Friends,

Traveling again this weekend so I’ll hold off on a lengthy commentary (aside from some of the comments below).

It looks like Senator Steve Daines (R-MT) is lobbying President Trump hard to be appointed the “special envoy” to the PRC while the Administration awaits the Senate confirmation of former Georgia Senator David Perdue as Ambassador to the PRC. Senator Daines spent six years living in the PRC managing Procter & Gamble’s operations and as a Senator, he has had a reputation for helping the Chinese Communist Party (“How China got a U.S. senator to do its political bidding,” Washington Post, December 17, 2017).

It isn’t entirely clear whether the Administration is looking for help or whether Senator Daines sees an opening to promote himself as the go-between in an effort to set up a Xi-Trump meeting.

Plenty of rumors swirling that the CCP wants a meeting but is unwilling to be seen as the ones asking for it.

Thanks for reading!

Matt

MUST READ

COVID pandemic likely unleashed by lab mishap: Germany's BND

Timothy Jones, DW, March 11, 2025

Germany's foreign intelligence service, the BND, concluded that the outbreak of the worldwide coronavirus pandemic in 2020 could well have been triggered by an accident at a Chinese laboratory that does virus research, German media reported on Wednesday.

The pandemic caused the death of millions of people across the world from the respiratory illness COVID-19, while fallout from the catastrophe continues to dog global economies and drive social tensions.

Alleged risky virus research methods in Wuhan

According to reports in the German papers Süddeutsche Zeitung and Zeit, the BND based its conclusion on the analysis of material from the public domain and that it collected in the course of an investigation with the code name "Saaremaa."

The material, some of which came from the Wuhan Institute of Virology, located in the Chinese city where the pandemic is believed to have started, indicated that there had been some risky research methods used there, compounded by breaches of laboratory safety rules, the reports said.

The papers said there was evidence that Wuhan researchers carried out so-called gain-of-function experiments, in which viruses occurring in nature are manipulated. Such research can cause changes in the way a virus causes illness, its transmissibility and the types of hosts it can infect.

There were also indications that there had been numerous violations of safety regulations at the lab, according to the reports.

The BND reached its conclusions as early as 2020, the papers said, giving them a likelihood rating of 80% to 95%, but the assessment was kept from the public at the time.

COMMENT – So in 2020… FIVE YEARS AGO… the German foreign intelligence service concluded with a certainty of 80-95% that COVID-19 emerged from a lab leak at the Wuhan Institute of Virology.

I think we can be pretty certain why Chancellor Merkel and her Government decided to keep that secret for so long… they feared PRC retaliation and they did not want to be seen as siding with President Trump’s administration.

And one wonders why there is such bad blood between the Trump Administration and Berlin.

U.S. Judge Finds China Liable for Covid Missteps, Imposes $24 Billion Penalty

Mitch Smith, New York Times, March 7, 2025

The judgment was issued in a case brought by the Missouri attorney general. The Chinese government did not respond to the claims in court.

A federal judge in Missouri found the Chinese government responsible for covering up the start of the Covid-19 pandemic and hoarding protective equipment in a ruling on Friday. He entered a judgment of more than $24 billion that Missouri officials vowed to enforce by seizing Chinese assets.

The lawsuit, filed by the Missouri attorney general’s office in April 2020, during the early months of the pandemic, accused the Chinese government of withholding information about the existence and spread of the virus and then of cutting off the supply of personal protective equipment, or P.P.E., from the rest of the world. Chinese officials said Friday that they did not accept the judge’s decision.

In his ruling, Judge Stephen N. Limbaugh Jr. wrote that “China was misleading the world about the dangers and scope of the Covid-19 pandemic” and had “engaged in monopolistic actions to hoard P.P.E.” Those actions, he said, hampered the early response to the pandemic in the United States and made it impossible to purchase enough equipment for medical providers responding to the virus.

Judge Limbaugh, of the U.S. District Court for the Eastern District of Missouri, imposed the judgment against China, its governing Communist Party, local governments in China, as well as a health agency and a laboratory in the country.

Missouri’s attorney general, Andrew Bailey, said in a statement that the ruling held China accountable for its actions.

“China refused to show up to court, but that doesn’t mean they get away with causing untold suffering and economic devastation,” said Mr. Bailey, a Republican. “We intend to collect every penny by seizing Chinese-owned assets, including Missouri farmland.”

A spokesman for China’s embassy in Washington, Liu Pengyu, said his government will not recognize the judgment.

“The so-called lawsuit has no basis in fact, law or international precedence,” he said in a statement. “China does not and will not accept it. If China’s interests are harmed, we will firmly take reciprocal countermeasures according to international law.”

It was not immediately clear how or when Missouri officials might move to seize Chinese assets, including land, as they pledged to do. Mr. Bailey’s office said it could seek assistance from the Trump administration in identifying and taking those assets.

Judge Limbaugh, who was appointed by former President George W. Bush, initially dismissed Missouri’s lawsuit. But the case was returned to him by an appellate court, and he held a bench trial in January at the federal courthouse in Cape Girardeau, Mo. No one argued on behalf of China at the hearing.

Foreign governments can be sued in American courts, though the circumstances under which those lawsuits can proceed are sharply limited by a measure known as the Foreign Sovereign Immunities Act. In his earlier dismissal ruling, Judge Limbaugh said that Missouri’s lawsuit was unable to move forward because of that act. The U.S. Court of Appeals for the Eighth Circuit said one of Missouri’s claims, about the hoarding of P.P.E., was not excluded by that act, and sent that portion of the case back to the district court.

COMMENT – I personally witnessed an individual who was driving a van with PRC diplomatic plates fill an entire shopping cart with PPE (N-95 masks) at a suburban Maryland Home Depot in early January 2020. He cleared the entire shelf of every available mask, as well as filters for masks.

This was two weeks before the PRC Government admitted that COVID-19 was transmissible between humans.

How Governments Back the Largest Manufacturing Firms

OECD, February 4, 2025

Government support has long been a central issue for trade but recently countries’ interest in subsidies, and industrial policies more broadly, has intensified. Yet evidence on the nature and scale of industrial subsidies and what they mean for global competition is scarce. This paper uses the recently created OECD MAnufacturing Groups and Industrial Corporation (MAGIC) database to shed more light on the level and types of subsidies received by the largest companies operating globally across 14 key industrial sectors. Subsidies are found to be widespread among these firms but modest on average relative to revenue.

There are, however, cases of sizeable subsidies, especially in heavy industries and semiconductors. Subsidies relative to firm revenue are also larger on average for firms based in China. The report then looks at the evolution of global market shares for the firms covered, finding China-based companies to have often gained market share, unlike OECD-based companies.

…

Key messages

This paper contributes to a rapidly growing literature and ongoing policy discussions about the size and nature of government subsidies. It builds on the OECD MAGIC database, a unique dataset containing detailed information about the level of subsidies for individual large manufacturing firms operating in 14 different sectors, across numerous OECD and non-OECD Members over the 2005-22 period.

Subsidies are found to be widespread among large industrial producers. Most of the firms in the OECD MAGIC database received at least one type of government support for half of the period for which their data are available or longer, with the median annual-firm observation corresponding to a subsidy of 0.6% of revenue. While seemingly modest on average, there are cases of very large subsidies, exceeding 15% of revenue. These cases are dominated by companies based in The People’s Republic of China (hereafter “China”), especially in the aluminium, cement, glass, and semiconductor industries, which receive not only large but long-running government support. Moreover, total subsides in relation to revenue tend to be larger for smaller firms and for state enterprises.

Subsidies are generally larger relative to firms’ investment in fixed tangible assets. Despite representing a relatively small percentage of total consolidated sales on average, subsidies can still have decisive impacts on individual transactions and investment decisions.

Countries and sectors tend to differ in the relative scale and types of subsidies (grants, tax concessions or below market-borrowings) they provide and receive. Subsidies relative to firm revenue are on average larger for firms based in China than for those based in other jurisdictions, particularly when it comes to below-market borrowings. The use of the latter type of subsidy is notably common in capital-intensive heavy industries, which rely relatively more on debt than equity for financing. Below-market borrowings have also been used to support distressed firms during crises (including in 2009 during the global financial crisis, and in China in 2015 to bolster domestic metal producers) and more occasionally to rescue companies experiencing financial difficulties for idiosyncratic reasons.

