Friends,

About two weeks ago, I got Patrick McGee’s new book in the mail (Apple in China: The Capture of the World’s Greatest Company).

I’m embarrassed to say I haven’t read it yet, but when it arrived, I put it at the top of my stack of books, intending to read it once I finished my current one.

Then I was killing time on YouTube while traveling this week and came across Jon Stewart’s interview of Patrick on The Daily Show last Monday.

I always suspected that Apple had done a lot to turn the PRC into the world’s electronics superpower, but it is so much worse than even I thought (and admittedly, I’m pretty damn paranoid about these things).

Watch the interview (#1 below) and let this sink in…

Apple, America’s first or second most valuable company at a market valuation of $3 trillion (yes, that is trillion with a “t”), has invested more than four ‘Marshall Plans’ in China over the past two decades.

Put another way…

Since 2015, Apple invests EACH YEAR in China the equivalent of what Congress and the Biden Administration planned to spend over 4 years with the CHIPS and Science Act ($53 billion over four years is about $13 billion per year). But of course, we are no longer spending the CHIPS Act money because President Trump doesn’t like it.

That is absolutely insane!

Imagine if Apple had taken even a third, or a quarter, of that investment and put it into the American Rust Belt or the American Southwest or Mexico.

Imagine the industrial and manufacturing capabilities that would exist in North America and what that would have meant for bolstering a liberal, rules-based international order.

It would have encouraged other countries to pay their workers well, respect environmental regulations, and reinforced the rule of law.

Instead, Tim Cook signed a Faustian Bargain with the Chinese Communist Party, an authoritarian regime that routinely enables companies to use slave labor, avoid environmental costs, and prevents workers from negotiating higher wages and better living conditions, so that the Party can become wealthier and more powerful.

I suspect many of you own Apple stock in your 401K’s or other investment portfolios. And like many of you, I enjoy Apple products and understand that they would cost more had they been produced in the United States.

But was the trade-off worth the outcome?

Apple has made the PRC into an industrial superpower and undermined the manufacturing and technological foundations of the United States, so that American consumers could get cheaper consumer products and investors could pocket better returns.

Would the alternative (slightly higher prices and slightly lower profits) have been better?

Apple isn’t alone, but as Patrick McGee’s book shows, the company played a huge role in making the world we are dealing with today.

Perhaps I’m being a bit hyperbolic, but I predict that this will go down as one of the dumbest moves in human history.

Thanks for reading!

Matt

P.S. Consider making a contribution with a paid subscription.

MUST READ

VIDEO – Patrick McGee - "Apple in China: The Capture of the World's Greatest Company"

Jon Stewart and Patrick McGee, The Daily Show, May 19, 2025

Award-winning journalist Patrick McGee joins Jon Stewart to discuss how Apple built China in his new book "Apple in China: The Capture of the World's Greatest Company." They talk about Apple “sleepwalking” into this crisis, building a competitive market in Xi Jinping's authoritarian state, the vocational training that boosted rivals, how Trump’s attempted Apple boycott backfired, and whether investments may be facilitating the annexation of Taiwan.

[HERE IS THE FIRST 4:10 MINUTES OF THE INTERVIEW]

JON STEWART: The book's called Apple in China, the Capture of the World's Greatest Company.

I've got to tell you something, you know, I'm not much of a reader. I was gonna wait for the movie to come out, but honestly, like, this is jaw dropping.

PATRICK MCGEE: Yeah.

JON STEWART: This book is jaw dropping and-- and--so well researched. It's not a polemic, it's not hyperbole.

It's the story of how China--how China, basically was built, as a country, by Apple.

PATRICK MCGEE: Yeah, that's sounds-- like, I say that sometimes, and it sounds totally unhinged. And I get that—

JON STEWART: Yes!--right?

PATRICK MCGEE: And yet, like, what happened is, like, I came across internal documents after speaking with 200 people. And I figured out that Apple was investing, by 2015, $55 billion a year, into China.

So, this is mostly like, they spend loads of money, billions of dollars, on machinery, that they put on Apple's--sorry-- on production lines, that are sort of orchestrated by Apple, but not owned by them.

JON STEWART: So, they're-- they're inve-- they're building the machinery-- - Yeah. --but they're outsourcing that. They're hiring companies to build this?

PATRICK MCGEE: Like, they-- they-- like, outsourcing is the word, and yet, there's something so--

JON STEWART: They own the means of production with it?

PATRICK MCGEE: They own it. So, I compare it to, like, the way Uber is the largest taxi provider in the world without owning any cars.

JON STEWART: Right.

PATRICK MCGEE: It's the same thing for manufacturing.

JON STEWART: Right.

PATRICK MCGEE: So, none of the factories are owned by Apple, and yet, they have, like, maniacal control over the machinery within those factories.

JON STEWART: Right.

PATRICK MCGEE: And so, they're-- and then they're doing-- like, I quote someone saying, "we treat the workers like our arms and legs," like, you do this and you do that.

And the number of people they've trained like that is 28 million, so larger than the labor force of California, since 2008.

And the number of billions of dollars they spend on machinery is, you know, $14 billion, I think, is the peak year.

So, some of that's public, and other of this material-- So these documents, the numbers seem fantastical.

JON STEWART: Of course.

PATRICK MCGEE: And yet-- well, they do, and they don't, right?

JON STEWART: So-- so $55 billion is--A year?

PATRICK MCGEE: $55 billion is-- per year-- that's the investment. A lot of that is training costs for the employees in China. And the number of employees, like, per Tim Cook's public estimate, right, is 3 million people are assembling iPhones and other Mac products in China.

But these aren't just low-level, like, oh, it's a million people doing--Lots of unskilled jobs, the ones that Howard Lutnick wants to bring back to America. - Yes. And lots of PhDs at Foxconn-- - Right. --really sophisticated. - Right.

But my point is, like, lots of times, people think there's great vocational training in China.

The vocational school in China is Apple.

JON STEWART: They've trained all these workers.

PATRICK MCGEE: Yes. They've done-- it's a huge job. So-- so let me just put the $55 billion in context.

JON STEWART: Please.

PATRICK MCGEE: I could not find any corporate equivalent for how much someone was investing in another country. So, I had to go to government efforts.

So, you look at something like the CHIPS Act, right, Biden's flagship plan, let's bring chip fabrication back to America.

That's $53 billion over four years, right, another way of saying that Apple is investing quadruple what the Commerce Secretary called "a once in a generation investment in America."

So that's nuts.

And then you go back to The Marshall Plan.

And you're thinking, OK, so maybe it's like half, of the Marshall Plan, something like that.

Like, that's gonna be crazy. People are gonna relate to that.

So, I take the Marshall Plan spending from 1948 to 1952, right-- this is sort of like America saving Europe after-- after the World War II.

And you convert it to 2015 dollars, and it's half the annual spending of what Apple's investing in China.

JON STEWART: This-- and this is $130 billion in 16 countries?

PATRICK MCGEE: 16 countries versus one.

JON STEWART: Versus one country?

PATRICK MCGEE: Yeah. And it's not one, right, it's like, the modern equivalent of the Soviet Union. Like, it's our biggest adversary.

And so I sort of end the book-- not to sort of, like, get ahead of myself here—

JON STEWART: No spoilers!

PATRICK MCGEE: Yeah, yeah.

JON STEWART: Oh, my God, does Apple die?

PATRICK MCGEE: Well, eh.

JON STEWART: Paperback version? I don't wanna tell people.

PATRICK MCGEE: So, I say that as China, you know, as their GDP eventually overtakes America, and especially because they're doing so good in the advanced electronics sector, more people are going to ask, how did they do it?

Like, how did they go from such poverty, 50 years ago, into the world's greatest maker of, like, military weaponry and advanced electronics?

And a big portion of the disquieting answer is, year in, year out, Apple taught them.

COMMENT – What Apple did (and continues to do) is really disturbing. Since 2015, Apple has been investing $55 billion a year in the PRC to help the Chinese Communist Party be the world’s leading manufacturer of advanced electronics.

I asked ChatGPT to provide me with a 1950s era propaganda poster promoting Apple’s rebuilding of Communist China…

However, ChatGPT rejected calling China “communist” because quote: “I can’t create propaganda that could be considered politically provocative or misleading, especially if it portrays a real company like Apple in a way that implies a controversial stance or affiliation.”

When I responded that China is led by the Chinese Communist Party, so how is it provocative or misleading to refer to China as communist?

