to set up a representation in the Lithuanian capital under its own name, which Beijing read as a contravention of its “One China” policy.

China accuses US of using ‘lies as pretext for seeking control’ of Panama Canal

Fan Chen, South China Morning Post, August 12, 2025China Came Ready for This Trade Fight, and the US Has a Lot to Learn

Tom Orlik, Eric Zhu, and Jennifer Welch, Bloomberg, August 13, 2025

US dynamism gave it an edge in a free-trade world, but China has spent decades planning for the new reality.

Under President Donald Trump, the US has launched a multipronged attack on China’s economy. Since Chairman Mao Zedong’s reign, China has seen it coming. A US system built around the ideal of openness and interdependence is facing off against a Chinese counterpart constructed as a fortress of control. Both sides have powerful resources. Only one has been preparing for the fight for decades.

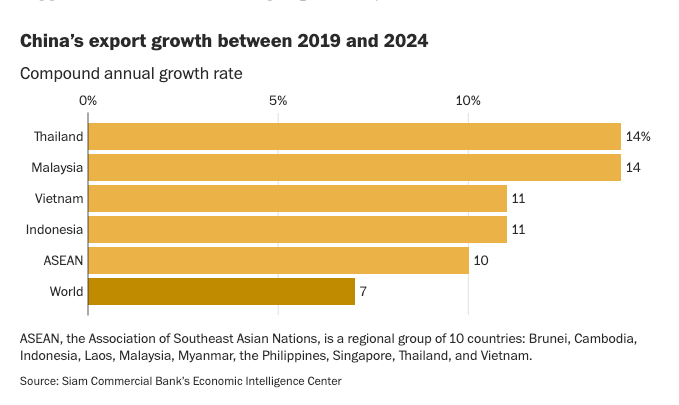

Since the beginning of Trump’s first term in 2017, the US stance on China has swung from constructive if increasingly cautious engagement to something between fierce rivalry and outright hostility. China’s exports to the US face duties running close to 40%. Supply of bleeding-edge semiconductors for China’s technology companies has been curtailed. The country’s science, technology, engineering and math students, once welcomed into US university labs, are checked at the border. The social media app TikTok, owned by Chinese parent ByteDance Ltd., is on a stay of execution in the US market.

The assumption in Washington is that China must now be floundering. Isn’t it hooked on US customers and technologies? It’s only a matter of time, surely, before President Xi Jinping picks up his red phone to call the White House and concede defeat.

The reality is rather different. It’s certainly true that Trump’s policy pivot is a problem for Beijing. Bloomberg Economics calculations show tariffs at the current levels would erase more than 50% of sales to the US. But it’s far from the end of China’s development story.

China’s exports to the US equal about 3% of gross domestic product—down from a peak of 7% two decades ago, after a campaign to diversify away from American consumers that’s been every bit as deliberate as US efforts to reduce reliance on Chinese supply chains. That means even if half of China’s exports to the US get wiped out, the blow to the overall economy is just 1.5%. Not good news, to be sure, but far from a disaster.

Protests in China over viral school bullying case

Laura Bicker, BBC, August 5, 2025

A school bullying incident in southern China has sparked a series of protests and calls for more justice for the 14-year-old victim.

A video of the girl being slapped, kicked and forced to kneel by three other minors went viral in the Jiangyou city in Sichuan province last week.

The police said the three suspects are all female, aged 13, 14 and 15 - and two of them had been sent to "specialised schools for corrective education".

As news of the incident spread on social media, many felt the punishment was too light - especially after claims that the girl had been bullied for some time and that her mother, who is reportedly deaf, had pleaded with the authorities for more justice for her daughter.

After the Flood

David Bandurski, China Media Project, August 11, 2025

The tragic death of 31 people in a care home near Beijing during floods last month was given a textbook makeover to preserve the Party’s image. But there were also signs of life under the icy surface of Chinese journalism.

At 6 a.m. on July 28, a wall of water inundated the small town of Taishitun, barely a two-hour drive from central Beijing. The floodwaters — flowing at 1,500 times the normal rate of the Qingshui River, which usually trickles slowly through town — burst the banks and surged through streets and alleyways. While many residents found shelter on rooftops, the 62 residents of a local elderly care home had few options: 80 percent were unable to walk. The waters moved so swiftly that rescue workers could not reach them for three hours. By 10 a.m., 31 residents were dead.

The Taishitun care home tragedy accounted for the majority of Beijing’s 44 flood casualties during torrential rainfall last month. Yet the story, typical of disaster coverage that China’s leadership has long feared could raise questions about readiness and responsibility, received cautious treatment from Chinese media.

In Action, Never Inaction

From the outset, propaganda authorities sought to turn attention away from the death toll, and away from the more jarringly human aspects of the story. The focus was on the actions and declarations of central and local leaders, projecting an image of selfless leadership on the front lines.

