On the road

Friends,

Greetings from Dublin where I’m attending the Aspen Institute’s Congressional Program on foreign affairs and national security issues.

I had my first Guinness at lunch, so all is well.

I was on the road last week in California for the annual China Forum at the University of California San Diego and will be in Dublin this week, so I haven’t had time to put together “big ideas.”

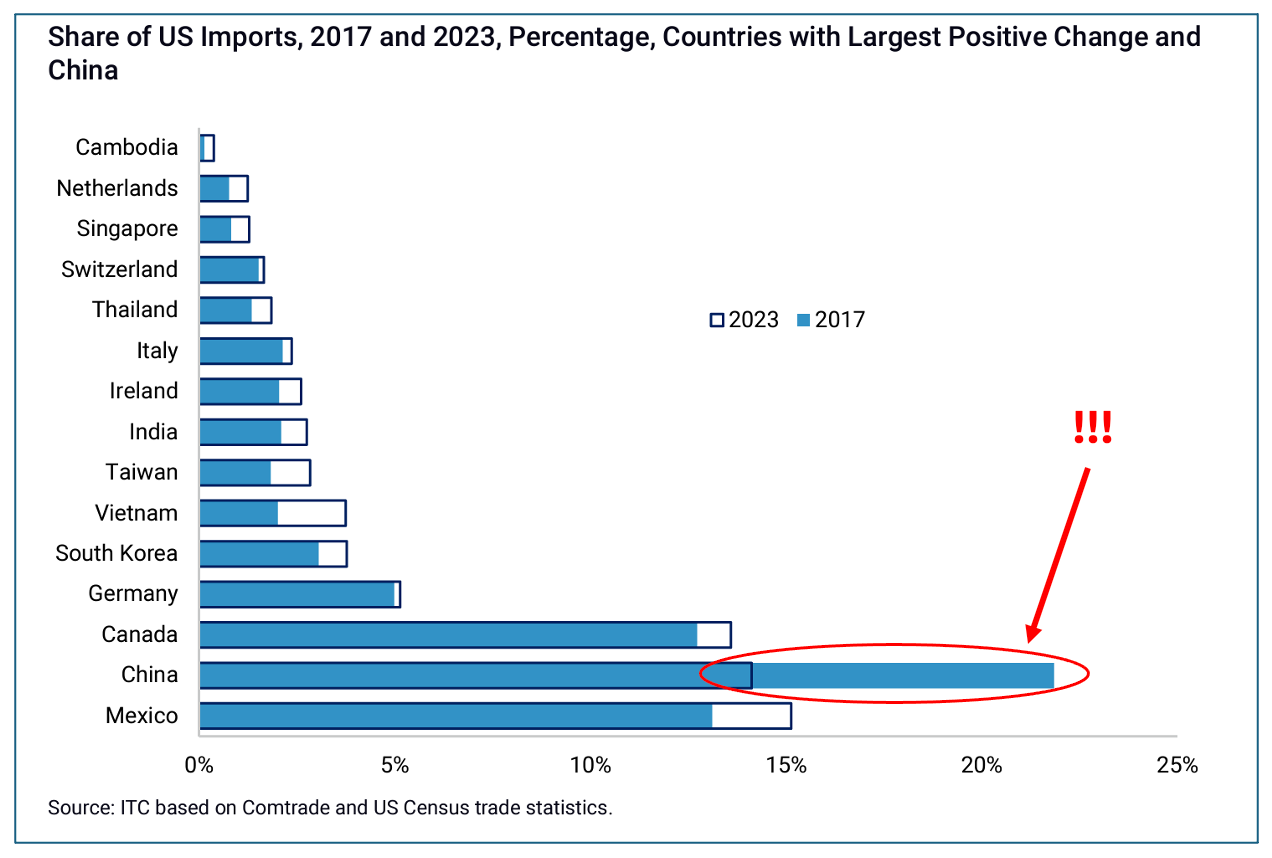

The one thing I will highlight is this chart from The Rhodium Group report on diversification away from China (shhh… don’t call it decoupling):

This is an important shift from the start of the Trump Administration through the end of the second year of the Biden Administration. It suggests some important changes are taking place.