Global market shares, which account for both domestic and foreign sales in a sector, tend to be rather stable for most of the firms, but there are cases of large shifts in market position. China-based companies have experienced more frequent gains than losses in market share and generally account for most of the firms with the largest market share gains. The opposite is true for firms based in other jurisdictions, mainly in OECD Member countries.

Conclusions

The OECD MAGIC database constitutes a very significant improvement in the knowledge on industrial subsidies, helping shed more light on the extent to which governments are supporting their industrial producers in key sectors of the global economy. Using information drawn from the database, this report has found subsidies benefitting the largest industrial companies to be widespread, with only few companies not receiving any subsidies over 2005-22. While industrial subsidies are seemingly modest on average, their distribution is very skewed, which shows in the form of instances of very large subsidies exceeding 15% of firm revenue. These cases are largely dominated by companies based in China and operating in heavy industries and semiconductors. Although global market shares have proved rather stable for most firms in the sample, China-based companies have experienced more frequent gains than losses in market share and generally account for most of the firms with the largest market share gains.

That said, more needs to be done, including in further improving data coverage and expanding the set of support instruments captured in the database. While the availability of updated and reliable information on government subsidies forms an important goal behind the OECD MAGIC database, work also needs to investigate the implications that these subsidies are having on firms and global markets. To that end, forthcoming OECD analysis will provide econometric evidence on what these subsidies mean for firm productivity, investment, and changes in market shares, among other outcomes.

COMMENT – It seems that one of the main purposes of the World Trade Organization (WTO) is to make subsidies transparent and to give WTO members the ability to remedy harm caused by another member’s subsidies.

Given the pervasive nature of subsidies provided by the PRC Government to PRC companies in industries like aluminum and semiconductors, it appears the United States is completely justified in imposing trade remedies (like tariffs) on PRC exports.

When historians go back to examine why the WTO failed, they will find a lot of evidence in Beijing’s abuse of an international system of norms.

Ship Wars: Confronting China’s Dual-Use Shipbuilding Empire

Matthew P. Funaiole, Brian Hart, and Aidan Powers-Riggs, CSIS, March 11, 2025

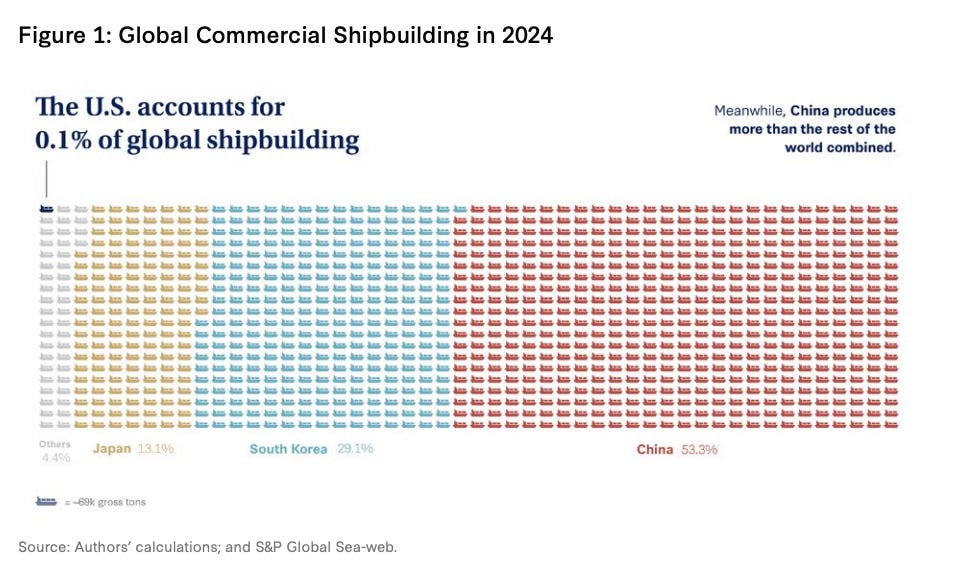

China has rapidly established itself as the world’s dominant shipbuilding power, marginalizing the United States and its allies in a strategically important industry. In addition to building massive numbers of commercial ships, many Chinese shipyards also produce warships for the country’s rapidly growing navy.

Foreign companies, including a number of American companies, are inadvertently helping to propel the PRC’s naval buildup by buying Chinese-made ships and sharing dual-use technologies with Chinese shipyards.

From page 4 of the Ship Wars report.

COMMENT – This is a BIG problem.

Worth reading their policy recommendations on pages 4-5.

My sense is that we still have not gotten our act together to even develop a plan to fix this… and another CR won’t help at all.

Mapping the Expansion of China’s Global Military Footprint

Craig Singleton, FDD, April 30, 2024

Amid the largest military build-up since World War II, China’s People’s Liberation Army (PLA) is aggressively pursuing expanded military access for its forces abroad.

The below map tracks the PLA’s growing global footprint. It includes information regarding the PLA’s existing military installations, PLA projects currently underway, and reported scouted locations for future military outposts. The map will be updated with the latest available open-source information.

As part of a concerted counter-basing campaign, the United States and allied governments should pro-actively engage with countries that appear most at-risk of either hosting a permanent Chinese military presence or supporting the PLA’s global logistics architecture to undermine China’s basing pursuits.

China’s strategy hinges, in part, on establishing an international network of “strategic strong points” (战略支点) that can provide support for overseas military operations or act as a forward base for deploying military forces overseas. The PLA’s expanding global footprint and corresponding ability to conduct a wider range of missions, including limited warfighting, carries major risks for the United States and its allies in the Indo-Pacific as well as other operational theaters.

Historically, the text of China’s “active defense” strategy emphasized the PLA’s role defending the country’s territorial integrity and winning localized wars in China’s “near seas.” Today, China’s growing emphasis on “far seas protection” necessitates that the PLA “adapt itself to tasks in different regions, develop the capacity of its combat forces for different purposes, and construct a combat force structure for joint operations.”

The PLA’s expanded mission prioritizes securing China’s major trade, energy, and resource routes along its principal sea line of communication (SLOC), which runs from mainland China through the Malacca Strait and into the Indian Ocean and Gulf of Aden. China is also leveraging its civilian logistics systems and commercial infrastructure, including projects financed by Chinese companies and/or affiliated with China’s Belt and Road Initiative, to support the PLA’s growing access needs.

At present, the PLA operates one declared overseas military base in Djibouti, which it established in 2017. Relatedly, the PLA maintains several man-made artificial islands in disputed parts of the South China Sea that it has fortified with missiles, runways, and advanced weapons systems. Beyond these naval outposts, the PLA's Strategic Support Force (SSF) also operates tracking, telemetry, and command (TT&C) stations in Pakistan, Namibia, Kenya, and Argentina that support China’s space and satellite operations.

After years of denials by Cambodian and Chinese officials, the PLA appears on-track to inaugurate its second overseas military base — and its first in the Indo-Pacific — at Cambodia’s Ream Naval Base as early as 2023. The U.S. Defense Department contends the PLA may have also made basing overtures to three additional countries in recent years: Vanuatu, the Solomon Islands, and Namibia. The Defense Department has further identified at least 13 additional locations that the PLA has likely considered to support its overseas military logistics and basing infrastructure. The Biden administration dispatched delegations to two of them — the United Arab Emirates in 2021 and Equatorial Guinea in 2022 — in an attempt to dissuade both governments from hosting an official Chinese military presence.

To date, the U.S. government has provided scant details regarding how China’s expanding overseas military presence could potentially impact U.S. and allied force posture around the world, most notably in the Indo-Pacific. Similarly, Washington has not outlined specific plans aimed at undermining China’s basing pursuits, which depend almost entirely on Beijing’s ability to positively shape host-country receptivity to its basing overtures.

COMMENT – Expect to see more of this map turn red.

China Is Waging a ‘Gray Zone’ Campaign to Cement Power. Here’s How It Looks.

Niharika Mandhana and Camille Bressange, Wall Street Journal, March 9, 2025

Years of ship-tracking data, flight paths and satellite images show a clear intensification of Beijing’s tactics across a swath of Asia.

From the choppy waters of the South China Sea and Taiwan Strait to the frozen ridges of the Himalayas, China is pursuing a relentless campaign of expansion, operating in the hazy zone between war and peace to extend its power across Asia.