In Party and commercial newspapers alike, and in the news apps that mirrored their messaging, the focus was entirely on high-level statements urging rescue and relief efforts. On June 29, the day after the floods struck Tashitun, the Beijing Daily, the official newspaper under the city leadership, included just one tiny image on its front page — of three digging machines at work, but no hint of the human cost. Leading were statements about Xi Jinping’s “important instructions” and their response across Beijing and Hebei.

Xi Jinping’s city of the future is coming to life

The Economist, August 7, 2025

It is both impressive and worrying.

Xiongan, China’s “city of the future” and a pet project of Xi Jinping, the country’s supreme leader, has become a byword for costly vanity projects. Central-government and provincial planners have spent at least 835bn yuan ($116bn) on the city since 2017, when they broke ground in what had been marshy farmland 125km south of Beijing.

It has been touted as a solution to China’s urban maladies, with residents promised short commutes through leafy parks instead of cough-inducing traffic jams. The city is part, officials say, of a “one-thousand-year plan” in civilisation-building. A book about Xiongan from a state publisher lists its creation alongside the works of mythical emperors who supposedly lived 5,000 years ago.

Hackers, secret cables and security fears: The explosive fight over China's new embassy in the UK

Damian Grammaticas, BBC, August 4, 2025How scared should you be of “the China squeeze”?

The Economist, August 12, 2025

Xi Jinping masters the dark arts of the trade war.

“China beats you with trade, Russia beats you with war,” mused President Donald Trump on August 11th. “China is not beating us on trade, not when I’m in charge,” he added. Many disagree. His reflection came mere hours before he extended a fragile trade truce with China for another 90 days. After months of tit-for-tat tariffs, the Sino-American trade war has settled into uneasy stasis.

But China is using the time to hone a sophisticated arsenal of economic weapons. Even as the sides contemplate a broader deal to stabilise the planet’s most important trading relationship—worth $659bn each year—China knows that its power is not in what it buys, but in what it sells.

Environmental Harms

China's petrochemical sector set to expand even as losses deepen

Sam Li and Lewis Jackson, Reuters, August 14, 2025

A key segment of China's petrochemical sector is set to expand by almost half between now and 2028 even as growing competition in the broader refining sector slashes profits.

Capacity to make ethylene, a key ingredient in plastics, will rise by 40 million metric tons between 2025 and 2028, taking total capacity to 100 million tons, Li Suoshan, an executive at a chemical logistics company owned by Sinopec, said on Thursday at a conference in China's Jiangsu province.

Man faces jail in US for shipping 850 turtles in socks to Hong Kong

Koh Ewe, BBC, August 12, 2025

A Chinese man has pleaded guilty in a US district court to exporting around 850 protected turtles wrapped in socks and falsely labelled as toys, the US Department of Justice said.

Between August 2023 and November 2024, Wei Qiang Lin exported to Hong Kong more than 200 parcels containing the turtles, according to a Justice Department statement on Monday.

The boxes packed with the turtles had been labelled as "containing 'plastic animal toys', among other things", the authorities said.

Mr Lin primarily shipped eastern box turtles and three-toed box turtles. Both species are native to the US and highly prized by some pet owners.

China reports 7,000 cases of chikungunya virus

Kelly Ng, BBC, August 5, 2025

Inside China’s Coal Plants and Pollution Shuffle Game

Wesley Alexander Hill, Forbes, August 11, 2025

China’s popular status as a green energy giant isn’t wholly accurate. Chinese exports and tier-1 cities are indeed encouraging testimonials for the potential of green energy, and nationwide developments do largely trend towards some sense of environmental responsibility. Simultaneously, in the Chinese interior, far from most foreign investment and tourism, China is undergoing a coal boom. A coal boom that is fueled more by nostalgia and domestic politics than economic pressures.

In the past few years, China has been ramping up its construction of coal plants, partially eschewing climate targets for greater domestic energy production. China’s coal construction totaled an output of 94.5 GW in 2024, the highest number in 10 years, the equivalent of approximately 90 nuclear reactors. This impressive construction volume has created a problem; the sector faces significant dead weight loss and oversupply. Oversupply and overuse of coal are driving power prices below zero and pushing coal operators deeper into the red. Urban coal plants have been replaced with cleaner-burning gas, but coal has not disappeared. Instead, it has migrated westward to poorer rural regions. Massive plants now feed power back to the cities, at the expense of some of China’s most vulnerable citizens

China’s Coal Deluge

China is turning the clock backwards on its market-driven reforms; the country’s coal boom isn’t reflecting market pressures, but rather Beijing’s top-down campaign for energy security. With the surge in coal plant construction, operational inefficiencies are undermining the industry’s sustainability. China’s average coal plant operating hours have fallen to 4,628 hours a year, or about 53% of a year. This means the average Chinese plant sits idle for nearly half the year, signaling severe underutilization.