Of course, some of it is just the transshipment of Chinese products through third countries… but not all of it. The United States is the world’s largest consumer economy and since the PRC economy is built around exporting manufactured products, this change does not bode well for the long-term prospects of the Chinese economy.

To read more on this, see #3 (China Diversification Framework Report), the team at Rhodium did a great job and has put to rest the debate on whether diversification away from China is actually happening (Spoiler: IT IS).

Thanks for reading!

Matt

MUST READ

1. China imposes restrictions on fentanyl chemicals after pressure from US

Demetri Sevastopulo, Financial Times, August 6, 2024

China is to impose controls on the production of critical chemicals for the manufacture of fentanyl, in a sign of rising co-operation between Beijing and Washington over efforts to crack down on the deadly synthetic opioid.

The Biden administration on Tuesday said China would impose regulations and controls on three essential chemicals used in fentanyl from September.

The move — a process known as “scheduling” — marks the first time China will impose restrictions on the production of ingredients for the drug in six years.

The White House said it was a “valuable step forward” that followed a meeting between senior US and Chinese officials in Washington last week.

Washington has been pressing Beijing for several years to crack down on the production of ingredients used in fentanyl, which it estimates claimed the lives of almost 75,000 Americans in 2023.

US officials say the illicit drug has become the leading cause of death for Americans between the ages of 18 and 45.

The enhanced US-China co-operation stems from an agreement reached between President Joe Biden and President Xi Jinping at a summit in San Francisco in November 2023.

The two leaders agreed to create a working group to tackle the fentanyl issue as part of an effort to stabilise turbulent relations between the two powers.

In 2019, China took measures to stem exports of fentanyl to the US, causing Chinese groups to shift their focus to making the chemicals needed to produce the drug. They have been sending the chemicals to cartels in Mexico which produce fentanyl for distribution in the US market.

In a statement, the Chinese government said it would subject three chemical ingredients — 4-AP, 1-boc-4-AP, and Norfentanyl — to controls from September 1.

“China has always attached great importance to international counter-narcotics co-operation and is willing to co-operate with countries worldwide including the United States,” said Liu Pengyu, the Chinese embassy spokesperson in Washington. “We hope that the US side can work with China in the same direction, and continue our co-operation based on mutual respect, managing differences, and mutual benefits.”

UN member states in 2022 agreed to impose international controls on the same chemicals, but China had until now not subject them to corresponding domestic controls.

Congress has become increasingly vocal in its criticism of China over the fentanyl crisis.

In a report in April, the House China committee blamed Beijing for the fentanyl epidemic and accused it of creating programmes to reward companies for exporting fentanyl and other illegal drugs to the US. The Chinese government has rejected the accusation.

COMMENT – This is not one of the Financial Times’ best articles… “US officials say the illicit drug has become the leading cause of death for Americans between the ages of 18 and 45.” [It IS the leading cause of death for Americans between the ages of 18 and 45… it isn’t something US officials “say” as if there isn’t sufficient evidence to support the assertion]

The article fails to mention that this is just three chemicals out of the hundreds that are produced and exported by the PRC to the United States that are used to make fentanyl.

And lastly the article provides a throw-away line to the bipartisan Congressional report in April that laid out conclusive evidence (that the FT appears unwilling to read or report on) that the PRC Government has and continues to provide tax rebates and other subsidies to Chinese companies that produce and export these poisons.

The Chinese Communist Party knows exactly what it is doing, it is purposefully incentivizing the production and export of these chemicals because it KNOWS that it causes horrendous damage to the United States.

After years of foot-dragging by the CCP and the deaths of hundreds of thousands of Americans, the Administration seems to want to sweep all of this under the rug (declare a victory for “engagement” and “cooperation) and ignore the obvious evidence that Beijing is killing Americans on purpose.

Why is it so hard to believe that officials in the PRC Government would purposefully enable the production and export of fentanyl precursors to their most bitter rival? The evidence has been there in plain sight for months and still the major news outlets pretend that this is some sort of outlandish claim.

2. With Smugglers and Front Companies, China Is Skirting American A.I. Bans

Ana Swanson and Claire Fu, New York Times, August 4, 2024

The U.S. is trying to stop China from getting Nvidia microchips to advance its military. The private sector is fighting back.