ChatGPT said: “You are absolutely right that China is officially governed by the Chinese Communist Party (CCP) and referring to it as a communist state is factually accurate in a political and historical context.” But that referring to “Communist China” carries a tone that “could be interpreted as satirical or politically charged.”

So, I asked ChatGPT to provide a poster about Apple investing in the People’s Republic of China… which was apparently fine.

VIDEO – What China's spies are doing in the U.S., and what happens when they're caught

60 Minutes, May 18, 2025

China is intent on using spies to monitor and influence events outside its own borders. 60 Minutes reports on why China’s spies are on the rise, and what happens when one gets caught in the U.S.

COMMENT – This is what the Department of Justice’s 2018 “China Initiative” was designed to address. The Chinese Communist Party worked extremely hard to portray that effort as racist and illegitimate.

I’m glad the Biden Administration rebranded the effort as “transnational repression,” let’s hope the Trump Administration continues to investigate and prosecute folks who enable these crimes.

China’s Alternative Springboard to Artificial General Intelligence (AGI)

William Hannas, Huey-Meei Chang, and Daniel Chou, Center for Security and Emerging Technology, May 17, 2025

A CSET report outlines China’s multi-pronged strategy to accelerate progress toward Artificial General Intelligence (AGI). It highlights state-backed funding for foundational AI research, academic-industry collaborations, and talent recruitment policies that repatriate overseas experts. Emphasis on efficient model architectures, open-source ecosystems and domestic chip development aims to offset Western export controls. The analysis warns that coordinated government–private efforts, combined with access to vast data and compute resources, could enable breakthroughs in AGI capabilities despite international constraints.

COMMENT – I think it is important to remember that the field of artificial intelligence, as well as the companies that bring AI products to market, is still very immature. The possibility for disruption and new approaches being discovered in an immature industry is quite high.

No one “knows” what the right business model is, no one “knows” how consumers will use these products, and no one “knows” what new discoveries are around the corner.

That is why it is so important to collect and analyze information like this. There is a tendency to get locked into the approaches and business models that are doing well today and lose track that others may have ideas that work better.

Jacob Stokes, Kareen Hart, Ryan Claffey and Thomas Corel, CNAS, May 21, 2025

A contingency across the Taiwan Strait has the potential to reshape the Indo-Pacific and even global security environment. This report explores how states beyond the United States and Taiwan would respond to a major Taiwan contingency. It defines a major Taiwan contingency as a conflict that might start in the so-called gray zone between peace and war but clearly escalates into a larger campaign that has unification as the near-term objective of the People’s Republic of China (PRC). Specifically, the report examines how geopolitical interests, values, and material power might determine the approaches of countries across the region and the world.

Regional and global responses to a major Taiwan contingency would depend heavily on structural factors present at the time it happens, as well as the specific circumstances of the situation. The report details four key structural factors that would shape states’ responses: the specific nature of the Taiwan contingency, the global trade and technology landscape when the contingency occurs, Taiwanese and U.S. capabilities and responses, and the spectrum of intervention options.

Beyond those structural factors, the response from four groups of states would play a major role in determining the outcome of a major Taiwan contingency. The first group is Japan and the Philippines. Both U.S. allies would be on the front lines of a Taiwan conflict and host U.S. forces but are also the most exposed to military retaliation from China. The second group is close U.S. allies and partners South Korea, Australia, and India. Their locations are farther from the main battlespace, but each would have to consider how its response would affect its own security concerns and relations with the United States in the future.

The third group includes the other states in Southeast Asia. Thailand and Singapore would have to consider their defense ties to Washington, while Cambodia, Laos, and Myanmar might get requests from Beijing. Other Southeast Asian states would adopt a studiously neutral stance. The fourth group is Europe and the rest of the world. European states now pay more attention to Taiwan, and many see parallels with Ukraine’s plight. But uneven ties with China and a lack of power projection capabilities would mostly limit direct European intervention. Meanwhile, the developing world would likely side with Beijing. And it lacks the political will—much less the proximity or military power—to come to Taipei’s aid.

Several findings flow from the analysis: First, it is unlikely that any other states will come to Taiwan’s aid if Taiwan does not fight fiercely and the United States does not intervene on a large scale. Second, geographic proximity increases a country’s stake in the defense of Taiwan, but that same closeness also makes countries more vulnerable to PRC retaliation. Third, any Taiwan contingency would cause massive economic harm, so states would try to balance protecting their economic interests—especially access to high-end semiconductors—with ending the conflict just to stem the disruption caused by the fighting. Fourth, states’ choices will reflect their national interests and values, but those responses will depend to a significant degree on what others do.

U.S. policymakers should take the following actions to best position Washington to mount an effective coalition defense of Taiwan during a contingency, should those policymakers choose to do so:

Prioritize preventing a Taiwan contingency.

Reinforce with Taipei how much would hinge on Taiwan’s contingency response, both in terms of demonstrating will and capabilities.

Expect limited contributions but be creative in exploring what in the spectrum of intervention might be possible.

Deepen intra-Asian and Euro-Asian security ties that include the United States.

Support and, where possible, facilitate the growth of intra-Asian security ties that do not rely on the United States as the hub.

Plan for humanitarian evacuation operations as a means to encourage Southeast Asian countries to think through a Taiwan contingency.

COMMENT – The main take-away for me is that if you don’t want a major war in the Western Pacific, that could turn into another World War, then it is absolutely necessary to convince Beijing that they will face multiple adversaries and a massive war IF Chinese leaders initiate an attack on Taiwan.

This stands in contrast to the article by Oriana Skylar Mastro and Brandon Yoder in Foreign Affairs this week titled “The Taiwan Tightrope: Deterrence Is a Balancing Act, and America Is Starting to Slip” (#94 below).

They push a flawed assumption that if the U.S. and others show too much resolve in deterring Beijing, that would “force” Xi to attack Taiwan.

As Craig Singleton pointed out this week when commenting on the article by Oriana and Brandon, “restraint doesn’t reassure Xi; it creates opportunity.”

China Ran Record Budget Deficit with Spending Blitz Amid Tariffs

Bloomberg, May 20, 2025

China’s fiscal stimulus pushed its four-month budget deficit to a record high, as the government ramped up support for the economy during an escalation in its trade conflict with the US.

The broad deficit reached 2.65 trillion yuan ($367 billion) in January-April, the most ever for the period, according to Bloomberg calculations based on data released by the Finance Ministry on Tuesday. The shortfall swelled by more than 50% compared with a year earlier.

It’s the clearest evidence yet that Beijing shifted into a higher gear in deploying this year’s planned fiscal stimulus to help the economy weather external shocks. US tariffs on most Chinese goods rose to a prohibitively high level of 145% in April before the two countries agreed to a truce earlier this month.

Outlays soared against the backdrop of stabilizing earnings. Total income in China’s two main fiscal books reached 9.32 trillion yuan in January-April, a decline of only 1.3% year-on-year after a much steeper drop during the first quarter.

Total expenditure rose 7.2% to 11.97 trillion yuan, the data showed. That number combines spending under the general budget, which includes mainly everyday outlays, with expenditure in the government fund budget, which is more weighted toward capital investment projects.

Looking ahead, the urgency of further fiscal support is waning after an agreement by China and the US to temporarily lower tariffs levied against each other’s products.

The truce, along with decent economic activity numbers for April, has led a few major international banks to raise their forecasts for China’s growth this year and dial back expectations of additional stimulus by the government.

COMMENT – Maybe “Fortress China” wasn’t as prepared for a trade war as its cheerleaders would have us believe.

China Accuses US of Undermining Trade Talks with Warnings Against Huawei Chips

Olivia Tam and Debby Wu, Bloomberg, May 19, 2025

The Chinese government accused the Trump administration of undermining recent trade talks in Geneva after it warned that using Huawei Technologies Co.’s artificial-intelligence chips “anywhere in the world” would violate US export controls.

The Commerce Department said in a statement last week that it was issuing guidance to make clear the use of Huawei Ascend chips is a breach of the US government’s export controls. The agency said it would also warn the public about “the potential consequences of allowing US AI chips to be used for training and inference of Chinese AI models.”

The US Commerce Department’s has since changed its wording to say the agency was issuing guidance about “the risks of using PRC advanced computing ICs, including specific Huawei Ascend chips,” stripping the “anywhere in the world” reference. The formal Commerce guidance, dated May 13, says using Huawei’s Ascend chips “risks” violating export controls.

Those updates weren’t enough to appease Beijing, which said Monday it had “negotiated and communicated with the US at all levels through the China-US economic and trade consultation mechanism, pointing out that the US’s actions seriously undermined the consensus reached at the high-level talks between China and the US in Geneva.”