Beijing carefully calibrates each move with the aim of staying below the threshold of action that could trigger outright conflict. But, step by incremental step, it has pushed deeper into contested areas, exhausting opponents and eroding their strength with a thousand cuts.

Whether it is probes by war planes, maneuvers by coast guard ships or the creeping construction of new civilian settlements, China is constantly pushing boundaries in what security strategists call the “gray zone.” It tests the limits of what its opponents consider tolerable behavior, escalating a bit with every new action.

The Wall Street Journal reviewed years of ship-movement data, satellite images, flight-tracking information and other measures of Chinese activity. Taken together, it shows a clear intensification of tactics meant to intimidate rivals and deepen China’s control.

South China Sea

Nowhere offers a better look at China’s gray-zone playbook than the South China Sea, where Beijing has shifted the balance of power bit by bit to become the dominant force.

The waterway is subject to a welter of competing claims, but tensions flow largely from China’s assertion that it is entitled to nearly all of the South China Sea. That puts it at odds with half a dozen other governments that also have claims there. It has also created tensions with the U.S., which doesn’t want a vital artery of global trade to turn into a Chinese lake.

Beijing has tightened its grip on the South China Sea through a series of steps stretching back more than a decade.

It began in 2013 by turning reefs into artificial islands. Then, it steadily militarized those islands with runways, radar and missile systems. At the time, some American military leaders dismissed the installations, arguing they would be sitting ducks in a conflict. But the island bases were pivotal to the next phase of Beijing’s gray-zone campaign: establishing a persistent, unmatched presence across the South China Sea.

China’s coast guard began to use the outposts to rest, refuel and take shelter from bad weather, enabling it to undertake long patrols without having to return to home ports hundreds of miles away. The number of ships grew and they were bolstered by another potent shadow force—swarms of fishing boats acting as a maritime militia to bulk up China’s presence.

These two fleets—the largest of their kind—are now ubiquitous in the South China Sea, far outnumbering their counterparts from competitor nations. Acting in tandem, they sail, swarm and skirmish—enforcing China’s will, clustering in sensitive spots at virtually all times and ousting rivals from waters to which those nations are entitled under international law.

The Philippines, a U.S. ally, has borne the brunt of the onslaught since 2022. China has used aggressive tactics, restricting the Philippines’s ability to operate inside its own exclusive economic zone.

“If you look at China’s coast guard and its maritime militia over the last three years—you would see a dramatic increase in the number of ships and the depth of the penetration,” said Ray Powell, director of SeaLight, a U.S.-based research initiative focused on gray-zone activities. “It’s taken on the character of a maritime occupation.”

Events at Sabina Shoal last year showed China’s ability—and willingness—to escalate, despite international opprobrium. It tightened its hold on the area in September after forcing a Philippine coast guard ship, which had been anchored at Sabina Shoal for months, to withdraw. The Philippine vessel pulled back after China’s coast guard and militia ships repeatedly blocked Manila’s attempts to deliver basic necessities to the crew.

China accuses the Philippines of stirring trouble. It has rejected a 2016 ruling by an international tribunal that said Beijing’s broad claims to historic rights in the South China Sea have no legal basis. Its Foreign Ministry didn’t respond to a request for comment for this article.

The Philippines has responded to China’s actions in the South China Sea by shining a light on them—releasing videos and detailed accounts of Chinese aggression and casting Beijing as a bully. Its approach has helped coalesce greater international support for Manila. But China’s reliance on gray-zone tactics—rather than, say, a direct assault to capture contested sites—has meant that the Philippines hasn’t invoked its most powerful tool, its mutual defense treaty with the U.S.

Taiwan

Over the past five years, China has engulfed Taiwan in an ever-thicker fog of gray-zone hostility. On most days, Chinese military aircraft fly toward Taiwan’s main island and across the median line—the informal boundary splitting the Taiwan Strait. Just a few years ago, even a handful of such crossings would have made the news.

The intensification of air activity is unmistakable. In 2021, Chinese sorties into Taiwan’s de facto air-defense identification zone, or ADIZ—which stretches beyond a territory’s airspace and enables it to monitor approaching aircraft—numbered 972, according to PLATracker, a site that collects and analyzes such data. Last year, the sorties crossed 3,000, straining Taiwan’s defenses and heaping pressure on its leadership.

The skies near Taiwan were particularly busy in August 2022 when Beijing launched major military exercises to protest a visit to Taiwan by then-U.S. House Speaker Nancy Pelosi. That month, it sent 446 sorties into Taiwan’s ADIZ.

China considers Taiwan to be a part of its territory and has vowed to take control of the democratically governed island. It chafes at U.S. support for Taipei.

The sorties have grown in number, frequency and scope. A few years ago, Chinese aircraft were heavily concentrated to Taiwan’s southwest, according to an analysis of their flight paths reported by Taiwan’s Ministry of National Defense and mapped by Damien Symon, a researcher at the Intel Lab, an intelligence consulting firm. In 2023, their routes extended all around Taiwan’s main island, including the more-distant east side.

It isn’t just aircraft. Beijing is deploying an expanding mix of forces, making Taiwan’s security picture more complex and more onerous to track. Those forces range from warships, coast guard vessels and research ships to drones, fishing fleets and more—in ever-greater numbers and in new patterns.

Last year, Beijing sent dozens of mysterious high-altitude balloons near and over Taiwan’s main island, floating as many as 57 in one month, forcing Taipei to study their paths and puzzle over their purpose.

Beijing has also established a provocative new pattern of mounting high-profile exercises involving its army, navy, air and missile forces to express its anger at political developments. It has undertaken five large-scale drills in 2½ years—including the one in 2022 after Pelosi’s visit—simulating a blockade of Taiwan.

Each iteration has displayed new elements, from the firing of missiles and use of an aircraft carrier to the deployment of coast guard ships to encircle Taiwan. The now-regular surge of Chinese forces around Taiwan is aimed at sending a message to Taipei: capitulation would be better than conflict.

Taiwan and the U.S. have failed to come up with a response that would prevent China from undertaking these exercises or halt its near-daily pressure.

While Washington is largely focused on deterring an invasion of Taiwan, security analysts say China may not launch an outright war, or even a blockade. It could instead impose a quarantine on Taiwan, said Bonny Lin, director of the China Power Project at the U.S.-based Center for Strategic and International Studies.

That means China could restrict air and maritime traffic into Taiwan and tighten its control over the flow of commerce using its coast guard and other law-enforcement forces, rather than its military. Lin, whose team has mapped out possible quarantine scenarios, said one could even begin with a major military exercise.

“A lot of things could start rolling, start happening on the spot,” she said. “When we think about what China could do in the gray-zone space—the very broad gray-zone space—we really need to think creatively that there are lots of large-scale activities that China could do.”

Himalayas

Traveling westward, the physical terrain changes from maritime to mountainous, but the gray-zone landscape is similar. Long stretches of China’s land borders with India and the strategically located nation of Bhutan are contested and unresolved despite decades of talks between the countries. Beijing has quietly built dozens of village settlements along these boundaries—not all of them on established Chinese territory.

China has been moving waves of people, mainly Tibetans, into many of these settlements. Official footage, and videos on Chinese social-media sites such as Douyin, show families arriving in buses, at times clutching images of Chinese leader Xi Jinping. Uniform rows of newly built houses await them, Chinese flags fluttering overhead. Signs proclaim Chinese sovereignty.

Bhutan’s Foreign Ministry said the boundary between Bhutan and China is the subject of ongoing negotiations between the two sides. The new Chinese settlements along Bhutan’s northeast border are “beyond the mutually agreed line during the boundary talks between Bhutan and China,” it said.

On Bhutan’s official maps, the areas of some of the recent Chinese construction fall within Bhutan’s marked borders. The maps, together with parliamentary discussions and ministerial statements over past decades, cast these areas as Bhutanese territory, according to Barnett, who is a professorial research associate at SOAS University of London.

Barnett says Chinese actions in these borderlands have progressed in six stages over a few decades. First, in the 1990s, China sent herders to disputed areas claiming customary grazing rights, much like the historic rights it asserts in the South China Sea. Then it dispatched official patrols to support the herders, squeezing out Bhutanese pastoralists. After that, temporary shelters or checkpoints emerged, to later be upgraded into robust outposts.

Next, China built roads linking these remote areas, said Barnett. Then, to consolidate control, it made villages and populated them.

COMMENT – Years of territorial expansion and aggression by the PRC against its neighbors.