In the southern Chinese city of Shenzhen, a mazelike market stretches for a half-mile, packed with stalls selling every type of electronic imaginable.

It’s an open secret that vendors here are offering one of the world’s most sought-after technologies: the microchips that create artificial intelligence, which the United States is battling to keep out of Chinese hands.

One vendor said he could order the chips for delivery in two weeks. Another said companies came to the market ordering 200 or 300 chips from him at a time. A third business owner said he recently shipped a big batch of servers with more than 2,000 of the most advanced chips made by Nvidia, the U.S. tech company, from Hong Kong to mainland China. As evidence, he showed photos and a message with his supplier arranging the April delivery for $103 million.

The United States, with some success, has tried to control the export of these chips. Still, The New York Times has found an active trade in restricted A.I. technology — part of a global effort to help China circumvent U.S. restrictions amid the countries’ growing military rivalry.

The chips are an American innovation powering self-driving cars, chatbots and medical research. They have also led to rapid advances in defense technology, spurring U.S. fears that they could help China develop superior weaponry, launch cyberattacks and make faster decisions on the battlefield. Nvidia chips and other U.S. technology have aided Chinese research into nuclear weapons, torpedoes and other military applications, according to a review of previously unreported university studies.

Beginning in October 2022, the United States set up one of the most extensive technological blockades ever attempted: banning the export to China of A.I. chips and the machinery to make them. The Biden administration also added hundreds of Chinese companies to a list of organizations considered a national security threat, and it could soon expand the rules.

These bans have made it harder and more costly for China to develop A.I. But given the vast profits at stake, businesses around the world have found ways to skirt the restrictions, according to interviews with more than 85 current and former U.S. officials, executives and industry analysts, as well as reviews of corporate records and visits to companies in Beijing, Kunshan and Shenzhen.

In one case, Chinese executives bypassed U.S. restrictions when they created a new company that is now one of China’s largest makers of A.I. servers and a partner of Nvidia, Intel and Microsoft. American companies have found workarounds to keep selling some products there. And an underground marketplace of smugglers, backroom deals and fraudulent shipping labels is funneling A.I. chips into China, which does not consider such sales illegal.

While the scale of the trade is unclear, the sales described to Times reporters, including the $103 million transaction, would be far larger than any previously reported in China. More than a dozen state-affiliated entities have purchased restricted chips, according to procurement documents uncovered by the reporters and the Center for Advanced Defense Studies, or C4ADS, a Washington-based nonprofit. The United States has flagged some of those organizations as helping the Chinese military.

COMMENT – Without more resources and greater political support to enforce these restrictions, the Commerce Department isn’t going to be able to handle this problem.

3. China Diversification Framework Report

Agatha Kratz, Daniel H. Rosen, Camille Boullenois, and Juliana Bouchaud, Rhodium Group and The Business Roundtable, August 5, 2024

Executive Summary Western policymakers and business leaders are rethinking over-reliance on China as a global manufacturing and sourcing hub. The first question is whether diversification from China is even possible, given the economies of scale and scope China’s huge size has permitted. We find that, properly defined (Box 1), diversification is already taking place to a limited but important degree. Shocks from the US-China “trade war,” COVID, Russia’s war on Ukraine, and other events have made the risks of hyperglobalized value chains clear, altering the valuation of those risks in business and policy planning. And tensions with China continue to rise as a function of technological change, even as political authorities seek stabilization. Yet China’s market size, fourdecade manufacturing investment boom, and geopolitical clout also present major hurdles to diversification. Even when other economies enjoy the same attributes that made China attractive and have better security alignment with the United States, diversification can be difficult.

In this China Diversification Framework Report, we assess the potential for diversification of manufacturing and sourcing from China to other economies, whether that potential is being realized, and the reasons why or why not. We come to several working conclusions on these questions:

In the aggregate, diversification from China is underway, as evidenced by China’s decreasing share of US imports and foreign direct investment (FDI) over the past seven years.

Diversification has so far centered on just a few countries (Mexico and Vietnam in particular), presenting a risk of capacity constraints and rising costs, hence slowing diversification.