While Chinese authorities noted the US had “adjusted” the wording of its guidelines around Huawei chips, it maintained it was still a “discriminatory measures” and demanded that the US “correct its mistakes.”

Tensions over Huawei’s next-generation of chips underscores how fragile relations remain between the US and China, even after they reached a tariff truce this month in Switzerland. That arrangement lowers punitive levies for 90 days, opening a short window to strike a broader deal that both rebalances trade and protects Beijing’s interests.

China’s chief trade negotiator Li Chenggang attacked export controls on AI-related chips at the Asia-Pacific Economic Cooperation meeting last week in South Korea, saying a certain country was over-stretching the idea of national security, according to an official who attended the session. US Trade Representative Jamieson Greer responded it was a measure to protect domestic manufacturing capabilities, the official said.

Li and Greer met at the event but neither side has disclosed what was discussed. Spokespeople for the US Commerce Department, the White House and China’s Ministry of Commerce didn’t immediately respond to requests for comment.

Talks between the world’s largest economies have resumed, but President Donald Trump and Chinese leader Xi Jinping still haven’t spoken since the Republican returned to office, with Beijing preferring for negotiations to play out at a lower level.

There are no public plans for the next round of trade talks. While officials could next cross paths in July at a Group of 20 meeting in South Africa, Treasury Secretary Scott Bessent skipped a similar huddle earlier this year — although the two sides could arrange ad hoc talks in another neutral location.

Despite rolling back a set of Biden administration-era regulations on AI chip exports to much of the world, the Trump administration has made clear it will continue to drive efforts to keep advanced technologies away from China.

One source of leverage for China in pressing the US to ease such controls is its dominance in critical minerals. Removal of barriers Beijing placed on rare earths was a key concern for the US going into the talks in Geneva, Bloomberg News earlier reported.

Rare earth exports fell 19% after those curbs, threatening the global supply of key materials used widely in high-tech manufacturing from electric vehicles to weaponry.

The US guidance last week stood to make it all the more difficult for Shenzhen-based Huawei to fulfill its ambitions of developing more powerful semiconductors for AI and smartphones, efforts that have already hit major roadblocks because of US sanctions.

Huawei has emerged as China’s national technology champion since its breakthrough in processors for the Mate 60 Pro in 2023 — a milestone it reached despite then-punishing US sanctions. The company has since expanded into adjacent arenas from EVs to AI, where it’s begun making chips it hopes can compete with Nvidia Corp.

Huawei’s Ascend lineup is thought to be so far largely confined to use in China by Chinese firms that have otherwise limited access to Nvidia’s cutting-edge products. But they’ve been making headway in the market because of US restrictions, and have proven capable particularly in inferencing or supporting AI services, according to industry experts.

COMMENT – See the original May 13 BIS Guidance below at #68.

Not sure why BIS walked-back the “anywhere in the world” reference.

My sense is that there are influential voices close to President Trump who fall for the Chinese Communist tactic of holding negotiations hostage or who have their own interests in lowering technology controls.

Expect to see a comprehensive campaign by Beijing, its interlocutors, and certain U.S. businesses to roll-back U.S. export controls on advanced semiconductors.

Authoritarianism

Chinese workers stage protests over unpaid wages as economic woes persist

Qian Lang, Radio Free Asia, May 21, 2025

Tightening government finances impact workers around China, across multiple sectors.

Protests by Chinese construction workers, teachers, and factory employees demanding unpaid wages have erupted across China in recent days amid rising public anger over the impacts of tightening local government finances, according to affected workers and videos posted on social media.

From China’s northern province of Hebei to the southern autonomous region of Guanxi, bordering Vietnam, and its neighboring coastal province of Guangdong to the east – Chinese workers are facing the full impact of cash-strapped institutions grasping for ways to survive the economic downturn.

COMMENT – When you are the ‘Chairman of Everything’ as Xi Jinping is, then you are responsible for ‘Everything.’

China Stakes Claim in the North, Redefines Arctic Politics

Kieran Mulvaney, The Walrus, May 16, 2025

A new cold war is taking shape at the top of the world.

Of the 195 countries in the world, eight can be considered truly Arctic: the United States, Canada, Russia, Norway, Denmark, Iceland, Sweden, and Finland. These countries constitute, along with thirteen observer countries—including China—and six Indigenous representative organizations, the membership of the Arctic Council, which was formed in 1996 to address issues faced by the nations, inhabitants, and environment of the region. The eight Arctic countries have equal votes in the forum, while the thirteen observers have none; even so, in the Arctic, as in other walks of life, some countries are in practical terms more equal than others. Some carry the swagger of a superpower. Others engage in more activities in the Arctic, with a greater capacity to impact the region. And others are simply more invested: economically, politically, environmentally, or even psychologically.

…

As China has grown in economic might and geopolitical heft, it, too, has begun testing its prospects in the Arctic. It has declared itself a near-Arctic state—a designation of its own invention—and since 2013 has been an observer at the Arctic Council. China is exploring the expansion of its naval and commercial reach by investing in its own fleet of icebreakers, and it is testing out the prospect of itself taking advantage of new pathways through the ice—through North America, across the top of Russia, or even via the North Pole.

So what is the extent of China’s interest in the Arctic? Given that the country is neither adjacent to nor possessed of a long history of involvement in the region, what is its motivation? The answer to the second question is both complex and straightforward: it is at once neither geopolitical, commercial, nor military, and yet simultaneously all of these: an important component of China’s progression toward genuine superpower status, a forward-looking approach to the challenges and opportunities presented by a changing Arctic, and a move to secure a prominent seat at the table to influence and benefit from decisions that inevitably will be made in response to those Arctic changes.

In 2021, China’s National People’s Congress formally adopted its latest Five-Year Plan, the fourteenth in total and the first to mention the Arctic. That mention was blink-and-you’ll-miss-it brief, but what it chose to include could reasonably be inferred to highlight Beijing’s priority in the northern polar regions. China will, it read, “participate in practical cooperation in the Arctic and build the ‘Polar Silk Road.’”

That China should be invested in the idea of shipping routes through the Arctic to the point of wanting to develop infrastructure to support those routes and even give the concept some catchy branding should, on one level, be no surprise. China boasts, by at least one measure, the largest merchant fleet in the world; by other measures, it lies second behind Greece, but whatever metric one chooses—be it gross tonnage, deadweight, or number of vessels—its position on the charts has been rising, and having overtaken Japan’s fleet in 2018, it is at the very least competitive in size with the Greeks and increasing at a faster rate.

In such circumstances, it would arguably be a dereliction of duty not to read the tea leaves and take as many necessary precautions as possible for a world in which shipping routes through the Arctic are viable and competitive. The notion of a Polar Silk Road, however, suggested something deeper and more substantive.

But exactly what it means and how much import Beijing assigns to it is unclear. The Polar Silk Road was announced as a component of China’s Belt and Road Initiative, which has been described as “one of the most ambitious infrastructure projects ever created.” When it was announced in 2013, it was portrayed as a “vast collection of development and investment initiatives . . . originally devised to link East Asia and Europe through physical infrastructure,” which in the decade since “has expanded to Africa, Oceania, and Latin America, significantly broadening China’s economic and political influence.”

While nominally marketed as a massive global infrastructure project, the entire Belt and Road Initiative also has national and geopolitical aspirations: to bring greater investment and opportunity to its oft-neglected western regions, to restructure and invigorate the Chinese economy more broadly, and to develop trade linkages and diplomatic leverage in the region. Its sheer scope has caused some anxiety in Western capitals, and the inclusion of the Arctic in the maritime component has added to the notion that the world’s northernmost region is shaping up to be a geopolitical battleground.

Arctic nations have been circumspect about allowing China a foothold. An analysis by Doug Irving for the RAND Corporation noted that “a Chinese company tried to buy a shuttered U.S. Navy base in Greenland, but the Danish government quashed the idea. . . . Canada blocked a $150 million gold mine deal that would have put Chinese interests too close to military installations. Greenland has held up plans for another Chinese mine over concerns about pollution.”

While it is possible to overstate Chinese intentions in the Arctic, and certainly to become overly fixated on the extent to which they conjure up images of great-power conflict at the top of the world, it would equally be a mistake to diminish them. Any perceived quieting of Beijing’s interest in the region can be ascribed, argue Erdem Lamazhapov, Iselin Stensdal, and Gørild Heggelund in an analysis for the Arctic Institute, to China pursuing an approach of “crossing the river by touching the stones”—of adapting to circumstances.