Authoritarianism

7. Whistleblowing citizen journalist Zhang Zhan ‘to stand trial again soon’

Qian lang, RFA, March 5, 2025

COVID-19 whistleblowing citizen journalist Zhang Zhan will soon undergo a second trial in Shanghai on public order charges amid reports she is once more refusing food in detention, people familiar with the case told RFA Mandarin.

Zhang, 40, was one of a group of citizen journalists detained, jailed or “disappeared” after they went to the central city of Wuhan to report on the emerging COVID-19 pandemic.

In December 2020, she wasfound guilty of “picking quarrels and stirring up trouble” -- a vague charge frequently used to target peaceful critics of the ruling Communist Party -- and sentenced to four years' imprisonment.

Last June, she was released from that sentence, during which she repeatedly refused food, but then was re-detained in September 2024.

Now, she faces new charges -- also of “picking quarrels and stirring up trouble” -- and will likely stand trial at the Pudong New Area People’s Court in Shanghai very soon, a person familiar with the case told Radio Free Asia.

COMMENT – Back in May 2024 I covered Zhang Zhan, a Chinese citizen journalist who is worthy of our respect and admiration for her courage. See Profile in Courage: What it means to stand up for principle in today’s China (May 19, 2024).

8. China rolls out U.S. farm tariffs as Xi digs in for wider trade war

Stella Yifan Xie, Nikkei Asia, March 10, 2025

Fresh salvo against Canada seen as warning against aligning with Trump policy.

The deadline for China's retaliatory tariffs on a slew of American farm goods passed Monday, while an announcement of fresh targeted levies on Canadian goods over the weekend underscored how Beijing is bracing for a wider trade war with the West.

From beef to chicken and grains, an array of U.S. agricultural products are now subject to China's new 10% to 15% duties. Cargo that departed before Monday and arrives in China by April 12 will be exempted as part of a transitional arrangement, Beijing said.

COMMENT – While nearly all media outlets focus on the Trump actions against Canada and the EU, Beijing has a good understanding of what these actions by the United States are meant to do: encourage fence-sitters like Ottawa (the same Canadian Liberal Party which welcomed CCP interference in the 2019 and 2021 national elections) to implement trade and economic policies that will disadvantage the PRC.

And CCP leaders are trying hard to ensure countries like Canada don’t do that, not with enticements, but preemptive punishments of their own.

China says it’s willing to cooperate with the U.S. on fentanyl

Evelyn Cheng, CNBC, March 12, 2025

China is willing to do more to address White House concerns about illicit fentanyl trade, but it will be “a different thing” if ongoing debate over the drug facilitates more U.S. tariffs on the world’s second largest economy, an official from the Chinese Ministry of Foreign Affairs told reporters Wednesday.

Washington should have “said a big thank you” to China on what it has done to restrict fentanyl trade in the U.S., the official said via an official English translation, claiming the White House did not appreciate the effort and instead raised duties on Chinese goods twice this year over the drug.

COMMENT – The PRC has done next to nothing to restrict fentanyl and it appears clear that the Chinese Communist Party is culpable for the deaths of hundreds of thousands of Americans over the past 7-8 years as the PRC Government provided subsidies and tax rebates for the export of fentanyl precursors.

See these two issues of this newsletter: Beijing’s Covert Fentanyl Campaign Against the United States (April 21, 2024) and Holding Beijing responsible for its role in the fentanyl crisis (June 23, 2024)

For an MFA spokesman to ask for a “big thank you” reminds me of the PRC’s demands that the world thank it for its COVID response.

Chinese students flock to Japanese art colleges for permanent residency

Sae Kamae, et al., Nikkei Asia, March 9, 2025

Two Sessions: China wraps up key political meet with call for ‘unrelenting struggle’

Hong Kong Free Press, March 12, 2025

Zuckerberg’s Meta considered sharing user data with China, whistleblower alleges

Naomi Nix, Washington Post, March 9, 2025

Meta went to extreme lengths, including developing a censorship system, in a failed attempt to bring Facebook to millions of internet users in China, according to a whistleblower complaint.

Meta was willing to go to extreme lengths to censor content and shut down political dissent in a failed attempt to win the approval of the Chinese Communist Party and bring Facebook to millions of internet users in China, according to a new whistleblower complaint from a former global policy director at the company.

The complaint by Sarah Wynn-Williams, who worked on a team handling China policy, alleges that the social media giant so desperately wanted to enter the lucrative China market that it was willing to allow the ruling party to oversee all social media content appearing in the country and quash dissenting opinions.

Meta, then called Facebook, developed a censorship system for China in 2015 and planned to install a “chief editor” who would decide what content to remove and could shut down the entire site during times of “social unrest,” according to a copy of the 78-page complaint exclusively seen by The Washington Post.

Meta chief executive Mark Zuckerberg also agreed to crack down on the account of a high-profile Chinese dissident living in the United States following pressure from a high-ranking Chinese official the company hoped would help them enter China, according to the complaint, which was filed in April to the Securities and Exchange Commission.

…

To strengthen their negotiating power, Meta leaders also considered bending their long-standing privacy rules for the benefit of the Chinese government. In August 2014, members of Meta’s privacy team discussed whether to confirm to the Irish data protection commissioner that Hong Kong users would still be afforded the same privacy protections as users in the United States and the European Union, according to the documents. Days after meeting with Meta’s China negotiating team, the privacy team was willing to weaken Hong Kong users’ rights, according to an email exchange contained in the complaint.

“In exchange for the ability to establish operations in China, FB will agree to grant the Chinese government access to Chinese users’ data — including Hongkongese users’ data,” one privacy policy staffer wrote.

COMMENT – This isn’t surprising at all… Zuck was desperate to get into the China market a decade ago and apparently willing to sacrifice the welfare of his customers to do it.

Inside Xi’s Crackdown on Scams with China’s Huge Surveillance State

Bloomberg, March 7, 2025

Nearly half of Hongkongers dissatisfied with opposition-free legislature

Hans Tse, Hong Kong Free Press, March 12, 2025

In New Book, Dalai Lama Tells Followers to Reject Any Successor Chosen by China

Tripti Lahiri, Wall Street Journal, March 10, 2025

Beijing renews warning to Tokyo: don’t stir up trouble with Taiwan

Kawala Xie, South China Morning Post, March 7, 2025

China-Russia Relations: February 2025

Anya Konstantinovsky, Council on Foreign Relations, March 5, 2025

Feminism is still a dirty word in China

Ciara Morris, Lowy Institute, March 4, 2025

Chinese Company to Single Workers: Get Married or Get Out

Vivian Wang, New York Times, March 4, 2025

TikTok hasn't negotiated with prospective buyers as deadline looms

Dan Primack, Axios, March 6, 2025

China says it is ‘ready for war’ with America

Sarah Newey, Telegraph, March 5, 2025

Shipping firms pull back from Hong Kong to skirt US-China risks

Greg Torode and Jonathan Saul, Reuters, March 6, 2025

China Says It Offers Stability as Trump Sows Chaos. The Reality Is Complicated.

David Pierson, New York Times, March 7, 2025

Sanctions Are Tangling, Not Stopping, China’s Iran Oil Trade

Serene Cheong, Bloomberg, March 8, 2025

Environmental Harms

China’s Waning Oil Thirst

Noah Berman, The Wire China, March 7, 2025

China’s transformation into a global economic power has also seen it become the world’s largest importer of crude oil. But is the country’s thirst for black gold from abroad now in decline?

Barring the two years of the Covid-19 pandemic, last year was the first in two decades when China recorded a year-on-year drop in petroleum imports.

While it may be too soon to be sure that China’s oil demand has peaked, most analysts agree that the country’s imports will crest by the end of the decade. They point to cyclical and structural factors working in tandem: China’s slumping property sector is depressing demand for refined oil products like diesel and gasoil just as non-oil transportation options, such as electric vehicles, trucks powered by liquified natural gas and high-speed trains, are growing in popularity.

“Everything suggests that we are heading for peak oil demand in China sooner rather than later,” says Erica Downs, a Chinese energy markets specialist at the Center on Global Energy Policy at Columbia University.

To be sure, analysts expect China’s oil imports to remain high, even if they are no longer growing rapidly. Some even expect a return to growth. “Net imports in China will grow next year because their consumption will still grow, just at a slower rate than they typically have in the past,” says Jeff Barron, an economist at the U.S. Energy Information Administration.