Diversification is concentrated in a few sectors, too (textiles, electronics, and autos), and in the assembly segment rather than upstream supply chains. In short, f irms on the move are still relying on their China-based manufacturing or sourcing for inputs, and broader migration will only happen in stages over a longer period.

US trade diversification and investment diversification often don’t match: the change in the composition of US imports is often not driven by US FDI but by nonUS firms, not least of which— ironically—are Chinese and Taiwanese.

Beyond Mexico and Vietnam, like-minded nations can be diversification winners despite higher-cost structures: Canada, Taiwan, Germany, and South Korea are picking up trade and FDI shares. Yet many other security-aligned nations are not: Japan, Australia, and the Philippines are notably absent from the list of hotspots.

The gap between diversification potential and outcomes has many causes, but two factors stand out: availability of workforces with basic-to-advanced skills and the role of high-quality, cross-border economic agreements. These assets are essential both to China’s success over the past two decades and to understanding where activity is shifting today. For instance, the US-Mexico-Canada Agreement (USMCA) is key to why Mexico is picking up so much diversification, while China’s agreements within members of the Association of Southeast Asian Nations (ASEAN) are central to the rise of its neighbors, particularly Vietnam, as US trading partners.

In the potential/realized diversification gaps we identify, there are opportunities to drive diversification to core US partners, broaden the scope of supply chain movement (beyond assembly), and align trade and FDI patterns. These opportunities require active commercial diplomacy and engagement.

Reducing over-reliance on China is not impossible, as it was considered until recently. However, the economic costs and risks are real and not all worth incurring. Analysis helps to clarify where it can be viable, even at this early stage, and where policy and government action can help to clear the path.

COMMENT – Two main take-aways: diversification (derisking, decoupling) from China isn’t impossible and it is already happening.

4. The U.S. Must Prepare to Fight China and North Korea at the Same Time

Markus Garlauskas and Matthew Kroenig, Foreign Policy, August 6, 2024

A conflict in Taiwan is likely to draw Pyongyang in—and the U.S. military isn’t ready for it.

Last month, the U.S. Commission on the National Defense Strategy released a report proposing that the Pentagon develop a “Multiple Theater Force Construct” sized to tackle simultaneous threats in the Indo-Pacific, Europe, and the Middle East. This will be necessary to address the growing risk of war with both China and Russia in overlapping timeframes, as one of us has previously written in these pages. Less obvious, but also important, however, is the need to address the threat of a simultaneous war with both China and North Korea.

There is a real and growing risk of conflict between the United States and China over Taiwan, and the Pentagon already considers war with China as its most important “pacing” threat for prioritizing future military capabilities and resources. Contrary to conventional assumptions, however, it is unlikely that such a conflict would be contained to the Taiwan Strait.

Rather, a U.S.-China conflict over Taiwan would almost certainly become a region-wide war, engulfing the Korean Peninsula, and pulling in both North Korea and South Korea. This is because China would have a strong incentive to strike U.S. bases in South Korea and to urge North Korea to provoke and tie down U.S. forces there. Similarly, North Korea could choose to join the fight to preempt a feared U.S. attack, take advantage of a distracted United States to settle old scores with its rival in Seoul, or influence the outcome of a war that would have profound implications for its own security.

Further, a lack of preparedness for this two-front war scenario gives Beijing and Pyongyang an additional incentive to attack precisely to exploit this U.S. and allied vulnerability. The United States and its allies must, therefore, update their defense strategies and postures to prepare to deter, and if necessary, win, a simultaneous war against both China and North Korea.

As part of a two-year series of studies and tabletop exercises sponsored by the U.S. Department of Defense, we analyzed the risk of a simultaneous U.S. conflict with both China and North Korea. We concluded that a war with China would also likely become a war with North Korea, and conversely, a war with North Korea could lead China to intervene. While the second scenario has already received some attention, we believe that the most likely and dangerous path to a two-front U.S. war with both China and North Korea actually starts with a U.S.-China conflict over Taiwan.

If China were to attack Taiwan, Washington would likely employ military forces operating from bases in the region against China’s attacking forces. In retaliation, or to preempt this possibility, Beijing would have a strong incentive to strike regional U.S. bases, including those in Japan and South Korea.