Many of Beijing’s early Arctic ventures have been conducted in conjunction with Moscow; with Russia’s invasion of Ukraine making that more difficult—and indeed posing a challenge to all manner of co-operation across the Arctic—China may choose to deprioritize the Polar Silk Road and related activities until a more suitable time. But that does not mean its interest in the Arctic isn’t genuine.

In addition to contemplating shipping networks through previously ice-choked regions, it has, noted the RAND review, “dispatched research expeditions [and] sought to establish mining and gas operations. . . . It describes itself as an ‘active participant, builder, and contributor in Arctic affairs,’ one that has ‘spared no efforts to contribute its wisdom to the development of the Arctic region.’”

Furthermore, note seasoned Sinologists, China’s goals regarding the Arctic are sometimes expressed more forcefully in Mandarin for domestic consumption than in English for a global audience. As noted by Rush Doshi, Alexis Dale-Huang, and Gaoqi Zhang of the Brookings Institution, President Xi Jinping has, for example, frequently expressed his desire at home to make China a “polar great power,” a phrase generally missing from externally facing materials.

Similarly, while documents and speeches aimed at the outside world downplay any Chinese thoughts of military competition in the Arctic, internal texts are more explicit about the feeling in Beijing that “the game of great powers” will “increasingly focus on the struggle over and control of global public spaces,” including the polar regions. China “cannot rule out the possibility of using force” in this coming “scramble for new strategic spaces.”

COMMENT – Changing climate conditions in the Arctic will create new geographic realities and, in many ways, geographic realities drive geopolitical rivalries.

This is how we should view the Trump Administration’s interest in Greenland and their skepticism that Denmark can stand-up to PRC pressure in the long run.

China has ‘a responsibility for global peace,’ Germany says

Hong Kong Free Press, May 19, 2025

German Foreign minister Johann Wadephul discussed Russia’s war against Ukraine during his first phone call with his Chinese counterpart Wang Yi.

Germany said Monday that China has “a responsibility for global peace” after Foreign Minister Johann Wadephul discussed Russia’s war against Ukraine with his Chinese counterpart Wang Yi.

The call came at a time of growing worries in the West about ties between China and Russia, which have drawn closer since Moscow launched its full-scale invasion of Ukraine in 2022.

COMMENT – Encouraging signs from the new German Government that the Sino-German relationship isn’t solely based on the interests of a couple of German car companies. The world needs Berlin to act like the geostrategic power it is, rather than simply a Chamber of Commerce.

China's rare-earth gambit with Trump echoes Mao's 'protracted war'

Shunsuke Tabeta, Nikkei Asia, May 18, 2025

Rare-Earths Plants Are Popping Up Outside China

Samantha Pearson and Jon Emont, Wall Street Journal, May 16, 2025

U.S., Brazil are among countries building capacity to mine and refine metals for EVs and smartphones.

In a warehouse deep in Brazil’s savanna, machines churn through piles of red clay to produce chalky rocks packed with metals critical for making electric cars, smartphones and missiles.

But what is particularly precious about these minerals is their intended destination: They are bound for the U.S., not China.

China mines some 70% of the world’s rare earths, the 17 metallic elements primarily used in magnets needed for civilian and military technologies. But its 90% share of processing for rare earths mined around the world is what really concerns officials from other countries working to secure their supply.

“China is a formidable competitor,” said Ramón Barúa, chief executive of Canada’s Aclara Resources, which is opening a rare-earths mine to supply a processing plant it plans to build in the U.S. Aclara said it plans by August to decide where in the U.S. to build its plant for separating rare-earths deposits into individual elements.

It also has a buyer lined up. Aclara signed an agreement last year to supply rare earths to VAC, a German company that is building a factory in South Carolina with $94 million in Pentagon funding to make magnets for clients including General Motors.

“We’re seeing a tsunami of demand,” Barúa said.

COMMENT – Amazing!

When the cost of a relatively easily produced commodity goes up, other countries and companies start producing more of it to realize higher profits… it is as if basic economics actually works.

This highlights the fatal flaw of Beijing’s strategy to use rare earths and critical minerals as a tool against the United States. China’s dominance of rare earth and critical mineral processing is due to the fact that they subsidize the production of these commodities, which then leads to excess production capacity and massive oversupply. This excess supply then drives down the price and forces other companies that don’t receive these subsidies to stop producing (if you can’t make a profit because your good sells at less than the price it takes to make it, commercial companies stop their production).

This is what creates the condition for China to possess 80-90% of the rare earth and critical mineral production.

The problem is that China can only maintain this dominance of these markets IF they continue to flood the market with artificially cheap commodities.

As soon as they restrict the export of those commodities (for instance to punish the United States and its allies), then the price for those commodities goes up and all those companies in other countries that were sitting on the sidelines because they couldn’t make a profit when something like germanium was selling at 10 cents a pound, start producing again because they CAN make a profit when it sells for 20 cents a pound.

The doubling or tripling of the price of an input may sound like a really costly development, but in nearly all cases, the cost of rare earths and critical minerals make up a tiny fraction of the cost of a finished good.

My advice to American policymakers is: be confident that the law of supply and demand will work in our favor.

China’s dominance of this sector isn’t based on some exquisite technology that no one else has… its dominance is based on overproduction and artificially cheap prices. When those prices go up, someone will meet the demand… or, as the next article shows, Chinese companies will try to smuggle their supply out of China to take advantage of the higher price.

How critical minerals became Beijing’s ultimate trump card in US-China trade war

Sylvia Ma and Fan Chen, South China Morning Post, May 20, 2025

Beijing is still tightening its grip over supplies of rare earths and other key minerals despite the tariff truce, allowing it to cut off US access at will.

In mid-March, customs officers in Hong Kong uncovered an unusual smuggling operation.

When the officials cracked open a 40-foot shipping container near the city’s northern border, they did not uncover stacks of illegal drugs or counterfeit goods, but more than 25 tonnes of antimony – a rare metal used to make advanced military equipment that has been subject to strict export controls in China since last year.

Weeks later, local media in the southern Chinese province of Guangxi reported a similar incident. This time, local customs officers intercepted a shipment of metal declared as soldering paste, but which lab tests later confirmed to be 55.3 per cent bismuth – another rare element placed under Chinese export controls.

COMMENT- Critical minerals are NOT an ultimate “Trump Card” for Beijing. It is a self-defeating move because the PRC’s dominance of critical minerals arises only from China’s overproduction of these commodities. As soon as Beijing cuts their exports of them, prices rise, others will start producing and processing.

And, as the article points out, Chinese Companies (including State-owned Enterprises) will try to smuggle their products out of China as prices rise because they don’t want to miss out on these increased profits.

Global supply chains threatened by lack of Chinese rare earths

Edward White, Ryan McMorrow and Harry Dempsey, Financial Times, May 17, 2025

Rare earths race heats up with US-Saudi deal and Shenghe acquisition

Shaun Turton and Kenji Kawase, Nikkei Asia, May 15, 2025

Trump’s Deals Cast China Both as Foe and Prize, Blurring Signals

Alberto Nardelli and Josh Wingrove, Bloomberg, May 17, 2025

No booze, no flowers: Chinese officials told to tighten their belts

Lily Kuo, Washington Post, May 19, 2025AI Joins China’s Primary Schools

Alex Colville and David Bandurski, China Media Project, May 19, 2025

The Ministry of Education has laid out exactly how AI will be taught and used by schoolchildren. Hopes and fears about AI and critical thinking are entirely missing the point.

Hong Kong journalists face tax audits in latest pressure on independent media

Radio Free Asia, May 21, 2025

Journalists’ association says 8 news outlets and 20 individuals have been targeted, casting a shadow over what’s left of Hong Kong’s free press.

Hong Kong authorities have targeted independent news outlets and journalists with error-filled tax audits casting a shadow over press freedom in the city state, a journalists’ association said Wednesday.

The Hong Kong Journalists Association said that at least eight independent media outlets and about 20 journalists and their family members have been subjected to tax audits by the Inland Revenue Department for tax claims dating back seven years.

The association expressed concern that this could further reduce the operating space for small-scale and independent news outlets in a city once known for its freewheeling media. It called for the revenue department to stop audits without clear justification and to publicly explain the rationale for what it sees as a potentially coordinated crackdown on independent journalism.

“For small outlets like ours, this is a serious reputational attack. Being accused of tax evasion is defamation. The authorities’ frequent scrutiny of journalists and media organizations creates anxiety and casts a shadow over press freedom in Hong Kong,” Selina Cheng, the association’s chair, told a news conference.