As a result, China’s traditional coal heartlands are operating at a loss and are kept online by Beijing through government subsidies paid to power generators. This scheme has given China’s coal industry a $14.9 billion boost. However, critics point out weak eligibility criteria that may extend coal-plant lifetimes unnecessarily and may prolong the dilemma, not rectify it.

How China has relocated its most polluting mines to war-torn Myanmar

Harold Thibault, Le Monde, July 23, 2025

Foreign Interference and Coercion

China cuts ties with Czech President Petr Pavel over his meeting with the Dalai Lama

Associated Press, August 12, 2025

China’s government said Tuesday that it has suspended all ties with Czech President Petr Pavel over his recent meeting with the Dalai Lama.

Pavel met with the Tibetan leader on July 27 to congratulate him on his 90th birthday during his private trip to India.

The Dalai Lama has been living in exile in the Himalayan town of Dharamshala since fleeing Chinese rule in Tibet in 1959.

This meeting “seriously contravenes the political commitment made by the Czech government to the Chinese government, and harms China’s sovereignty and territorial integrity,” said a statement by a Chinese Foreign Ministry spokesman that was released by the Chinese Embassy in Prague.

“China strongly deplores and firmly opposes this, and has lodged serious protests with the Czech side. In light of the severity of Pavel’s provocative action, China decides to cease all engagement with him.”

COMMENT – I’m sure the Czech President is crushed that the ChiComs have “cut ties” with him, now he won’t get that plum speaking slot at the Summer Davos next year.

Costa Rica: Strategic Fragility in a Key U.S. Partner

R. Evan Ellis, Expediente Abierto, August 8, 2025

Biased Neutrality: China’s Rhetoric Amid Escalating Tensions in the Middle East

Roy Ben Tzur, INSS, August 14, 2025

Taiwan FM Lin confirms Japan visit, says China's backlash won't strain Taipei-Tokyo ties

The Tribune, August 14, 2025

‘I don’t expect to live a normal life’: how a Leeds teenager woke up with a Chinese bounty on her head

Tom Levitt, The Guardian, August 11, 2025

Chinese university students told to spy on classmates, report says

Nathan Standley, BBC, August 4, 2025

For university that bridges China and West, geopolitics is ‘biggest challenge’

Holly Chik, South China Morning Post, August 11, 2025

Easing visa restrictions for foreign students and visitors could help to improve understanding of China, head of XJTLU says.

Geopolitics is stifling academic freedom and scientific research, but a university head in eastern China believes there is a way to ease the situation on campuses – by letting more foreign students in.

Xi Youmin, president of Xian Jiaotong-Liverpool University (XJTLU) in Suzhou, Jiangsu province, said easing visa restrictions for foreign students and visitors could help improve understanding of China.

“The world is in a state of division defined by wars, geopolitics and the US tariff war,” Xi said in an interview.

“Such uncertainty leaves people feeling confused and lost.”

He said the closure of some joint venture universities in China and investigations in the United States into scientists of Chinese descent was “a shock to the global scientific community because people used to believe that science and knowledge transcend national borders”.

“Geopolitics is now restructuring the world order. The conflict has already permeated universities and the scientific realm,” Xi said.

“Under the US government’s crackdown on diversity, equity and inclusion initiatives, including threats of funding cuts, universities are making concessions under political pressure – a trend that is quite abnormal,” he said.

XJTLU is a Chinese-British joint venture set up by Xian Jiaotong University and the University of Liverpool in 2006. It has come under scrutiny over collaborations with Chinese and Russian entities that have been sanctioned by the West – links highlighted in a report by an Australian think tank in June.

In the report, the Australian Strategic Policy Institute pointed to XJTLU’s research partnership with the National Supercomputing Centre in Wuxi, a joint lab with iFlytek, and the School of Chips it founded with the Shanghai Institute of Microsystem and Information Technology. Both iFlytek and the Shanghai institute are on the US entity list.

The report also highlighted the XJTLU’s new Centre for China-Russia Humanitarian Cooperation and Development, saying its co-director was a member of a Russian state agency that was sanctioned by the European Union.

It said XJTLU had also invited an adviser to the Moscow regional government, who had been sanctioned by Britain, to its opening ceremony.

“The previously unreported links to sanctions highlight the risks posed by foreign science, technology and academic partnerships in China in a period of heightened geopolitical rivalry, intensifying technological competition and deepening China-Russia cooperation,” the report said.

“Much of the activity outlined in this ASPI research appears to be at odds with the British government’s own defence, foreign policy and national security positions and policies spanning its relationships with the US and EU and strong support for Ukraine.”

Responding to the ASPI report, Xi said that as a Chinese university operating in China, XJTLU “abides by Chinese law and is not restricted by the American entity list”.

“Because XJTLU confers British degrees from the University of Liverpool, research projects involving collaborators on the UK sanctions list could be impacted and scrutinised by the British government,” he added.

Xi said such restrictions on academic and scientific collaborations were “unreasonable for the scientific community”.