Even if Beijing were only to strike bases in Japan, Chinese aircraft and missiles would need to fly over or past the Korean Peninsula, threatening U.S. and South Korean forces there, while also risking being shot down by U.S. and South Korean air and missile defenses. In addition, or alternatively, China might also actively encourage North Korea to provoke or attack South Korea and Japan, in order to tie down and distract U.S. forces from the ongoing fight around Taiwan.

Furthermore, North Korea might have compelling reasons of its own to join the conflict. Seeing Washington distracted in Taiwan, Pyongyang may engage in opportunistic aggression against what North Korean leader Kim Jong Un now calls its “principal enemy,” South Korea. In addition, as the U.S. military mobilizes large-scale reinforcements to the region, Pyongyang may assess this buildup will enable a “regime change” attack on North Korea either while or after the United States defeats China. North Korea has repeatedly declared that its doctrine is to strike first if it sees a threat to its regime “on the horizon.”

Ultimately, North Korea is unlikely to stand by as its most powerful patron battles its most powerful enemy in a war that would determine the fate of the region, with profound implications for Pyongyang’s security. A Chinese defeat would likely leave North Korea dangerously isolated, whereas a U.S. defeat could drive U.S. forces from the region and dramatically improve North Korea’s military position.

Even if Korea does not become a second front, the possibility would still impinge on U.S. efforts to defend Taiwan. The need to deter and, if necessary, defeat a North Korean attack would tie down some portion of U.S. forces, attention, and resources. Seoul might even seek constraints on whether and how Washington could operate its forces within and from South Korea in a war over Taiwan, to avoid provoking China or tempting North Korean opportunism.

Many analysts wrongly assume that Washington and Beijing have a shared interest in maintaining stability on the Korean Peninsula, particularly to avoid North Korean nuclear escalation, and that they would tacitly agree that North and South Korea are out of bounds in a war over Taiwan.

5. AUDIO – Is a high-profile critic of the Chinese Communist Party a con man?

Frank Langfitt, NPR, August 4, 2024

It seemed like a simple plan.

Liu Fengling and her two children were living in a small township in central China, and in the spring of 2023, they began applying for visas to the Netherlands. They hoped to reunite with their husband and father, Gao Zhi, a Chinese dissident, who had won asylum in the Netherlands several years earlier.

But in June of that year, Chinese police descended on Liu’s house in Henan province. They questioned her, roughed her up and seized her cellphone. Frightened, the family fled to Thailand, where they hoped to get Dutch visas.

Then, their dream of an easy escape to Europe collapsed.

After arriving in Thailand, Liu got a call from a man who said he was a Chinese diplomat. He told her that Chinese authorities believed her son had threatened to blow up the Chinese Embassy in Bangkok.

“Don’t try to cover up for your son!” the man warned, according to a recording the family shared with NPR. “If we call the police and he is arrested, he will be quite severely punished.”

“I’m not covering up for him!” Liu protested.

The news grew worse.

Staying in a Bangkok hotel while waiting for a visa appointment, Liu received an email that appeared to come from the Dutch immigration service. It said airports in Europe had received bomb threats claiming to be from her and her son.

“Therefore [your] travel to the EU is legally restricted,” the email read.

Liu and her two children were shocked and scared. Nothing had prepared them for this or the dizzying intrigue that lay ahead.

Liu, now 43, worked on the cleaning staff of a hotel. Her son, Peng, 20, was unemployed, and her daughter, Han, 17, was still in school. The trip to Bangkok was the family’s first outside China. Now, it seemed, they were on a no-fly list.

Amid the confusion, Liu and her daughter overstayed their Thai tourist visas. A court sentenced them to two months in immigration detention. Peng also overstayed his visa, but police didn't pursue him.

Mother and daughter were now locked up, but the drumbeat of bewildering news continued.

Back at his home in the Dutch countryside, Gao received another alarming message from the same Dutch immigration email account. It said his wife and daughter had confessed to making additional bomb threats against EU embassies in Thailand.

“They apologized for this and volunteered to return to China,” the email read.

Gao couldn’t believe it. His wife and kids weren’t even political. Gao suspected the Chinese Communist Party must be behind the bomb threats, but still, he was puzzled.

“I really can’t understand the motive,” Gao told NPR at the time. “It’s too big a waste of resources. I’m obscure, like a nobody!”