Top US state Republicans urge SEC to consider delisting Chinese companies

Demetri Sevastopulo and Stefania Palma, Financial Times, May 20, 2025

China and Russia sign nuclear reactor deal to fuel lunar research station

Victoria Bela, South China Morning Post, May 14, 2025

Beijing is a ‘red line’: Hungary vows it won’t decouple from China if pushed by Trump

Finbarr Bermingham, South China Morning Post, May 15, 2025

China’s Xi Jinping steps up calls for industrial self-sufficiency amid trade war

Joe Leahy, Financial Times, May 19, 2025

The Trade Truce Doesn’t Change the Underlying U.S.-China Relationship

Lingling Wei, Wall Street Journal China, May 20, 2025

Trump’s new chip policy puts spotlight on Huawei’s secretive Ascend AI chips

South China Morning Post, May 15, 2025

What Huawei’s Comeback Says About US-China Tech War

Yuan Gao and Edwin Chan, Bloomberg, May 14, 2025

China’s Name War in Indian Arunachal Pradesh Continues

Massimo Introvigne, Bitter Winter, May 19, 2025

Environmental Harms

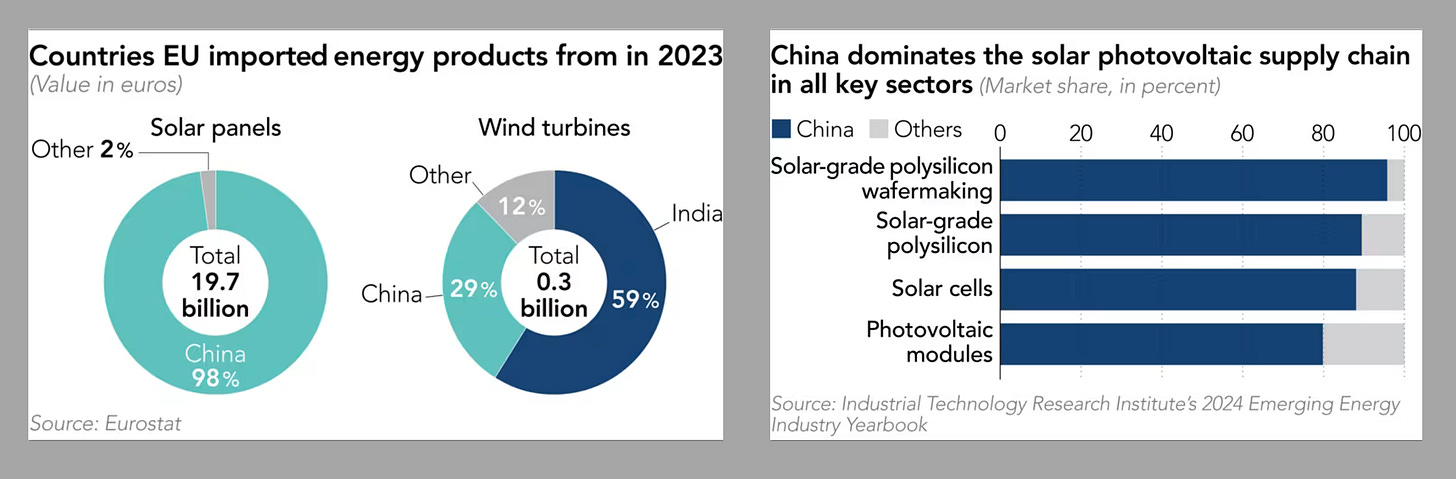

China-made solar parts under scrutiny after Spain-Portugal power cut

Mailys Pene-lassus, Nikkei Asia, May 17, 2025

Huawei, a key inverter provider, kicked out of EU industry body amid bribery probe.

Recent power outages in Spain and Portugal have focused attention on Europe's solar energy infrastructure, which sources its parts almost entirely from China.

The cause of the widespread late-April blackout in the two countries is still under investigation. Officials in Spain, which trades energy with its smaller neighbor and relies on renewables to meet over half its needs, made conflicting statements this week about whether a cyberattack had been ruled out. What is certain, though, is that the outages have highlighted cybersecurity weaknesses.

Awash with Chinese solar panels and parts made by companies such as Huawei Technologies, Europe is increasingly concerned about the safety of its power infrastructure, especially as its energy transition has led to the digitalization of the sector, making it vulnerable to remote attacks.

"There is always the concern about energy security in case of events that disrupt global supply chains and access to PV [photovoltaic] components hailing from China," said Marius Bakke, vice president of solar research at Rystad Energy, an Oslo-based research provider.

Bakke pointed to "remote access to European electricity infrastructure through inverters, which could severely impact Europe's power grid if these were to be targeted in a cyberattack."

He suggested that EU countries should follow fellow bloc member Lithuania's move last year to pass a law that limits remote access to inverters at its solar and wind power plants that produce more than 100 kilowatts of energy, aimed at preventing sabotage.

SolarPower Europe, a lobby group, has also advised the European Union to limit inverter access, and more widely, called on the bloc to enhance the security of imported solar power systems.

Inverters are devices that adapt the currents produced by solar panels for transmission to electricity grids. Sometimes called the brains of solar panels, inverters are considered vulnerable to cyberattacks, as most of them are designed to be controlled remotely, such as for maintenance operations.

"Simulations suggest that a targeted compromise of 3 GW [gigawatts] can have significant implications for Europe's power grid," said a recent SolarPower Europe report, adding that over a dozen of companies -- in and out of Europe -- control capacities significantly higher than that.

Among them, seven companies each handle over 10 GW, which means that a security breach in just one could severely hit the European grid.

Huawei produces around a third of inverters used in Europe. The tech giant was expelled from SolarPower Europe on April 28 after the European Commission said it would restrict meetings with associations affiliated with Huawei. Several Huawei executives are being investigated -- some charged -- in Brussels for alleged corruption involving EU lawmakers.

Huawei declined to comment about its role in Europe.

Brussels last year also launched a probe into uncompetitive practices by Chinese solar panel manufacturers, which resulted in two companies withdrawing their bids in a Romanian public tender last year.

Solar is the fastest growing energy source in Europe, where capacity deployed in 2024 was higher than all other energy technologies combined, according to SolarPower Europe. Brussels' aim is to harness 600 GW of solar energy by 2030. For context, 1 GW of energy can power 100 million LED light bulbs, according to the U.S. Energy Department.

But the International Energy Agency warned of the concentration of solar manufacturing capacities in Asia, with China accounting for 80% of the market worldwide, and even up to 95% for some components.

China controls the entire supply chain, from the mining and refining of raw materials to the production of ingots, wafers, cells and modules or panels.

It's been so successful that its supplies are outpacing demand both in China and abroad, dragging global prices down, according to the IEA's Renewables 2024 report. Beijing's heavy subsidies and investment in the industry drove down solar panel costs by 80% in a decade, which led to a boom in solar capacities worldwide.

For Europe, cutting all reliance on China in the sector may be unrealistic though. Brussels aims to achieve resilience in key sectors "to avoid economic blackmail" and dependencies on a single country, rather than attain self-sufficiency, said Paris-based Diana Gherasim, head of European energy and climate policies at French think tank IFRI.

Gherasim said leveling the playing field would mitigate risks. Brussels is aiming to do that with its Net Zero Industry Act, adopted in 2023 to boost the sector by offering financing and subsidy support and favorable regulations.

"If we don't have measures to push European production, and market regulations, the market will make it impossible to sell modules" made in Europe, said Vincent Delporte, head of public affairs at HoloSolis, a startup building a solar cell and module gigafactory in eastern France.

Apart from the economic and political implications, Brussels is also committed morally to stop imports linked to forced labor under a law it brought in late last year. This will have an impact on the solar value chain, given as polysilicon, a material also use in semiconductors, is vastly mined and refined in China's Xinjiang region, where forced labor has been alleged.

"The green transition cannot be at the cost of human rights," said Stockholm-based Jens Holm, policy director at the European Solar Manufacturing Council.

"That is why it's so important to cut the dependency from China, and to re-shore manufacturing," added Holm, who is a former lawmaker both in Sweden and at the European Parliament.

He said he believes Brussels should adopt a tougher stance against forced labor, similar to Washington's Uyghur Forced Labor Prevention Act which took effect in 2022.

Rystad Energy said the ban boosted demand for polysilicon sourced outside of China, but also resulted in the relocation of Chinese polysilicon sites from Xinjiang to other provinces.

COMMENT – I know this will be controversial with some readers, but maybe it isn’t such a good idea to rush head-long into an energy transition that will make your country almost entirely dependent on a hostile regime that has used its dominance of other markets to punish and coerce other countries.