COMMENT – This seems like wishful thinking by a bunch of folks committed to climate cooperation. I think it is far more likely that we will see a Chinese economy that continues to pursue a “more of everything” approach to energy.

26. China’s construction of new coal-power plants ‘reached 10-year high’ in 2024

Anika Patel, Carbon Brief, February 13, 2025

A “resurgence” in construction of new coal-fired power plants in China is “undermining the country’s clean-energy progress”, says a new joint report by the Centre for Research on Energy and Clean Air (CREA) and Global Energy Monitor (GEM).

The country began building 94.5 gigawatts (GW) of new coal-power capacity and resumed 3.3GW of suspended projects in 2024, the highest level of construction in the past 10 years, according to the two think tanks.

Foreign Interference and Coercion

Taiwan fears Beijing is taking independence crackdown overseas

Yimou Lee, Reuters, March 7, 2025

Taiwan is considering warning citizens about risks of travelling to countries with strong ties to China, such as Laos and Cambodia, as they could be caught up in Beijing's campaign against Taiwan independence supporters, according to a senior Taiwan official and an internal memo.

China, which claims democratically governed Taiwan as its own despite the island's rejection, issued guidelines last year to punish "diehard" Taiwan independence activists, including with the death penalty, even though Chinese courts have no jurisdiction on the island.

Late last month, a senior Chinese official gave closed-door instructions to state security units to "implement" the guidelines in countries friendly to China, according to a government memo reviewed by Reuters and a senior Taiwan security official. Both cited intelligence gathered by Taipei for that assessment.

China's Taiwan Affairs Office and foreign ministry did not immediately respond to a request for comment.

In a statement, Taiwan's foreign ministry told Reuters China had tried to use the guidelines to "shackle" Taiwan's democracy and freedom. The ministry said it had asked its overseas offices to monitor and assess related risks and would boost public awareness on travel safety.

Taiwan security agencies have been looking at whether to raise the alert level for travel to certain countries for its citizens, the official said. Reuters was not able to establish whether any decision had been made on the alert or the countries for which that review was underway.

Taiwanese in Cambodia, Laos and some unspecified African nations could risk being taken in for investigation on suspicion of backing independence, the official said, citing Taiwan's assessment of the development and speaking on condition of anonymity.

"They might be taken for questioning by the local or Chinese police there, at least to psychologically intimidate them," the official told Reuters.

COMMENT – Cambodia and Laos are client states of the PRC. If ASEAN had any power as an organization, they would do something about it, but since they won’t, Beijing essentially has a veto over any action by ASEAN.

China, Russia, U.S. Arctic competition looms over Greenland elections

Shogo Kodama, Nikkei Asia, March 9, 2025

Taiwan revokes residency for Chinese TikTok influencer

Kathrin Hille, Financial Times, March 12, 2025

Can China fill the void in foreign aid?

Yun Sun, Brookings, March 12, 2025

With the United States significantly downsizing its provision of international aid, a key question that has emerged from the Global South and traditional donor community is whether China will exploit the opportunity and fill the void. A careful examination of the nature, size, type, and motivation of China’s aid reveals the improbability of China replacing the U.S. Agency for International Development (USAID) in the foreign assistance space.

There is a significant gap in the size of aid

First, China’s foreign aid has consistently been a fraction of America’s. It is a common misperception that China’s Belt and Road Initiative (BRI) is aid. In reality, the overwhelming majority of BRI financing is loans, including $327 billion disbursed by the Export-Import Bank of China by the end of 2022, and investments, including $300 billion invested by Chinese commercial entities by the end of 2023. Fudan University put China’s cumulative BRI engagement between 2013 and 2023 at $1.053 trillion: about $634 billion in construction contracts and $419 billion in non-financial investments. The BRI essentially consists of commercial activities with a tint of development finance. That’s why they are often referred to as “BRI engagement,” and never as foreign aid.

According to U.S. government data, in the 2023 fiscal year, USAID’s budget was about $42 billion, including approximately $17 billion for governance, $9.4 billion for humanitarian assistance, $7 billion for health and population, $3.5 billion for administrative costs, $1.3 billion for agriculture, $1.1 billion for education, $740 million for infrastructure, $720 million for economic development. USAID has not been the only government implementing agency for foreign assistance. The State Department also had a nearly $19 billion budget for foreign assistance, along with the Department of Treasury (about $2 billion), the Department of Agriculture (about $450 million), etc.

In comparison, Chinese foreign aid is significantly smaller. According to the 2021 version of China’s foreign aid white paper “China’s International Development Cooperation in the New Era,” between 2013 and 2018, China’s total foreign aid reached 270.2 billion RMB (around $42 billion based on the average exchange rate during the same period). That means China spent an average of $7 billion on foreign aid annually during this time period. But during the same period, the United States spent $286 billion on foreign aid,1 or $47.7 billion per year. Thus, from 2013 to 2018, Chinese aid only amounted to 14.6% of what America spent.

China has not published its aid data since 2018. But a 2024 Ministry of Commerce (MOFCOM) report put the annual average amount of Chinese aid at 20.5 billion RMB from 2013 to 2022 (approximately $3.13 billion at the average exchange rate during this period). The discrepancy between this data and the above data is most likely due to the multilateral aid China provides to international organizations, which goes through the Ministry of Finance rather than MOFCOM. But COVID-19 and China’s travel restrictions and economic slowdown also contributed to the decrease in Chinese aid since 2020. MOFCOM’s foreign aid budget dropped 20% from 19.7 billion RMB (approximately $3 billion) in 2018 to 16.8 billion RMB (approximately $2.6 billion) in 2021.

The current size of Chinese bilateral foreign aid can be deducted from the budgets of China’s two primary aid agencies: the Ministry of Commerce and the China International Development Cooperation Agency (CIDCA). By its mandate, MOFCOM is “responsible for foreign aid, design and implement foreign aid policy and plans, promote foreign aid reforms, compile foreign aid plans, decide on foreign aid projects and organize their implementation, and manage the use of government funding under the category of foreign aid.” In comparison, CIDCA’s responsibility is more on the management side: foreign aid strategy, the overall size of foreign aid, priorities of Chinese aid, feasibility studies, policy coordination with recipient countries, as well as the monitoring and evaluation of foreign aid projects.

MOFCOM’s foreign aid budget for 2024 is 20.48 billion RMB, roughly $2.82 billion. CIDCA’s foreign aid is much smaller: 54 million RMB for foreign aid and 131.2 million RMB for international development cooperation, bringing us to a total of 186.2 million RMB, approximately $25.62 million. The total foreign aid budget of the two institutions is $2.85 billion for 2024. This number aligns with the overall trend of China’s economic slowdown and reduced engagement since COVID-19. But it also means the volume of Chinese aid is only a fraction of U.S. foreign aid.

Different motives and purposes

The United States and China also use aid very differently. According to China’s official documents, Chinese foreign aid is divided into three categories: grants, zero-interest loans, and concessional loans. Grants are the traditional foreign aid projects in the Western definition, including welfare projects, capacity building, technical assistance, humanitarian assistance, material support, and South-South cooperation aid. Zero-interest loans are used to develop public facilities and social projects. Historically, zero-interest loans are usually forgiven eventually. And concessional loans are used to develop large infrastructure projects and production projects in developing countries, including equipment, machines, and technical support among others.

Concessional loans are the most misunderstood category. The principal of Chinese concessional loans is raised on the market by the Export-Import Bank of China, but the loans’ lower interest rates are subsidized by China’s foreign aid budget, meaning that Chinese foreign aid is used to offset the differences between the concessional loan interest rates and commercial loan interest rates.

If we look at the historical distribution of China’s foreign aid budget, we get the data below:

A striking takeaway from the data is the significant increase in foreign aid spending on concessional loans since 2009, which aligns with China’s push for hard infrastructure since 2010 and under BRI. It is well known that China’s concessional loans are aimed at promoting the export of Chinese contract services and products, often using recipient countries’ natural resources as collateral. Since Xi Jinping took over in 2013, the weight assigned to grants has increased, which coincides with China’s push for soft power influence, but it’s still smaller than concessional loans.

The data also shows that China’s spending on what USAID traditionally focuses on—“grants,” such as capacity building and humanitarian assistance—is less than 50% of its total foreign aid budget, at $3.29 billion during 2013-2018, and potentially around $1.5 billion a year in the 2024 budget if the same distribution remains.