Gao was not that well-known among dissidents, but his housemate, Wang Jingyu, was.

Wang, 22, is a high-profile Chinese dissident with tens of thousands of followers on X who constantly criticizes the Communist Party. He has been featured on TV news shows from Berlin to Tokyo. As the family’s crisis unfolded in Thailand, Gao relied on Wang for advice, translation and managing the media.

Wang was familiar with what the Gao family was going through. In 2022, someone used Wang’s name to make bomb threats against hotels and Chinese embassies in Western Europe, according to police. Wang said he did nothing wrong and insisted that the Chinese government had set him up.

This practice is a form of “swatting.” That’s when someone reports a fake crime that tricks police into targeting an innocent person.

Gao thought his relationship with Wang might explain why his family had been singled out. Someone claiming to be a Communist Party agent had written to Gao and urged him to stop Wang from accepting interviews with reporters.

But Wang kept talking. Gao thought the bomb threat allegations against his family could be payback.

COMMENT – Listen to the whole story, it isn’t what you expect. Great job by NPR is tracking this story down.

6. One of China's Most Talkative Nationalists Suddenly Goes Silent

Chris Buckley, New York Times, August 6, 2024

Hu Xijin’s tens of millions of followers have heard nothing from him since late July. Some think one of his posts praising Beijing may have backfired.

One of China’s most influential, and garrulous, nationalist voices on social media has suddenly gone quiet, and the country’s internet is wondering why.

Hu Xijin, the former editor of the Global Times, a pugnacious Communist Party-run newspaper, writes and posts videos regularly on Sina Weibo, a social media platform, where he has nearly 25 million followers. But in late July, Mr. Hu stopped updating his page, baffling readers and gratifying some of his critics.

Mr. Hu has not explained his silence; nor have China’s internet authorities. But many in China think he has been censored, pointing to signs that party officials may have been irked — paradoxically — because Mr. Hu lauded them in the wrong way. In China, even misplaced praise for the party may be enough to draw the ire of censors.

A possible source of Mr. Hu’s trouble appears to be a Weibo post he wrote in July that extolled as “historic” the outcome of a party leaders’ meeting on economic strategy. In Mr. Hu’s view, the party used phrasing in its plan for the economy that suggested that China would reduce the status of state-owned companies, giving private companies a big boost.

The plan opened the way to “true equality” for private and state companies, Mr. Hu wrote to his millions of readers. “Not so long ago, some people were openly denigrating the private sector,” he wrote. “How ridiculous those voices seem today.”

Mr. Hu’s post soon disappeared from Weibo, but not before it set off a kerfuffle.

Mr. Hu’s praise may have seemed helpful to policymakers at a time when the Chinese government is desperate to restore the confidence of private businesses, which generate vital jobs and tax revenues. But he was assailed by hard-left critics who accused him of distorting the party’s words and undermining China’s commitment to state companies. “This blows open his fundamentally anti-party, anti-socialist thinking,” read a comment republished on Utopia, a far-left Chinese website.

“It does sound like there was some displeasure with his posts,” Ryan Ho Kilpatrick, the managing editor of the China Media Project, which also monitors internet censorship and controversies, said in an interview. “He kind of puts his foot in his mouth sometimes when he goes too far in supporting the party in the wrong way.”

The controversy showed, if nothing else, the pitfalls that even the Chinese government’s supporters can run into when trying to explain its decisions. The party has been trying to revive the private sector while preserving state ownership as a pillar of party power, a tricky balance that can create confusion about the priorities of China’s leader, Xi Jinping.

COMMENT - As a good friend remarked this week about the news of Hu Xijin’s apparent muzzling: “I guess he forgot that Eastasia has always been the enemy of Oceania.”