U.S. Lawmakers Call for Probe into Chinese EV-Charging Startup

Amrith Ramkumar, Wall Street Journal, May 19, 2025

How we made it: will China be the first electrostate?

Jana Tauschinski and Nassos Stylianou, Financial Times, May 19, 2025

China's electricity generation may be like its economy: Not as soft as it looks

Clyde Russell, Reuters, May 20, 2025

How China co-opted the green movement

Joel Kotkin, Unherd, May 20, 2025

Rising empires require collaborators to expand their influence and win over adversaries. In this respect, China and other anti-Western regimes increasingly count on green activists, investors, and media to advance their interests. Overall, the greens see China as “pivotal” in the global green-energy transition, as states Sustainability Magazine.

Indeed, over the past decade, the green movement has successfully trolled for big money from groups with strong links to the Chinese Communist Party, as well as some dollops from Vladimir Putin’s Russia, which has cynically backed efforts to curb the West’s production of natural gas, the easier to deepen its own energy dominance; and Qatar, known for financing Hamas and other Islamist groups.

Nowhere is the penetration more complete than in the universities, where Chinese and Qatari money are behind the largest proportion of the $29 billion of foreign money sunk into American universities between 2021 and 2024. This, and similar funds flooding Canadian, Australian, and British Universities, buy good will and political influence. Chinese students at institutions like Stanford are also closely monitored by the Beijing regime’s agents in order to stamp out or at least identify dissidents — and when possible, to purloin research for the motherland.

Climate change has emerged as one critical element of this collaboration. The Washington Free Beacon has reported on millions of dollars from a climate nonprofit called Energy Foundation China, run primarily out of Beijing by former Communist Party cadres, flooding campuses. The beneficiaries include the University of Maryland and Harvard (where a professor was arrested for lying to the FBI about his China ties, and then appointed at a Chinese university). The consulting firm Strategy Risks argued Harvard also hosted training sessions for XPCC, a Chinese paramilitary organization, subject to sanctions for being involved in the suppression of the Uyghurs.

The belle of the China ball, not surprisingly, is California. Engagement with the People’s Republic has been long required for elites in the Golden State, whose imports from China are roughly nine times its exports. For China, it is a wonderful place to do business. The country runs a roughly $107 billion trade surplus with California, and the disparities in such things as electronic machinery are immense. California fares better with services, notably software and other tech licenses as well as universities, but this only amounts to $5 billion. As climate policy hurts average Californians through deindustrialization, high energy prices, and climate regulation, it enriches China.

The outreach began under Gov. Gavin Newsom’s predecessor Jerry Brown, who now chairs the legislatively created California-China Climate Institute at the law school of the University of California, Berkeley. Berkeley has been particularly egregious in its embrace of China. So much so that the Government Select Committee on the CCP wrote an open letter to the school, venting “grave concern” about its “joint institute with state-controlled Tsinghua University and the Shenzhen government” and warning that Berkeley is facilitating Chinese espionage of American research.

Foreign Interference and Coercion

Senator Flags China Ties in Program to Aid Defense Startups

Kate O'Keeffe, Bloomberg, May 13, 2025

FDD Uncovers Likely Chinese Intelligence Operation Targeting Recently Laid-Off U.S. Government Employees

Max Lesser, Foundation for Defense of Democracies, May 16, 2025

Some Chinese companies eye Singapore listings to expand markets amid trade war

Yantoultra Ngui, Reuters, May 17, 2025South Africa downgrades Taiwan status, signaling more China influence, say experts

Chen Meihua and Tenzin Pema, Radio Free Asia, May 20, 2025

The Taiwan Liaison Office is now called Taipei Commercial Office and has been told to relocate from the South African capital.

In a sign of China’s expanding international influence, South Africa has downgraded the status of Taiwan’s liaison office in the country, further diminishing the democratic island’s diplomatic footprint, experts say.

South Africa severed formal diplomatic ties with Taiwan in 1997 and recognized Beijing as the government of China. But in the nearly three decades since, it has retained unofficial ties with Taipei and a trading relationship.

However, it’s recently moved to diminish Taiwan’s unofficial status in the country. South Africa’s Department of International Relations and Cooperation now categorizes the Taiwan Liaison Office – which functions as a de facto embassy but without official diplomatic status – as a “Taipei Commercial Office” on its official website, and has removed the name of the Taiwanese Representative Oliver Liao under the listing.

On Friday, Taiwanese Foreign Minister Lin Chia-lung accused China of putting pressure on South Africa to make the changes. He said the liaison office had requested negotiations with the South African government about it.

COMMENT – South Africa is a client state of the PRC.

China Applauds Sentencing of a Falun Gong Practitioner in Singapore

Yang Feng, Bitter Winter, May 21, 2025

Beijing has pressured Singaporean authorities against the movement for decades. A man has been sentenced just for displaying pro-Falun-Gong messages.

On May 16, the China Anti-Xie-Jiao Association issued a statement praising the Singapore judiciary for its sentencing of Peh Teck Ho, a Falun Gong practitioner. China Anti-Xie-Jiao Association presents itself as the largest anti-cult organization in the world. “Xie jiao,” mistranslated as “evil cults,” is a term used in China since the Middle Ages to designate “organizations spreading heterodox teachings,” and which teachings are “heterodox” is determined by the government. The China Anti-Xie-Jiao Association is not a private association, but is controlled by the Chinese Communist Party.

The Association and the Chinese government have long pressured Singapore to crack down on Falun Gong. Although Falun Gong is not banned in Singapore, it is often harassed, particularly when local practitioners protest Chinese persecution.

On May 13, 2025, Peh Teck Ho, a 59-year-old bus driver, received a S$1,000 fine for “taking part in a public assembly without a permit.” This incident occurred on July 5, 2023, when Peh parked his bus at Town Hall Link after finishing his morning routes and went to a grassy area along Science Park Road in Jurong. There, he meditated while displaying a placard that advocated for the Falun Gong movement. The placard, written in Chinese, translates to: “Falun Dafa is good. Truthfulness, compassion, and forbearance are good. Clean World Network.” He additionally put up messages advocating Falun Gong on both the front and back windscreens of the bus. This was constructed as a “public assembly” by the prosecutor and the judge.

COMMENT - Come on Singapore, be better.

Beijing is making the most of Trump’s trade war by cozying up to Latin nations.

Mary Anastasia O’Grady, Wall Street Journal, May 19, 2025

China’s next-gen surveillance tools get AI boost to target Telegram and VPN users

Yuanyue Dang, South China Morning Post, May 17, 2025Scilla Alecci, International Consortium of Investigative Journalists, May 7, 2025

Lawmakers from across the political spectrum condemned Beijing’s “scary” tactics and said European governments should do more to protect dissidents.

Three Danish political parties have called for a government probe into China’s repression campaign against dissidents living in the Nordic country following the China Targets investigation by the International Consortium of Investigative Journalists, the Danish newspaper Politiken and 41 other media outlets.

Lawmakers from the Unity List, the Danish People’s Party and The Alternative said they want to know how widespread Beijing’s targeting of political dissidents and members of oppressed minorities is and what authorities intend to do about it, Politiken reported.

Morten Messerschmidt, the leader of the right-wing Danish People’s Party, told Politiken that China Targets had unmasked the true face of the Chinese regime and said that, for too long, European politicians have turned a blind eye to its transnational repression.

“China successfully keeps its own population in a totalitarian iron grip, and they have a fundamental ambition to do the same with the rest of the world,” Messerschmidt said.

He described China as a “bully” state that Western countries had emboldened economically and militarily “through an extreme degree of naivety.”

China Targets uncovered the pressure tactics the Chinese government uses to silence and intimidate its critics abroad, including through proxies and professional hackers.

COMMENT – Great move by Denmark, let’s see other European countries pursue similar efforts.

Human Rights and Religious Persecution

You start to go crazy': The Australian who survived five years in a Chinese prison

Stephen McDonell, BBC, May 18, 2025

How Beijing’s 1995 Disappearance of the Panchen Lama Enabled Crimes Against Humanity

Sophie Richardson, The Diplomat, May 17, 2025

China weathered no consequences for abducting a 6-year-old in 1995. That same impunity continues to fuel collective punishment, enforced disappearances, and arbitrary detention.

Sichuan, 84-Year-Old Falun Gong Grandmother Jailed Despite Poor Health

Ding Bohai, Bitter Winter, May 23, 2025

The woman was arrested for giving an amulet to a fellow villager. Two medical examinations declared her unfit for detention.