COMMENT – The Chinese Communist Party doesn’t do “foreign assistance” it does debt-trap diplomacy and uses corruption to bind countries in the global south to its cause… South Africa is just one example.

Panama Port Deal Plants U.S. Flag in China-Dominated Sector

James T. Areddy, Wall Street Journal, March 6, 2025

32. China signals anger at CK Hutchison's Panama ports sale, rattling investors

Kenji Kawase, Nikkei Asia, March 14, 2025

Chinese authorities have signaled their displeasure over Hong Kong conglomerate CK Hutchison selling its Panama Canal port assets to a consortium led by U.S. investment firm BlackRock, pushing the Li Ka-shing family company's share price sharply lower.

A commentary condemning the deal was published by Hong Kong's state-backed newspaper Ta Kung Pao on Thursday, warning that allowing the canal to be "Americanized" would lead to Washington using it for political purposes to restrict Chinese trade. The article was reposted in full by the joint official website of the Chinese Communist Party's Hong Kong and Macao Work Office and the central government's Hong Kong and Macao Affairs Office, underscoring that it expressed Beijing's views.

33. Beijing calls Li Ka-shing a ‘traitor’ in Panama ports deal

Yong Jian, Asia Times, March 15, 2025

Beijing criticized the tycoon for selling Chinese assets in 2015, and now slams his decision to dispose of his ports worldwide.

Beijing criticized Hong Kong tycoon Li Ka-shing for “betraying all Chinese people” after his flagship company announced its plan to sell most of its global ports, including two at the Panama Canal, to BlackRock.

The Chinese State Council’s Hong Kong and Macao Affairs Office (HKMAO) circulated an article titled “Don’t be naive and senile” on its website on Thursday, calling on the 96-year-old entrepreneur to rethink the transaction.

The article said the “big deal” proposed by CK Hutchison, Li’s flagship company, is not ordinary commercial behavior, as it was announced after US President Donald Trump called for regaining control of the Panama Canal in January.

“After the Panama Canal is ‘Americanized’ and ‘politicized,’ the US will definitely use it for political purposes and pursue its own political agenda,” Wang Junxi – the name may be a pseudonym as the author has no title and has not published any article before – says in the article, citing comments from “many netizens.”

“Once the US implements docking restrictions and imposes ‘political surcharges,’ Chinese companies’ logistics costs and supply chain stability will face significant risks.”

Wang says that, through this transaction, BlackRock will control approximately 10.4% of the world’s container terminal throughput, becoming one of the world’s three largest port operators; the company will probably cooperate with the United States’ suppression policy against China, increase the cost of China’s freight docking, and squeeze the market share of Chinese shipping companies.

“The US may also use this transaction as a model to push for mergers and acquisitions of ports worldwide through political pressure, control more key ports, and use ‘long-arm jurisdiction’ to implement suppression measures, leaving Chinese ships nowhere to dock,” he says.

COMMENT – The Chinese Communists are clearly not happy about this. Expect to see even further tightening of control over Hong Kong businesses.

U.S. Investigation Into Global Antidoping Agency Continues Under Trump

Tariq Panja and Michael S. Schmidt, New York Times, March 11, 2025

The World Anti-Doping Agency will report to its board that federal officials questioned one of its U.S. employees last month in the inquiry into the agency’s handling of positive tests by Chinese athletes.

The Justice Department and F.B.I. investigation into whether the global antidoping authority and China covered up the positive tests of Chinese Olympic swimmers who went on to win medals at the past two Summer Games has continued under the Trump administration, according to a draft document obtained by The New York Times.

The document, which the World Anti-Doping Agency plans to provide to its executive committee for a meeting this month, said that federal officials interviewed an employee of the agency who is an American citizen on Feb. 12 as part of the continuing investigation.

The investigation began under the Biden administration after The Times and a German broadcaster revealed that 23 Chinese swimmers had tested positive for a banned substance ahead of the 2021 Olympics but that neither Chinese authorities nor WADA had disclosed the results or taken any action against the swimmers.

In the final days of his first administration, President Trump signed into law a measure giving the U.S. authorities the power to pursue doping allegations across borders. The focus of the investigation, involving possible Chinese corruption and wrongdoing by an international organization, is among matters that Mr. Trump and his administration have signaled they are deeply interested in.

The latest development about the investigation was revealed in a section titled “U.S. Situation” in a 255-page draft report WADA plans to provide to its executive committee members. Its author was listed as Olivier Niggli, WADA’s director general.

The document said that the interview of the WADA employee was conducted on a voluntary basis and done “in the presence of our U.S. counsel.”

The document also indicated that the United States, which is the largest funder to WADA, still has not paid its dues to the organization. The funding cutoff was initiated under the Biden administration in response to WADA’s handling of the doping allegations and apparently has continued under Mr. Trump. Relations between WADA and the United States remain strained, according to the document.

COMMENT – My prediction is that WADA will be waiting a really long time for the dues from the United States.

China's COSCO teams with Germany's BLG to ship cars to Europe

Kohei Fujimara, Nikkei Asia, March 11, 2025

Mercedes to develop smart cars for global markets with China's Hesai lidar

Reuters, March 12, 2025

Human Rights and Religious Persecution

A Viral Video of a Chained Woman in China and the Secret Campaign to Save Her

Vivian Wang, New York Times, March 5, 2025

The video blogger had visited Dongji Village, in eastern China, to find a man known for raising eight children despite deep poverty. The man had become a favorite interview subject for influencers looking to attract donations and clicks.

But that day, one of the children led the blogger to someone not featured in many other videos: the child’s mother.

She stood in a doorless shack in the family’s courtyard, on a strip of dirt floor between a bed and a brick wall. She wore a thin sweater despite the January cold. When the blogger asked if she could understand him, she shook her head. A chain around her neck shackled her to the wall.

The video quickly spread online, and immediately, Chinese commenters wondered whether the woman had been sold to the man in Dongji and forced to have his children — a kind of trafficking that is a longstanding problem in China’s countryside. They demanded the government intervene.

Instead, local officials issued a short statement brushing off the concerns: The woman was legally married to the man and had not been trafficked. She was chained up because she was mentally ill and sometimes hit people.

Public outrage only grew. People wrote blog posts demanding to know why women could be treated like animals. Others printed fliers or visited the village to investigate for themselves. This was about more than trafficking, people said. It was another reason many young women were reluctant to get married or have children, because the government treated marriage as a license to abuse.

The outcry rippled nationwide for weeks. Many observers called it the biggest moment for women’s rights in recent Chinese history. The Chinese Communist Party sees popular discontent as a challenge to its authority, but this was so intense that it seemed even the party would struggle to quash it.

And yet, it did.

To find out how, I tried to track what happened to the chained woman and those who spoke out for her. I found an expansive web of intimidation at home and abroad, involving mass surveillance, censorship and detentions — a campaign that continues to this day.

The clampdown shows how rattled the authorities are by a growing movement demanding improvements to the role of women in Chinese society. Though the party says it supports gender equality, under China’s leader, Xi Jinping, the government has described motherhood as a patriotic duty, jailed women’s rights activists and censored calls for tougher laws to protect women from mistreatment.

Yet even as the crackdown forced women to hide their anger, it did not extinguish it. In secret, a new generation of activists has emerged, more determined than ever to continue fighting.

COMMENT – An extremely well-done multi-media report from the New York Times on a story that deserves a lot more attention.

2 jailed ex-Hong Kong lawmakers sentenced to weeks in prison over legislature clash six years ago

Hans Tse, Hong Kong Free Press, March 12, 2025

Hong Kong social worker Jackie Chen found guilty of rioting during 2019 protest after retrial

Hillary Leung, Hong Kong Free Press, March 11, 2025

Industrial Policies and Economic Espionage

China Says It Has ‘Ample’ Policy Tools to Spur Growth

Wall Street Journal, March 6, 2025

China Is Secretly Worried Trump Will Win on Trade

Lingling Wei and Alex Leary, Wall Street Journal, March 5, 2025

In seeking accord with U.S., Beijing wants to avoid becoming isolated like the Soviet Union during the Cold War.

Soon after Donald Trump won the presidential election in November, Xi Jinping asked his aides to urgently analyze the Cold War rivalry between the United States and the Soviet Union.

His concern, according to people who consult with senior Chinese officials, was that as President Trump gears up for a showdown with Beijing, China could get isolated like Moscow during that era.