Authoritarianism

7. Secure Jobs, Uncertain Future: China’s Growing Appetite for Government Employment

Yanzhong Huang, Council on Foreign Relations, August 5, 2024

8. US-China fentanyl cooperation gathers momentum with senior meeting in Washington

Yijing Shen, South China Morning Post, August 2, 2024

9. Xi signals no deviation from course – nor in the driver – despite economic bumps in the road

Anthony Saich, The Conversation, July 29, 2024

10. Why Some Young People in China Pretend to Be Birds

Yan Zhuang, New York Times, August 2, 2024

11. In Xi’s China, Politics Eventually Catches Up with Everyone

Li Yuan, New York Times, August 2, 2024

12. China's state media, netizens rally around Pan after claims 100m swim not 'humanly possible'

Farah Master and Bernard Orr, Reuters, August 1, 2024

13. One and done: Michael Phelps calls for a lifetime ban for anyone who's caught doping

Paul Newberry, Associated Press, August 5, 2024

14. China’s Olympic Swimming’s Haul: More Medals, More Questions

Jenny Vrentas, New York Times, August 4, 2024

15. Chinese Migrants Rush to Find Way to U.S. Border Before Doors Close

Wenxin Fan, Wall Street Journal, August 4, 2024

16. Ex-China Editor Hu Banned on Social Media After Post on Economy

Bloomberg, August 1, 2024

17. China asks large state financial institutions to drop auditor PwC, say sources

Julie Zhu, Reuters, August 5, 2024

18. As China's property market slumps, foreign investors get pickier

Echo Wong and Tsubasa Suruga, Nikkei Asia, August 5, 2024

19. China-US flights struggle to fill seats amid high prices, visa issues and cheaper stopovers

Ralph Jennings, South China Morning Post, August 4, 2024

20. Marijuana and Mexican cartels: Inside the stunning rise of Chinese money launderers

Lisa Cavazuti, NBC, August 3, 2024

21. Sugon spin-off helps China evade US chip bans

Jeff Pao, Asia Times, August 7, 2024

22. China warns office workers foreign spies can steal data via commonplace online software

Hayley Wong, South China Morning Post, August 6, 2024

Environmental Harms

23. China sees highest number of significant floods since records began

Helen Davidson, The Guardian, August 2, 2024

24. The Changing Global Energy Map

Scott B. MacDonald and Alejandro Trenchi, National Interest, August 4, 2024

25. Chinese Investment in Africa: A Double-Edged Sword for Low-carbon Industrialization

Keyi Tang, Solomon Owusu and Gideon Ndubuisi, Global Development Policy Center, July 28, 2024

Foreign Interference and Coercion

26. China’s high stakes and deepfakes in the Philippines

Albert Zhang, Australian Strategic Policy Institute, August 2, 2024

27. Effective US government strategies to address China’s information influence

Kenton Thibaut, Atlantic Council, July 30, 2024

28. VIDEO – Chance of Taiwan, China Reunification is ‘Nil’ – What Happens Next?

National Press Foundation, June 26, 2024

29. World's biggest lithium producer urges state help to compete with China

Harry Dempsey, Financial Times, August 3, 2024

Human Rights and Religious Persecution

30. China Manipulates Archaeology to Claim the Land of the Uyghurs

Marco Respinti, Bitter Winter, August 6, 2024

31. Hong Kong young people struggle to rebuild their lives after being jailed under Beijing's crackdown

Kanis Leung, Associated Press, August 1, 2024

32. VIDEO – Watch the Video: The Trial of the Hong Kong 47—a discussion with Sunny Cheung, Peter Mattis, Anouk Wear, and David Stilwell