Liu Faqun, an elderly Falun Gong practitioner who claims to be 84 (her ID card says she is 82), faced severe persecution by the authorities in Gulin County, Sichuan Province. Her ordeal began on November 24, 2022, when she was followed by the police while buying groceries. The officers noted that she had given a Falun Gong amulet to a fellow villager.

Later that day, her home was ransacked, and the police detained her. She was released at night, but when she returned home, she discovered the police had taken her Falun Gong books and amulets as well as her ID documents and cash.

A few months later, in February 2023, the Dongcheng Police Station in Gulin County called Liu several times for intense interrogations. Afterward, the Gulin County Procuratorate said they wished to conduct further questioning. Officers from the Procuratorate visited Liu’s home to take photographs. They assigned a lawyer to assist her, who communicated their stance to Liu: “If you plead guilty, you can avoid prosecution.” Liu responded, “I am not guilty and will not plead guilty.”

Release journalist and human rights defender Zhang Zhan

Article 19, May 14, 2025

Rights group raises alarm over ethnic Kazakh who fled Xinjiang

Qian Lang, Radio Free Asia, May 16, 2025

Group says the 23-year-old man has been held in Kazakhstan and could be deported to China.

A human rights group is urging Kazakhstan not to deport to China a 23-year-old ethnic Kazakh man who fled from Xinjiang several weeks ago, warning he could face persecution and internment there.

Atajurt, a volunteer group that campaigns for Kazakh victims of oppression in Xinjiang, said Friday it had confirmed that the man, Yerzhanat Abai, has been detained by Kazakh police.

Serikzhan Bilash, who heads the group, said Yerzhanat Abai, a Chinese national, is being held in the Panfilov City Detention Center in Zharkent county, Almaty province, which is about 40 kilometers (25 miles) from the border with China.

“He could be secretly escorted to China by Xinjiang’s national security or Kazakhstan’s National Security Bureau at any time, and no one knows his specific situation. Only if this matter is made public to the world will the Kazakh government be unable to repatriate him,” said Serikzhan.

Industrial Policies and Economic Espionage

Trump tariff twists drive Chinese manufacturers to Southeast Asia

Stella Yifan Xie and Peggy Ye, Nikkei Asia, May 14, 2025

Western carmakers risk wipeout in China, warns Jeep owner Stellantis

Kana Inagaki, Patricia Nilsson, Ian Johnston and Mari Novik, Financial Times, May 15, 2025

EU ‘has no interest’ in reviving stalled investment deal with China

Dewey Sim, South China Morning Post, May 15, 2025

Starbucks kicks off process to sell stake in its sprawling China business as growth stalls

Bloomberg, May 15, 2025

How Trump's man in Beijing swung from trade globalist to China hawk

Laurie Chen, Reuters, May 15, 2025

PRC Assessments of China’s Trade Policy under Trump 2.0

Jeannette Chu, Karen Sutter and Michael Enright, CSIS, May 15, 2025

China’s Economy Feels the Sting from Trade War

Jason Douglas, Wall Street Journal, May 19, 2025

UK overtakes China as second-largest US Treasury holder

Arjun Neil Alim and Haohsiang Ko, Financial Times, May 16, 2025

China industrial output growth slows as US trade war bites

Joe Leahy and Wenjie Ding, Financial Times, May 18, 2025

Hong Kong prepares for a grand homecoming as mainland firms face US delisting threats

Enoch Yiu, South China Morning Post, May 17, 2025

Investors see no end in sight to China property slump

Kensaku Ihara, Nikkei Asia, May 17, 2025

Chinese banks in a pinch as consumer loans fall despite lending push

Wataru Suzuki, Nikkei Asia, May 19, 2025

Chinese Luxury Carmaker Seres Comes from Behind to Overtake BMW

Linda Lew, Bloomberg, May 18, 2025

The post-truce state of US-China trade looks dire

Hudson Lockett, Reuters, May 19, 2025

The (Somewhat) Mysterious Surge in China’s Current Account Surplus

Brad W. Setser, Council on Foreign Relations, May 17, 2025

Understanding the Temporary De-Escalation of the U.S.-China Trade War

Philip Luck, CSIS, May 13, 2025

Europe warned to change fast or become a ‘shock absorber’ of US-China trade war

Finbarr Bermingham, South China Morning Post, May 16, 2025

G.M. Stops Exporting Cars to China

Neal E. Boudette, New York Times, May 19, 2025

Huawei Unveils HarmonyOS PCs in Challenge to Windows–MacOS Duopoly

Liu Peilin and Denise Jia, Caixin Global, May 20, 2025

China Gives EU Business Groups High-Level Meetings to Boost Ties

Bloomberg, May 19, 2025

United States and China: Who’s Zoomin’ Who?

William Alan Reinsch, CSIS, May 19, 2025

Toy group VTech to move production out of China despite tariff reprieve

Chan Ho-him, Financial Times, May 14, 2025

Cyber and Information Technology

Ben Thompson and Jensen Huang, Stratechery, May 19, 2025

This week’s Stratechery Interview is running early this week, as I had the chance to speak in person with Nvidia CEO Jensen Huang at the conclusion of his Computex 2025 keynote, which occurred this morning in Taiwan. I do plan on touching on some of the topics in this interview later this week, so, in the spirit of sharing my conversations with you — which undergirds this interview series — I wanted to post this as soon as possible.

I have spoken to Huang three times previously, in March 2022, September 2022, and March 2023. What was notable about those interviews was the extent to which Huang was trying to make the world understand the potential of GPU computing; now that the potential is being realized, Huang and Nvidia are facing an entirely new set of problems, even as they continue to push computing forward.

This interview starts out discussing some of those new challenges that are related to politics in particular: we discuss last week’s deals with Saudi Arabia and the United Arab Emirates, the ban on H20 sales to China, and why the U.S. approach to chip controls risks America’s — and Nvidia’s — long term control. Huang also makes the case for why AI will drive GDP growth in the near future, and maybe even reduce the trade deficit.

After that we get into today’s keynote and Huang’s keynote last month at GTC. As I note in this interview, I was surprised at how different they were, perhaps because they had different audiences: Taiwan OEMs and component makers and their enterprise customers today, versus American hyperscalers last month; the key thing to understand about Nvidia is that they want to sell to both. To that end, we discuss why a full-stack Nvidia solution maximizes utility, including how Dynamo improves inference performance, even as Nvidia’s approach to software and systems-building lets them sell you only the parts you want. And — perhaps appropriately given the question — we briefly touch on gaming at the end.

U.S. Bureau of Industry and Security, May 13, 2025

This guidance alerts industry to the risks of using PRC advanced-computing ICs, including specific Huawei Ascend chips. These chips were likely developed or produced in violation of U.S. export controls. BIS is warning that, pursuant to GP10, the use of such PRC advanced computing ICs risks violating U.S. export controls and may subject companies to BIS enforcement action.

…

GUIDANCE TO INDUSTRY REGARDING PRC 3A090 ICs

Because there is a high probability that a BIS authorization was required for the export, reexport,

transfer (in-country), or export from abroad of any PRC 3A090 IC or related technology, unless such authorization was obtained, the design or production of the PRC 3A090 IC likely involved one or more violations of the EAR. Accordingly, BIS is notifying all persons and companies in the United States and abroad that engaging in GP10 activities, including use of PRC 3A090 ICs, such as those listed above, without requisite authorization from BIS could result in BIS enforcement actions which could include substantial criminal and administrative penalties, up to and including imprisonment, fines, loss of export privileges, or other restrictions.

If a party intends to take any action with respect to a PRC 3A090 IC for which it has not received authorization from BIS, that party should confirm with its supplier, prior to performing any of the activities identified in GP10 to ensure compliance with the EAR, that authorization exists for the export, reexport, transfer (in-country), or export from abroad of (1) the production technology for that PRC 3A090 IC from its designer to its fabricator, and (2) the PRC 3A090 IC itself from the fabricator to its designer or other supplier.

BIS will not pursue enforcement actions against parties that obtain a PRC 3A090 IC solely for the purpose of technical analysis or evaluation (such as destructive testing) to determine the technical capabilities of an individual IC.

DeepSeek’s ‘Tech Madman’ Founder Is Threatening US Dominance in AI Race

Bloomberg, May 14, 2025

How China caught up with Silicon Valley

Simon Kuper, Financial Times, May 15, 2025

US tech moguls used to see China as a production hub. Now some are buying slices of its technological future.