He’s not wrong to worry. Even though Trump may be the one who currently looks isolated on the world stage—picking trade fights with erstwhile allies like Mexico and Canada, alarming Europe over his handling of the war in Ukraine and vowing to annex Greenland and the Panama Canal—the truth is that China doesn’t hold a strong hand.

With a domestic economy in crisis, Xi is playing defense, hoping to salvage as much as possible of a global trade system that helped pull his country out of poverty. Across the Pacific, Trump is intent on rewiring that very trading system, which he and his advisers see as having benefited the rest of the world—and China most of all—at the U.S.’s expense.

It isn’t just trade. The competing agendas of the leaders of the world’s two largest economies are poised to lead to precisely what China is trying to avoid: a superpower clash not seen since the Cold War, an all-encompassing rivalry over economic, technological and overall geopolitical supremacy.

Trump, who highlighted the need to counter China throughout his campaign, returned to the White House with a comfortable victory and Republican control of Congress. He believes he can deal with Beijing from a position of strength, advisers said.

Many of his early diplomatic moves should be viewed in that context, these people said. Trump is trying to end the conflicts in the Middle East and Ukraine to better focus on China, they said. His recent enthusiastic embrace of Russia and its authoritarian leader, Vladimir Putin, is propelled in part by a strategic desire to drive a wedge between Moscow and Beijing.

One reason Trump wants U.S. control of the Panama Canal is that he sees the Chinese infrastructure that has been built up there in the past three decades as a national-security threat. On Tuesday, he notched a victory of sorts, when a consortium of investors led by U.S. asset management firm BlackRock agreed to buy majority stakes in ports on either end of the Panama Canal from Hong Kong-based CK Hutchison.

“All the stuff he’s doing is so that we can put more resources” to counter China, an administration official said.

Trump on Tuesday added to existing tariffs on China, citing its role in the fentanyl crisis in the U.S., surprising Chinese officials who were still trying to figure out how to approach what they see as an erratic U.S. leader.

China, which itself has tried to reshape the global order, aligning itself with Russia to challenge the West, now finds itself on the back foot. The vision haunting Xi is one where China finds itself cut off by trade restrictions and sanctions, suffering Soviet-style isolation with fewer outlets for its goods and limited access to crucial technologies.

“Now China is in danger of becoming the target of a similar rivalry,” one of the people who consult with Beijing said. “Xi believes that must be avoided.”

What complicates Beijing’s efforts at shaping its strategy toward the U.S. is the difficulty in getting Trump’s core team to engage. China hasn’t been a primary focus for Trump in his first weeks. His near-term priorities have been on fixing illegal immigration, slashing government spending and ending Russia’s war in Ukraine.

While Xi is waiting for clarity on what the U.S. wants from Beijing, his economic team is preparing ways to hit back at Trump.

Since November, China has dispatched several delegations to Washington to explore potential deals with the new administration, arguing that tariffs would add to the inflationary pressure in the U.S. that Trump is trying to tame.

Simultaneously, Beijing has developed an arsenal of tools—such as export controls on critical minerals—to inflict economic pain on the U.S. and has been courting America’s traditional partners to prepare for a more intense face-off with Washington.

One lesson Xi has learned from the first trade war with Trump is that China has more to lose from hitting back at Trump’s tariff hikes with proportional levy increases, the people said, as the U.S. buys substantially more from China than the other way around.

Michael Pillsbury, a China expert at the conservative Heritage Foundation who consults with the administration, said he has met with members of Chinese delegations that have visited Washington since the election. The Chinese effort amounts to a campaign to ward off tariffs, he said.

“They are kind of desperate,” Pillsbury said. “Their economy is in trouble. Now that Trump put the tariffs on, they know this campaign has failed.”

Still, as Washington amps up pressure, Beijing is trying to project confidence. After Trump’s latest tariff actions this week, China swiftly retaliated. Meanwhile, Beijing set a growth target of about 5% for 2025, a signal that it expects the Chinese economy to resist the rising trade pressures. A Chinese Foreign Ministry spokesman took a defiant stance, saying, “If war is what the U.S. wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end.”

‘Let the Chinese stew’

Trump and Xi seemed to be off to a good start, similar to the beginning of Trump’s first term in 2017. The American leader invited Xi to his Jan. 20 inauguration, and while the Chinese leader sent his vice president instead, it was still a goodwill gesture from a leadership often wary of political risks. Both leaders have expressed an interest in having a summit.

Such diplomatic niceties, however, only mask the actions beneath—and what likely is in store for China.

Trump’s “America First” policy essentially calls for dismantling the norms set up by the World Trade Organization since 1995. Under those norms, China has been able to flood the world with cheap exports while limiting foreign access to its own market. China’s $295 billion trade surplus with the U.S. is the widest of any U.S. trading partner.

Matt Turpin, a visiting fellow at the Hoover Institution who served on Trump’s National Security Council during his first term, said Trump believes that U.S. interests, especially those of American workers and companies, are harmed by the liberal international economic system that developed after the Soviet Union’s collapse.

To re-engineer the system, Turpin said, Trump’s trade team may “focus on getting relatively favorable deals with everyone else first and let the Chinese stew in their continuing economic depression.”

The people close to the administration said Trump believes that the U.S. can strengthen its leverage over Beijing by individually renegotiating terms of trade with its other partners.

On his first day in office, Trump signed a presidential memorandum directing federal agencies to conduct a series of reviews of the U.S.’s existing trade relationships. One key task for his economic team is to cut deals with countries like Mexico and Vietnam, part of efforts to prevent Chinese companies from rerouting goods to the U.S. through third parties.

After Trump first threatened to hit Mexico and Canada with 25% tariffs in early February, Mexico made a “very interesting proposal” to match the U.S. on tariffs for imports from China, Treasury Secretary Scott Bessent told Bloomberg TV. Following a pause, Trump on Tuesday followed through on his tariff threat, arguing that the two countries still hadn’t firmed up their policies to stop migrant and drug flows across the border. A day later, the White House said it will give automakers a one-month exemption from the new levies.

9 takeaways from the economic briefing at China’s ‘two sessions’

Mandy Zuo, South China Morning Post, March 6, 2025

As China’s ‘employment problems’ mount, Premier Li vows to create jobs, ward off poverty

Mandy Zuo, South China Morning Post, March 6, 2025

U.S. lawmakers urge probes into alleged Chinese tariff dodging

Pak Yiu, Nikkei Asia, March 6, 2025

Walmart Asks Chinese Suppliers for Major Price Cuts on Trump Tariffs

Bloomberg, March 6, 2025

Walmart Gets an Earful from China Over Response to Trump Tariffs

Hannah Miao and Raffaele Huang, Wall Street Journal, March 12, 2025

Beijing, under economic pressure, seeks to help local factories facing requests to cut prices.

President Trump’s trade war with China has landed Walmart WMT -2.56%decrease; red down pointing triangle in the hot seat in Beijing.

Chinese authorities summoned Walmart officials for a dressing-down this week after receiving complaints that the retailer was pressuring some Chinese suppliers to cut prices to absorb the cost of U.S. tariffs, state media and people familiar with the matter said Wednesday.

The president’s decision to add a 20% tariff on Chinese imports on top of previous tariffs has put U.S. retailers such as Walmart in a tough spot. Raising prices risks the ire of Trump and American consumers, but getting suppliers to bear the burden isn’t simple either.

China, too, is under pressure as tariffs inflict pain on its export-focused economy, which is grappling with overproduction and weak demand at home. U.S. businesses have been reducing their dependence on China in response to worsening relations, a trend that developed during Trump’s first term and has accelerated since.

Many companies are shifting production to Southeast Asia and elsewhere. For sensitive high-tech goods, some U.S. companies are already pursuing an “anything but China” strategy.

In recent weeks, Walmart and other U.S. retailers have told some suppliers they want discounts on China-made products, according to industry executives. Some suppliers have also been asked to move production outside of China, they say.

That was the backdrop for Tuesday’s meeting in Beijing, where Chinese officials asked Walmart representatives to explain what the company was doing, according to people familiar with the meeting. The officials said making Chinese suppliers pay the costs of tariffs would be irresponsible and unfair.

There was also a veiled threat: The Chinese side told Walmart that asking suppliers to lower prices might violate contracts and disrupt market order, and the officials referred to potential legal consequences, the people said.