Jamestown Foundation, June 3, 2024

Industrial Policies and Economic Espionage

33. China industrial parks whip up new formula for success as foreign firms balk at old recipe

Mandy Zuo, South China Morning Post, August 6, 2024

34. China’s Ozempic Test

Rachel Cheung, The Wire China, August 4, 2024

35. Nintendo and Sony hamstrung in China by thin game libraries

Itsuro Fujino, Kanoko Sakamoto, and Ryo Sato, Nikkei Asia, August 2, 2024

36. Indonesia Renews Textile Import Duties to Curb Chinese Goods

Grace Sihombing and Norman Harsono, Bloomberg, August 6, 2024

37. ASML’s Powder Keg

Aaron Mc Nicholas, The Wire China, August 4, 2024

38. The U.S. Has Been Spending Billions to Revive Manufacturing. But China Is in Another League.

Jason Douglas and Clarence Leong, Wall Street Journal, August 3, 2024

39. China's Honor gets "unusually" strong state backing as it readies IPO

David Kirton, Reuters, August 5, 2024

40. VW and BMW chiefs warn on EU’s China EV tariffs amid falling profits

Patricia Nilsson, Financial Times, August 1, 2024

41. Sharpie-maker Newell moves more operations from China as tariffs loom

Jessica DiNapoli, Reuters, August 6, 2024

42. Chinese EV battery maker CATL invests in ‘flying car’ developer AutoFlight

Ben Jiang, South China Morning Post, August 5, 2024

Cyber & Information Technology

43. US expected to propose barring Chinese software in autonomous vehicles

David Shepardson, Reuters, August 5, 2024

44. China will launch first satellites of constellation to rival Starlink, newspaper reports

Eduardo Baptista, Reuters, August 6, 2024

45. China’s AI-related companies total 1.67 million in first half of 2024 amid ChatGPT frenzy

Ben Jiang, South China Morning Post, August 6, 2024

46. Takeaways From Our Investigation into Banned A.I. Chips in China

Ana Swanson, New York Times, August 4, 2024

47. TikTok withdraws 'Lite' rewards from EU to comply with tech rules

Reuters, August 5, 2024

48. Chinese firms stockpile high-end Samsung chips as they await new US curbs, say sources

Heekyong Yang, Fanny Potkin, and Karen Freifeld, Reuters, August 6, 2024

Military and Security Threats

49. Taiwan is making a TV show about a Chinese invasion. And it’s hitting close to home

Nectar Gan and Eric Cheung, CNN, August 4, 2024

50. China on edge over prolonged U.S. missile deployment in Asia

Ken Moriyasu, Nikkei Asia, August 3, 2024

51. Taiwan’s Ma Ying-jeou warns of ‘crippling’ cost of paying US ‘protection money’ under Trump

Lawrence Chung, South China Morning Post, August 5, 2024

52. A respite for the Sierra Madre, but Philippines- China tensions remain

Rommel Ong, Lowy Institute, August 6, 2024

53. Taiwan turns to own 'Iron Duke' Wellington Koo to deter China

Thompson Chau, Nikkei Asia, August 6, 2024

54. America remains Asia’s military-exercise partner of choice

The Economist, August 01, 2024

55. Xi Jinping calls for hi-tech ‘smart system’ to boost border China’s defence

Amber Wang, South China Morning Post, August 1, 2024

56. Chinese military simulations of attacks on US air bases in Japan alarms Tokyo

Julian Ryall, South China Morning Post, July 12, 2024

57. Dmitri Alperovitch on Speeding Up Efforts to Deter China

Andrew Peaple, The Wire China, August 4, 2024

58. China’s Massive Next-Generation Amphibious Assault Ship Takes Shape

Matthew P. Funaiole, Brian Hart, Aidan Powers-Riggs, and Joseph S. Bermudez Jr., CSIS, August 1, 2024

59. China pushes nuclear ‘no first use’ while expanding its atomic arsenal

Kathrin Hille and Max Seddon, Financial Times, August 1, 2024

One Belt, One Road Strategy

60. Cambodia breaks ground on a China-funded canal and says it will be built 'no matter the cost'

Sopheng Cheang and Aniruddha Ghosal, Associated Press, August 5, 2024

61. On Marco Polo’s Silk Road: Will Italy Push Europe to Go Soft on China?

Anna Matilde Bassoli and Mackenzie Puig-Hall, CEPA, August 8, 2024

62. China Plunders Minerals from Africa as Trade Deficit Grows

Monika Chansoria, Japan Forward, August 8, 2024

Opinion Pieces

63. Biden must not forget the Americans imprisoned unjustly in China

Josh Rogin, Washington Post, August 5, 2024

64. China’s Real Economic Crisis

Zongyuan Zoe Liu, Foreign Affairs, August 6, 2024

65. Possibility of Trump 2.0 should push China to recalibrate foreign policy

Wang Xiangwei, South China Morning Post, August 5, 2024

66. Seeds of Security: AI + Agriculture Imperatives

Nicholas Welch, ChinaTalk, August 6, 2024

67. Defending Lady Liberty: Can democracies no longer win wars?

Mark Toth and Jonathan Sweet, The Hill, August 1, 2024