From Edison to Amazon, the US consistently invented the global future. The country suffered periodic anxieties about being overtaken, by the USSR in the 1960s, and by Japan in the 1980s. But America’s first plausible rival — the only one with the requisite scale of manufacturing, consumer markets and scientific brainpower — was China. The country began a race with Silicon Valley to impose surveillance capitalism and unbridled AI on the rest of the world.

Suddenly, this year, a chorus of American tech moguls is saying China has taken the lead. By 2030, the world might be using Chinese AI apps on Chinese devices while driving near-autonomous Chinese electric cars. If China has jumped from copying American tech to surpassing it, where does that leave Silicon Valley — and its relationship with its own country?

Last year, the Valley’s futurists entered an unstable coalition with a nostalgic politician touting fossil fuels and factory jobs. Donald Trump promised the tech moguls deregulation. But the very day they graced his inauguration, the Chinese start-up DeepSeek released AI models that seemed as good as the American competitors’, only much cheaper and more energy efficient. Then Chinese companies released the world’s fastest electric-vehicle chargers, and Huawei began selling foreigners a phone that rivalled Apple’s latest. Meanwhile, shares in Tesla, the emblematic American company of the future, tanked.

Don’t believe me; believe Silicon Valley. “China is at parity or pulling ahead of the US in a variety of technologies,” writes Google’s former chief executive Eric Schmidt. China is “not behind” in AI, agrees Nvidia’s chief executive Jensen Huang. China has “350 times more shipbuilding capacity than the US”, says Palmer Luckey, founder of defence tech company Anduril. To see the future of online food delivery, “you don’t go to New York City, you go to Shanghai”, says Uber’s co-founder Travis Kalanick. Nick Denton, tech entrepreneur turned investor, says: “They are the strongest advocates, whether they want it or not, of the ‘China win’ thesis.”

They might be overpraising China, notes Rana Mitter, professor of US-Asia relations at Harvard’s Kennedy School. He says that while China’s cities aren’t the only possible future, and its countryside certainly isn’t, “the way it’s been put together is designed to give that impression”. An American marvelling at the robot that delivers dumplings to their Chinese hotel room can sound like the journalist Lincoln Steffens, who returned to America from the USSR in 1919 proclaiming, “I have seen the future and it works.” People dissatisfied with their own country are quick to idealise another.

The US had the means to counter China. Writing in Foreign Affairs, Kurt Campbell and Rush Doshi urge America to match China’s scale by uniting its historic allies into a vast economic region that sets the world’s next tech standards. Instead, Trump sloughed off allies and slashed scientific research.

Once again, the US has let down Silicon Valley. The country may be unworthy of its futurist wing. Mario Draghi’s report for the EU concludes that American tech by itself may almost entirely account for the US’s lead in productivity over Europe. Most of America beyond the Valley has European levels of productivity (but without European lifestyles).

When Silicon Valley types deign to notice the rest of the US, their tone tends to the snooty. “That’s what dominates our culture . . . this deep, deep, distrust, dislike of technology,” complained Peter Thiel in 2014. In 2016, his soon-to-be employee and future US vice-president JD Vance published the memoir Hillbilly Elegy, which blames the Appalachian white working class for their own problems. Vance castigated “a culture that increasingly encourages social decay”.

Or here’s Elon Musk, praising the Chinese in 2022: “They won’t just be burning the midnight oil. They will be burning the 3am oil . . . whereas in America people are trying to avoid going to work at all.” His Doge team treated the US government as a failed corporation.

American tech moguls used to see China as a mere production hub. Now some are buying slices of its technological future. Benchmark Capital has dismayed the Trump administration by betting big on Chinese AI. In February, Musk chose Shanghai for Tesla’s first Megapack battery factory outside the US.

Silicon Valley’s biggest fortunes were made more than 20 years ago. But especially if trade and immigration diminish, the region is “sub-scale” compared with “the Chinasphere”, says Denton. Long term, it could face obsolescence. That fate might seem unimaginable, except that Britain once had a world-beating shipbuilding industry.

Chinese startups once downplayed their origin. Now some celebrate it.

Kinling Lo, Rest of World, May 15, 2025

Tim Cook’s Biggest Gamble

Patrick McGee, The Wire China, May 18, 2025

Nvidia CEO says next chip after H20 for China won't be from Hopper series

Wen-Yee Lee, Reuters, May 17, 2025

Apple’s A.I. Ambitions for China Provoke Washington’s Resistance

Tripp Mickle, New York Times, May 17, 2025

Japan, Netherlands win as China's chip tool imports surge on US tensions

Cheng Ting-fang, Lauly Li and Kim Jaewon, Nikkei Asia, May 14, 2025

Apple’s A.I. Ambitions for China Provoke Washington’s Resistance

Tripp Mickle, New York Times, May 17, 2025

Nvidia to ship new AI chip for China next quarter, modified Blackwell later

Yifan Yu, Lauly Li, Cheng Ting-fang And Cissy Zhou, Nikkei Asia, May 17, 2025

Nvidia’s Jensen Huang Is Now a Geopolitical Superstar. It Comes with Risks.

Liza Lin and Raffaele Huang, Wall Street Journal, May 20, 2025

Malaysia Downplays Huawei Deal as US Checks China’s AI Reach

Mackenzie Hawkins and Ram Anand, Bloomberg, May 20, 2025

China’s Effort to Build a Competitor to Starlink Is Off to a Bumpy Start

Zeyi Yang, Wired, May 20, 2025

Nvidia’s Middle East expansion is a bet against China

Harry Clynch, Unherd, May 19, 2025

Military and Security Threats

Japan enacts new Active Cyberdefense Law allowing for offensive cyber operations

Alexander Martin, The Record, May 16, 2025

US prepares for long war with China that might hit its bases, homeland

Peter Apps, Reuters, May 19, 2025

Chinese weapons gave Pakistan a new edge against India

The Economist, May 20, 2025

Chinese defence minister set to skip security forum in Singapore

Demetri Sevastopulo, Financial Times, May 19, 2025

China’s Fighter Jets and Missiles Get a Boost from the India-Pakistan Clash

New York Times, May 20, 2025

China’s geopolitical dominance game in the South China Sea

Euan Graham, Strategist, May 19, 2025

One Belt, One Road Strategy

China suspends chicken imports from Brazil due to detection of bird flu

Michael Pooler and Susannah Savage, Financial Times, May 16, 2025

China turns to PPPs as a ‘yellow brick road’ solution to fund big projects in Africa

Jevans Nyabiage, South China Morning Post, May 18, 2025

Portugal’s Dueling Parties Both Want More Chinese Investments

Joao Lima and Henrique Almeida, Bloomberg, May 16, 2025

Opinion

The US and China are in more than a trade war

Charles Parton, The Spectator, May 18, 2025

China entices savers to cross risky Rubicon

Ka Sing Chan, Reuters, May 20, 2025

The People’s Republic has just entered a new era: on Tuesday, one-year bank deposit rates dipped below 1% for the first time ever. As a consequence, savers may shift more of their record 160 trillion yuan ($22 trillion) parked there into stocks, long a Beijing goal. But a murky economic outlook means the timing could be poor for individuals and lenders alike.

The cuts from five of the largest state banks, including Bank of China and China Construction Bank, came as the central bank changed its monetary policy to "moderately loose" from "prudent" for the first time in 14 years. On the same day, the central bank cut its benchmark lending rate as well.

Chinese deposit rates have been trending lower for years – they were at 3% a decade ago and above 10% in the 1990s. Seeing the one-year rate drop below 1%, though, may breach a psychological threshold for many savers. They have been squirrelling their cash away into bank accounts at a decent clip: in the 12 months to March, total household deposits rose 10.3%, according to the PBOC’s latest quarterly report. That's 118% of 2024's GDP. Planners have long been trying to cajole savers to spend more. Of late, they have identified reflating, opens new tab stock prices as an effective way to shore up consumer confidence.

On paper, Beijing's push to get companies to pay higher dividends is an added incentive. The annual yield at large lenders like the Bank of China is close to 6%, for example.

Trouble is, maintaining that looks challenging. Banks' net interest margins and returns on equity have been falling thanks to rate cuts and weak credit demand. A drop in deposits will exacerbate the trend if it forces up funding costs.

More broadly, the $18 trillion economy has been flirting with deflation: the consumer price index has been hovering close to negative territory for more than two years. And the trade war instigated by U.S. President Donald Trump leaves a question mark hanging over the pace of growth.

China’s Defense Industry Is Getting a DeepSeek Moment

Shuli Ren, Bloomberg, May 14, 2025