“If Walmart insists” on making Chinese suppliers absorb the blow, “then what awaits Walmart is not just talk,” state broadcaster China Central Television said on social media Wednesday.

COMMENT – While Walmart will feel some heat, the CCP can’t push too hard because there are plenty of countries with producers of textiles and other low-cost consumer items that would love to replace the PRC in Walmart’s supply chain. And once those shifts happen, Walmart would have little reason to shift back to the PRC.

If the CCP wants their manufacturers to maintain access to the U.S. market (hence maintain the high volume of exports which drive the Chinese economy), they will avoid pressing Walmart too hard… but I suspect the Party will overplay its hand.

If I could give some advice to Walmart’s General Counsel: withdraw all executives and senior managers from the PRC now, before they become targets of Exit Bans and detention.

China’s Inflation Problem Isn’t Just Going Away

Daniel Moss, Bloomberg, March 5, 2025

More words than deeds from China on consumption keep deflation in play

Reuters, March 5, 2025

China’s Export Growth Disappoints Amid Trade Tensions

Wall Street Journal, March 7, 2025

China’s ‘world’s factory’ eyes industry modernisation with economic crown on the line

Ji Siqi, South China Morning Post, March 7, 2025

China Had Record $540 Billion of Exports in Rush to Beat Tariffs

Bloomberg, March 6, 2025

China Struggles to Shake Off Disinflationary Pressure as Trade Threats Loom

Wall Street Journal, March 9, 2025

China’s consumer prices fall for first time in more than a year

Eleanor Olcott, Financial Times, March 8, 2025

Chemicals, Steel Firms in Europe Squeezed by China, Tariff Woes

Chloe Meley, Bloomberg, March 9, 2025

Beijing buzzwords hint at slow-burn consumer fix

Ka Sing Chan, Reuters, March 10, 2025

Hedge funds cut China stocks for fourth week as DeepSeek optimism fades

Summer Zhen, Reuters, March 10, 2025

Honda to halve engine output capacity at key Chinese plant

Shizuka Tanabe, Nikkei Asia, March 10, 2025

China’s new financial captain faces tough mission

Ka Sing Chan, Reuters, March 11, 2025

How BYD undercuts Tesla around the world, by the numbers

Khadija Alam, Rest of World, March 12, 2025

Russia imposes fees to stem flood of low-cost Chinese cars

Ryan McMorrow, et al., Financial Times, March 9, 2025

Russian goods seizures cause havoc on China-Europe rail link: ‘big impact’

Ji Siqi, South China Morning Post, March 11, 2025

Freight companies ‘dare not’ use the railway after Russia tightened sanctions and impounded huge volumes of Europe-bound cargo.

Last week, China’s leaders made promises to support the China-Europe Railway Express – an overland freight link that has become a symbol of Beijing’s ambitious drive to recreate the ancient Silk Road.

But the reality is that traffic along the intercontinental rail link has been declining for months, as a wave of Russian goods seizures causes logistics companies to lose confidence in the project, industry insiders said.

“We have not dared to ship [goods via the railway] since November,” said Andrew Jiang, general manager of freight forwarding company Air Sea Transport in Shanghai.

COMMENT – I guess its not all rainbows and unicorns in the Sino-Russian relationship.

Cyber and Information Technology

3 men charged with fraud over alleged movement of Nvidia chips get additional charge, to be remanded further

Koh Wan Ting, Channel News Asia, March 6, 2025

DeepSeek, Huawei, Export Controls, and the Future of the U.S.-China AI Race

Gregory C. Allen, CSIS, March 7, 2025

Trump administration also considers broader measures against the AI model over national-security concerns

Liza Lin, et al., Wall Street Journal, March 7, 2025

Trump: Administration talking to four groups about possible TikTok sale

Julia Shapero, The Hill, March 9, 2025

President Trump said Sunday his administration is in talks with four groups about a potential TikTok sale, with less than a month until a ban on the popular video-sharing platform is set to go into effect.

“We’re dealing with four different groups, and a lot of people want it, and it’s up to me,” Trump told reporters aboard Air Force One.

When asked whether there will be a deal soon, the president said, “It could be.”

A TikTok ban was initially set to go into effect on Jan. 19, after large bipartisan majorities in Congress passed a bill requiring the app’s China-based parent company, ByteDance, to divest or face a U.S. ban. It was signed into law by then-President Biden last April.

However, Biden declined to enforce the law in his final days in office, and Trump signed an executive order halting enforcement for 75 days shortly after his inauguration. He now has until April 5 to reach a deal to keep the app available in the U.S.

As the deadline nears, Trump has indicated there could be some flexibility.

When asked by a reporter last Thursday if he plans to extend the deadline if a deal is not hammered out in time, Trump said, “Probably, yeah.”

COMMENT – We are about three weeks away from the deadline… anyone want to place any bets on the outcome?

Huawei users tap workaround to install Google apps outside China

Itsuro Fujino, Nikkei Asia, March 9, 2025

‘Open source’ model: why France wants to work closely with China on AI

Kandy Wong, South China Morning Post, March 11, 2025

Japan losing to China in deep sea race as key research vessel ages

Dai Kuwamura, Nikkei Asia, March 11, 2025

China’s Manus Follows DeepSeek in Challenging US AI Lead

Saritha Rai, Julie Zhu, and Edwin Chan, Bloomberg, March 10, 2025

From chatbots to intelligent toys: How AI is booming in China

Laura Bicker, BBC, March 11, 2025

Europe’s Banks, Unlike U.S. Rivals, Play with DeepSeek

Michael Roddan, The Information, March 12, 2025

Chinese Companies Rush to Put DeepSeek in Everything

Zeyi Yang, Wired, March 12, 2025

Secret commands found in Bluetooth chip used in a billion devices

Matt Binder, Mashable, March 10, 2025

Military and Security Threats

China's naval growth goes vertical

David Vallance, Lowy Institute, March 3, 2025

Exposing China’s Legal Preparations for a Taiwan Invasion

Cheng Deng Feng and Tim Boyle, War on the Rocks, March 11, 2025

Thailand asks Germany to review policy to save China submarine deal

Marwaan Macan-markar, Nikkei Asia, March 6, 2025

DOJ announces charges, sanctions against 12 Chinese hackers for Treasury breaches

Maggie Miller, Politico, March 5, 2025

Active-Duty and Former U.S. Army Soldiers Arrested for Theft of Government Property and Bribery Scheme

Office of Public Affairs, U.S. Department f Justice, March 6, 2025

U.S., EU and Japan increase naval deployments in South China Sea

Amy Chew, Nikkei Asia, March 7, 2025

Pakistan separatists launch new 'army' in war on Chinese interests

Adnan Aamir, Nikkei Asia, March 7, 2025

Philippines Probing Network of Hundreds of Alleged Chinese Spies

Cliff Harvey Venzon, Bloomberg, March 7, 2025

US Warned of Caribbean Becoming 'Chinese Lake'

James Bickerton, Newsweek, March 9, 2025

China Is Mapping the Seabed to Unlock New Edge in Warfare

Austin Ramzy, Wall Street Journal, March 12, 2025

Chinese Warships Circle Australia and Leave It Feeling ‘Near-Naked’

Victoria Kim, New York Times, March 12, 2025

China, Russia, Iran to hold nuclear talks in Beijing on Friday

Reuters, March 12, 2025

Chinese naval modernization may be aided by foreign firms, report says

Lily Kuo, Washington Post, March 12, 2025

One Belt, One Road Strategy

Sri Lanka balances India and China

Kamalaharan Shanmugam, Gateway House, March 6, 2025

Chinese defense company builds industrial estate in Cambodia

Radio Free Asia, March 11, 2025

China pledges to help Africa develop as ‘land of hope for the 21st century’

Zhao Ziwe, South China Morning Post, March 7, 2025

Brazil braces for more Chinese demand, higher food prices amid US trade war

Roberto Samora and Gabriel Araujo, Reuters, March 7, 2025

The railway that China hopes will take on the US in Africa

Monica Mark, Financial Times, March 11, 2025

China Piles the Pressure on India in Its Own Backyard

Peter Martin, et al., Bloomberg, March 11, 2025

Opinion

A New Deal with Moscow?

Walter Russell Mead, Wall Street Journal, March 10, 2025

Trump’s bid for a pact with Putin recalls the efforts of FDR and other presidents.